Fact Check: A Meme Claims to Show Inflation-Driving Profits for 15 Corporations. We Dug Into the Numbers

Claim:

A meme shared online in April and May 2024 accurately reported the profits of 15 corporations and accurately said these profits drove overall inflation up.

Rating:

What's True:

Some of the net incomes the meme listed were accurate, such as those for JPMorgan Chase, Delta Air Lines and Apple.

What's False:

Most of the net incomes the meme listed were inaccurate. Some were overstated, such as those for Kraft Heinz, Verizon, Albertsons, Walmart, Target, Nike and Starbucks. Others were understated, such as those for Exxon Mobil, Amazon, Tesla and Kaiser Permanente. Two economic experts said inflation during 2023 was not necessarily caused by corporate profits.

Context:

Although the meme did not explicitly state that it was referring to net income/net profit, it is fair to say that is what it meant by "profits." We looked at whether the profits listed in the meme reflected the true net incomes of each company.

On May 4, 2024, a Facebook user posted a meme showing a list of companies, including Nike, Apple and Starbucks, and their purported profits for 2023. It also alleged the profits drove up inflation and the cost of living.

The text in the meme read:

Just in case you were confused about why the price of everything keeps going up and mistakenly concluded it was inflation.

2023 profits by company:

What does this have to do with anything?

Starbucks made $24.56 billion in profits for 2023. Which means it could give each of its 400,000 employees an $11,000 raise and would still have $20 billion in profit.

But instead workers rely on tips.

Corporate profits are driving inflation.

https://www.facebook.com/photo/?fbid=2174796252917981&set=gm.1802866153569102&idorvanity=1647913799064339

Similar posts appeared elsewhere on Facebook, on Reddit and in numerous posts on X, where one user wrote: "This is not inflation, this is exploitation, this is the profit for the rich at the expense of the poor, this is capitalism!"

Together, the posts had amassed hundreds of thousands of views and interactions at the time of this writing.

The meme refers to each company's profit. According to Investopedia, profit exists in numerous forms but simply means how much revenue remains after a company's expenses are taken away. Different types of profit depend on what types of costs are deducted from revenue. Although the meme did not specify which type of profit it was referring to, it was fair to interpret this as net profit, also known as net income, which, Investopedia said, is a standalone number calculated by deducting all costs and expenses from revenue.

Snopes looked at each company's actual net income for 2023 and compared each number to the respective alleged figure in the meme.

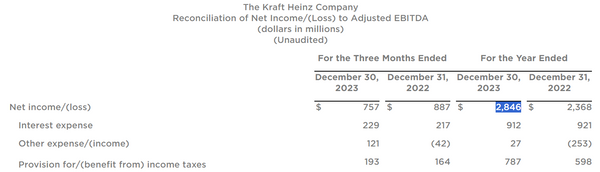

Kraft Heinz

Alleged net income: $8.973 billion

Real net income: $2.846 billion

Kraft Heinz's 2023 net income. (Kraft Heinz)

ExxonMobil

Alleged net income: $9.1 billion

Real net income: $36.010 billion

ExxonMobil's 2023 net income. (ExxonMobil)

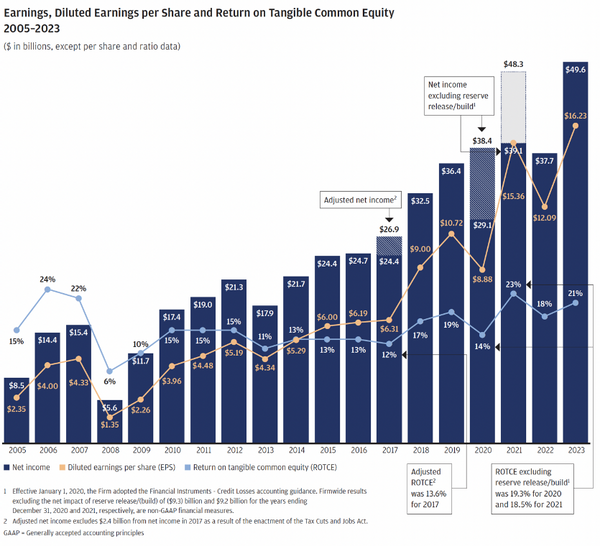

JPMorgan Chase

Alleged net income: $49 billion

Real net income: $49.6 billion

JPMorgan Chase's 2023 net income. (JPMorgan Chase)

