French Stocks Slide Again as Political Risk Roils Banking Shares

(Bloomberg) -- French equities posted their biggest two-day decline in a year as banking stocks fell along with the country’s bonds as the fallout from President Emmanuel Macron’s decision to call a snap election deepened.

Most Read from Bloomberg

Dozens of CVS Generic Drug Recalls Expose Link to Tainted Factories

Fed’s Higher-for-Longer Stance Hits Firms That Expected Rate Cut

France’s benchmark CAC 40 Index ended the session 1.3% lower, bringing the total decline over the past two days to 2.7%. Lenders Societe Generale SA, Credit Agricole SA and BNP Paribas were among the biggest losers, seeing the Euro Stoxx Banks Index mark its worst day since last August. The pan-European Stoxx 600 fell 0.9%.

Stocks and bonds have been rattled this week as Macron called an election following his party’s defeat in the European Parliament election over the weekend. The French election, which will take place over two rounds and conclude on July 7, confronts investors with the risk of Marine Le Pen’s far-right National Rally taking control of the legislature.

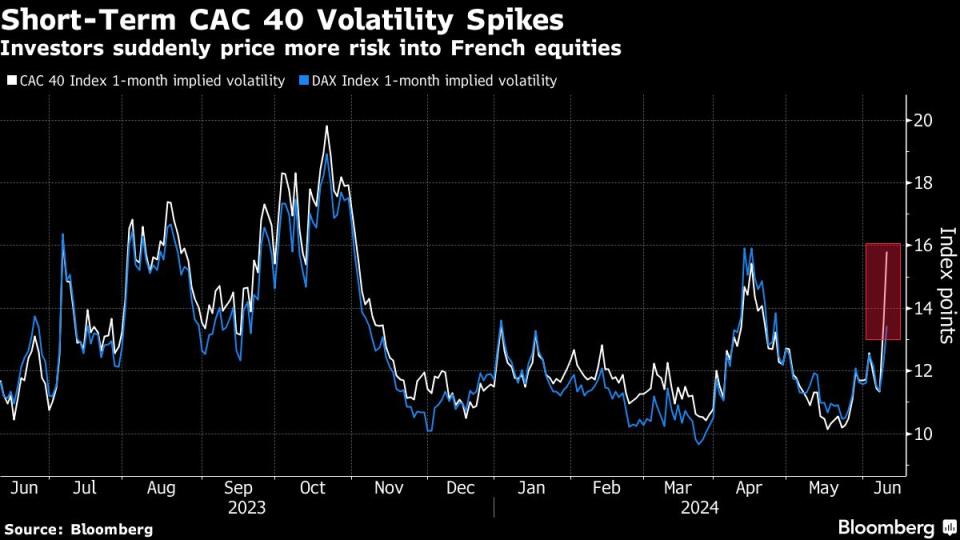

“Markets had absolutely not anticipated a high political risk event in France and in Europe so what’s happening today is not trivial at all,” said Raphael Thuin, head of capital markets strategies at Tikehau Capital. “Political risk will only grow in the coming weeks, with new polls and rumors triggering bursts of volatility.”

Traders were focused on speculation that Macron has been discussing resigning if his party performs poorly in upcoming elections. Macron subsequently said his position won’t be affected.

The yield on 10-year French bonds jumped as much as 10 basis points and widened the spread over equivalent German bonds to the highest level since March 2020 on a closing basis.

The uncertainty also prompted investors to trim exposure to stocks in Italy and Spain, with the countries benchmarks falling around 2%. Italian bonds, considered among the region’s riskiest given the government’s debt pile, were also swept up in the rout for a second day, with the spread over bunds jumping to 150 basis points.

Morgan Stanley analysts said that while a selloff in French banking stocks appears to be overdone, there was likely to be continued weakness in the sector until the elections were finalized.

Investors’ focus was also turning to US inflation data and the Federal Reserve’s monetary-policy decision, both due Wednesday. The Fed is widely expected to keep borrowing costs on hold, but there’s less certainty on officials’ rate projections.

“There is a bit more politics creeping in, but I think markets are largely taking it in their stride,” Ben Seager-Scott, chief investment officer at Forvis Mazars, said by phone. “It’s all about inflation, the Federal Reserve and rates.”

Among individual movers, shipping stocks were notable decliners following weakness across Asian peers, while dashed takeover hopes weighed on Spain’s Naturgy Energy Group SA. Covestro AG was the biggest gainer as the German chemicals maker drew closer to granting Abu Dhabi National Oil Co. access to in-depth due diligence in expectation of an improved bid.

For more on equity markets:

French Options Surge After Macron’s Snap Vote: Taking Stock

M&A Watch Europe: Naturgy, Atos, SocGen, Raspberry Pi, Cellnex

London Stock Trading at a Premium to US Rival Eyes NY: ECM Watch

US Stock Futures Unchanged; Target Hospitality, Yext Inc. Fall

Tax U-Turn: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika, Sagarika Jaisinghani and James Cone.

Most Read from Bloomberg Businessweek

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

As Banking Moves Online, Branch Design Takes Cues From Starbucks

Food Companies Hope You Won’t Notice Shortages Are Raising Prices

©2024 Bloomberg L.P.

Yahoo News

Yahoo News