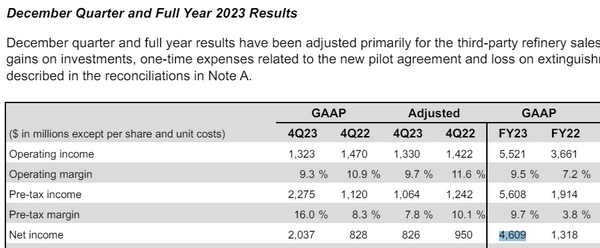

Delta Air Lines

Alleged net income: $4.6 billion

Real net income: $4.609 billion

Delta Air Lines' 2023 net income. (Delta Air Lines)

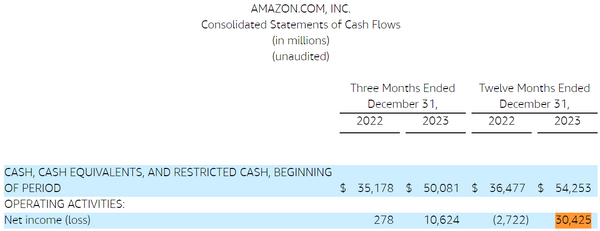

Amazon

Alleged net income: $9.9 billion

Real net income: $30.425 billion

Amazon's 2023 net income. (Amazon)

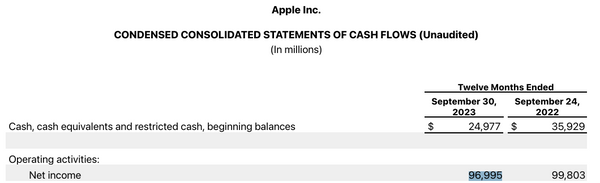

Apple

Alleged net income: $97 billion

Real net income: $96.995 billion

Apple's 2023 net income (Apple)

Tesla

Alleged net income: $13.6 billion

Real net income: $14.997 billion

Tesla's 2023 net income. (Tesla)

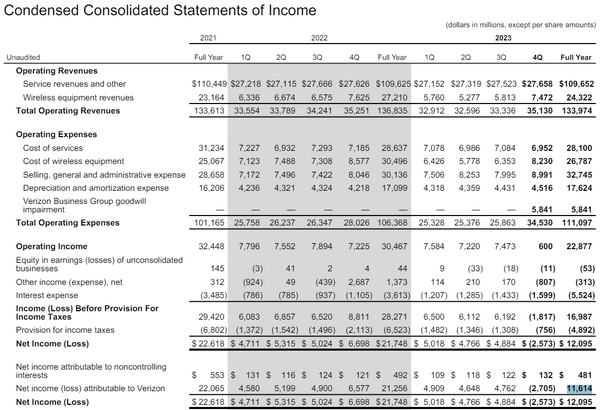

Verizon

Alleged net income: $78.6 billion

Real net income: $11.614 billion

Verizon's 2023 net income. (Verizon)

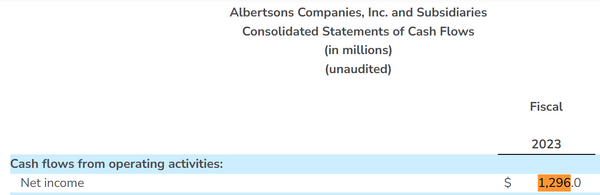

Albertsons

Alleged net income: $21.75 billion

Real net income: $1.296 billion

Albertsons' 2023 net income. (Albertsons)

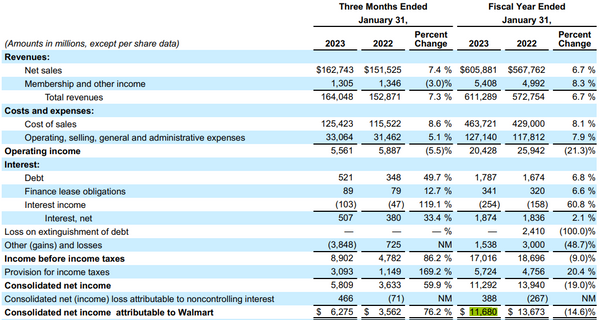

Walmart

Alleged net income: $155 billion

Real net income: $11.68 billion

Walmart's 2023 net income. (Walmart)

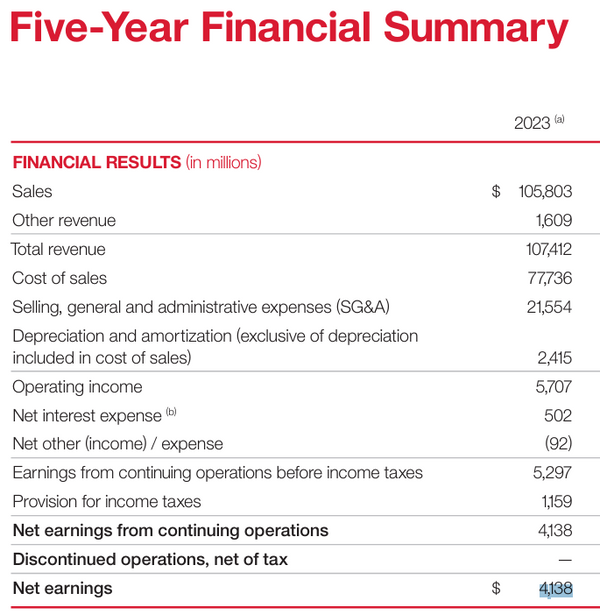

Target

Alleged net income: $25.2 billion

Real net income: $4.138 billion

Target's 2023 net income. (Target)

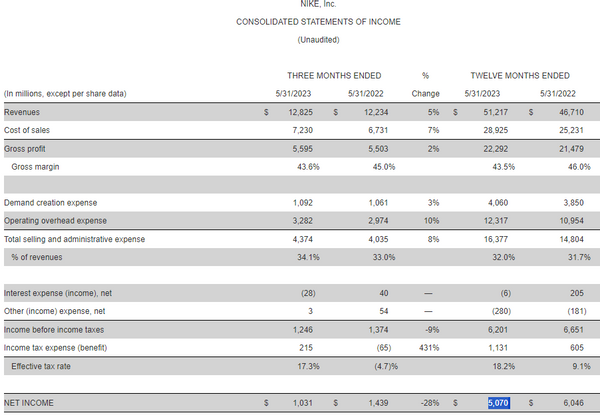

Nike

Alleged net income: $22.65 billion

Real net income: $5.070 billion

Nike's 2023 net income. (Nike)

Blue Cross Blue Shield Association

Alleged net income: $7.5 billion

Real net income: N/A

Snopes was unable to establish BCBSA's real net income, but a spokesperson for the organization told us:

"The Blue Cross Blue Shield Association is a national federation of 33 independent Blue Cross Blue Shield companies where each company tracks its own annual earnings. For more information, please reach out to the individual companies found here."

However, other outlets have reported the $7.5 billion figure as accurate, such as hospital magazine Becker's Healthcare and risk management, transfer and financing website Business Insurance.

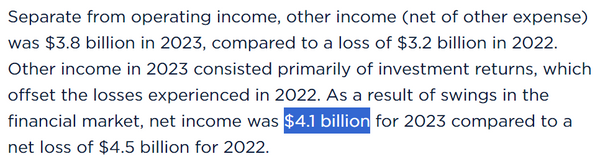

Kaiser Permanente

Alleged net income: $3.29 billion

Real net income: $4.1 billion

Kaiser Permanente's 2023 net income. (Kaiser Permanente)

A spokesperson for Kaiser told Snopes:

This is primarily a list of publicly traded companies that we do not belong in. As nonprofit organizations, Kaiser Foundation Health Plan and Hospitals do not have shareholders who profit from positive financial performance.

Our net income instead is used to support our integrated care delivery system. This includes maintaining and growing our network of 40 hospitals and more than 600 clinics, vast IT infrastructure, and countless medical devices in service of our 12.6 million members, while working to improve the health of the communities we serve.

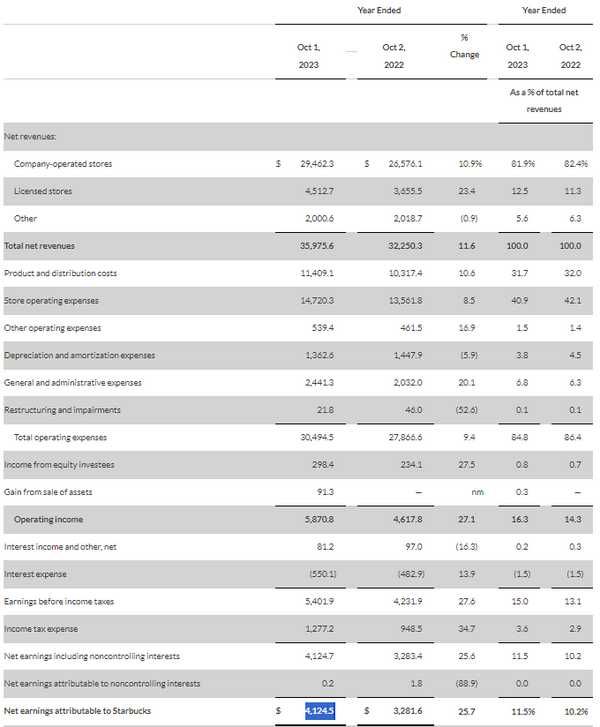

Starbucks

Alleged net income: $24.56 billion

Real net income: $4.1245 billion

Starbucks' 2023 net income. (Starbucks)

Did These Profits Drive Up Overall Inflation?

David Wilcox, senior fellow at the Peterson Institute for International Economics and director of U.S. economic research at Bloomberg, told Snopes that inflation is an ongoing process fueled by serious imbalances in the economy. In an inflationary environment, households and businesses expect rising prices to be the norm, and workers expect wage increases, all of which becomes deeply embedded in everyone's thinking. One-time price increases, on the other hand, are different and do not necessarily cause inflation, he said:

There are a million different reasons why a company may be able to raise its prices once. Maybe a major competitor has just gone out of business. Maybe the item that company makes has just become more popular. In general, assuming costs aren't rising at the same time, a company raising the prices on its products will see its profit margin increase. But a higher profit margin doesn't equate to faster inflation.

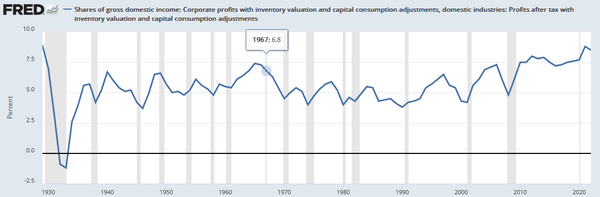

For such price increases to cause inflation, Wilcox told Snopes there would need to be continued increases in profit margins. As shown in the chart below, he explained: "The corporate profit share was high in 2022 (last available annual observation), but was not showing the kind of upward trend that would be required if profits were to be a major driver of ongoing inflation."

FRED graph showing corporate profit share up to 2022. (Federal Reserve Economic Data)

On the other hand, a spokesperson for the International Monetary Fund directed Snopes to a June 26, 2023, blog post on corporate profits and inflation, which read: "Rising corporate profits account for almost half the increase in Europe's inflation over the past two years as companies increased prices by more than spiking costs of imported energy."

The IMF post added: "Europe's businesses have so far been shielded more than workers from the adverse cost shock."

Pete Klenow, professor of economics at Stanford University, gave another insight. He told Snopes inflation may have been partially caused by rising mark-ups (what you add to prices in order to make money) from mid-2021 to mid-2022. However, he did not attribute inflation since that period to rising mark-ups.

He said: "I would say that costs [for businesses] are simply rising for the last two years, and firms are passing this on to consumers. The level of profits may be rising, but capital's share [of income, compared to workers' share of income] overall has not been rising, so overall capital income is just rising in the same proportion as income."

Because the meme shows accurate profits for only a few of the companies listed — JPMorgan Chase, Delta Air Lines, Apple and possibly the Blue Cross Blue Shield Association (some of the remaining companies' profits are understated, while others' are overstated), and because experts said inflation wasn't necessarily driven by corporate profits, we rate this claim "Mostly False."

Sources:

Albertsons Companies, Inc. Reports Fourth Quarter and Full Year Results. https://www.albertsonscompanies.com/newsroom/press-releases/news-details/2024/Albertsons-Companies-Inc.-Reports-Fourth-Quarter-and-Full-Year-Results/default.aspx. Accessed 7 May 2024.

Amazon.com Announces Fourth Quarter Results. https://ir.aboutamazon.com/news-release/news-release-details/2024/Amazon.com-Announces-Fourth-Quarter-Results/default.aspx. Accessed 7 May 2024.

Apple Inc. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited). https://www.apple.com/newsroom/pdfs/fy2023-q4/FY23_Q4_Consolidated_Financial_Statements.pdf. Accessed 7 May 2024.

BCBS® Companies and Licensees | Blue Cross Blue Shield. https://www.bcbs.com/bcbs-companies-and-licensees. Accessed 7 May 2024.

'BCBS Companies Post $7.5 Billion Net Income in First Half of 2023'. Business Insurance, https://www.businessinsurance.com/article/20231027/STORY/912360693/BCBS-companies-post-$75-billion-net-income-in-first-half-of-2023. Accessed 7 May 2024.

Delta Air Lines Announces December Quarter and Full Year 2023 Financial Results. https://s2.q4cdn.com/181345880/files/doc_earnings/2023/q4/earnings-result/Delta-Air-Lines-Announces-January-Quarter-2024.pdf. Accessed 7 May 2024.

Emerson, Jakob. Most Profitable BCBS Companies in First Half of 2023. 25 Oct. 2023, https://www.beckerspayer.com/payer/most-profitable-bcbs-companies-in-first-half-of-2023.html.

'ExxonMobil | 4Q 2023 Earnings'. ExxonMobil, https://corporate.exxonmobil.com/news/news-releases/2024/0202_exxonmobil-announces-2023-results. Accessed 7 May 2024.

Financial and Operating Information. https://www.verizon.com/about/sites/default/files/2024-01/4Q23_VZ_FOI_012324.pdf. Accessed 7 May 2024.

Hansen, Niels-Jakob; Toscani, Frederik; Zhou, Jing. Europe's Inflation Outlook Depends on How Corporate Profits Absorb Wage Gains. 26 June 2023, https://www.imf.org/en/Blogs/Articles/2023/06/26/europes-inflation-outlook-depends-on-how-corporate-profits-absorb-wage-gains.

Investors | Target Corporation. https://corporate.target.com/investors. Accessed 7 May 2024.

Kaiser Foundation Health Plan and Hospitals Report 2023 Financial Results. https://about.kaiserpermanente.org/news/press-release-archive/kaiser-foundation-health-plan-and-hospitals-report-2023-financial-results. Accessed 7 May 2024.

Kraft Heinz Reports Fourth Quarter and Full Year 2023 Results. https://ir.kraftheinzcompany.com/news-releases/news-release-details/kraft-heinz-reports-fourth-quarter-and-full-year-2023-results. Accessed 7 May 2024.

'Letter to Shareholders from Jamie Dimon, Annual Report 2023'. JPMorgan Chase & Co., https://reports.jpmorganchase.com/investor-relations/2023/ar-ceo-letters.htm. Accessed 7 May 2024.

'Net Income vs. Profit: What's the Difference?' Investopedia, https://www.investopedia.com/ask/answers/122414/net-income-same-profit.asp. Accessed 7 May 2024.

NIKE, INC. REPORTS FISCAL 2023 FOURTH QUARTER AND FULL YEAR RESULTS. https://investors.nike.com/investors/news-events-and-reports/investor-news/investor-news-details/2023/NIKE-Inc.-Reports-Fiscal-2023-Fourth-Quarter-and-Full-Year-Results/default.aspx. Accessed 7 May 2024.

Q4 and FY 2023 Update. https://digitalassets.tesla.com/tesla-contents/image/upload/IR/TSLA-Q4-2023-Update.pdf. Accessed 7 May 2024.

Starbucks Reports Q4 and Full Year Fiscal 2023 Results. https://investor.starbucks.com/press-releases/financial-releases/press-release-details/2023/Starbucks-Reports-Q4-and-Full-Year-Fiscal-2023-Results/default.aspx. Accessed 7 May 2024.

Walmart Releases Q4 and FY23 Earnings. https://corporate.walmart.com/news/2023/02/21/walmart-releases-q4-and-fy23-earnings. Accessed 7 May 2024.

Yahoo News

Yahoo News