I was a first-time homebuyer and got scammed out of $167,000 of my life savings

Pat and Marisa Lawlor were the victims of real estate wire fraud in 2022.

The couple lost their $167,000 downpayment for their first home because of a fake email.

They've dedicated their time since to educating other first-time homebuyers.

This as-told-to essay is based on a conversation with 49-year-old Los Angeles-based business owner Pat Lawlor. It has been edited for length and clarity.

My wife Marisa and I were stoked when a seller accepted our offer on their home after we were outbid at three other places.

But three weeks later I ended up wiring our $167,000 downpayment to criminals pretending to be my escrow office.

We were first-time homebuyers, and before this, we were renting a house while raising two kids and never making tons of money.

I sell roller skates and skateboards, and my business went crazy as people started going outside more around the pandemic lockdown. We were able to get out of credit card debt and save enough for a downpayment on a house. So, we began our homebuying process in November 2021.

We were like, "This is our only chance to do this. Let's do it!"

But, during that time it was a seller's market — there was no inventory. We'd put in offers on three different houses and were outbid on all of them.

Finally, in February 2022, our offer on a home in the San Fernando Valley was accepted, and we opened escrow with a boutique escrow company chosen by the seller.

I asked my real-estate agent, "Who are these people?"

His reply: "It's a seller's market. Do you want to get this house or not?"

It felt like if we pushed back on anything, they would just take somebody else's offer. So, we wired our deposit to the escrow office, and we were kind of just waiting for everything to go through.

The scam

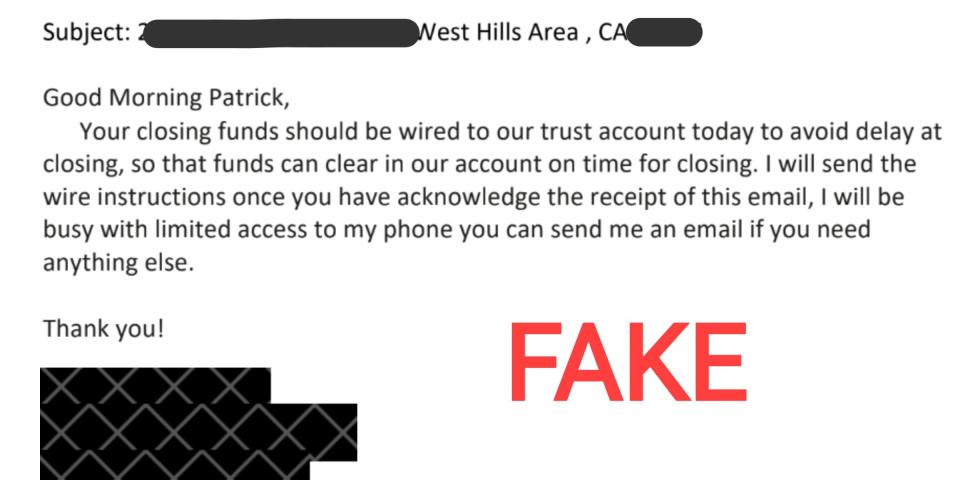

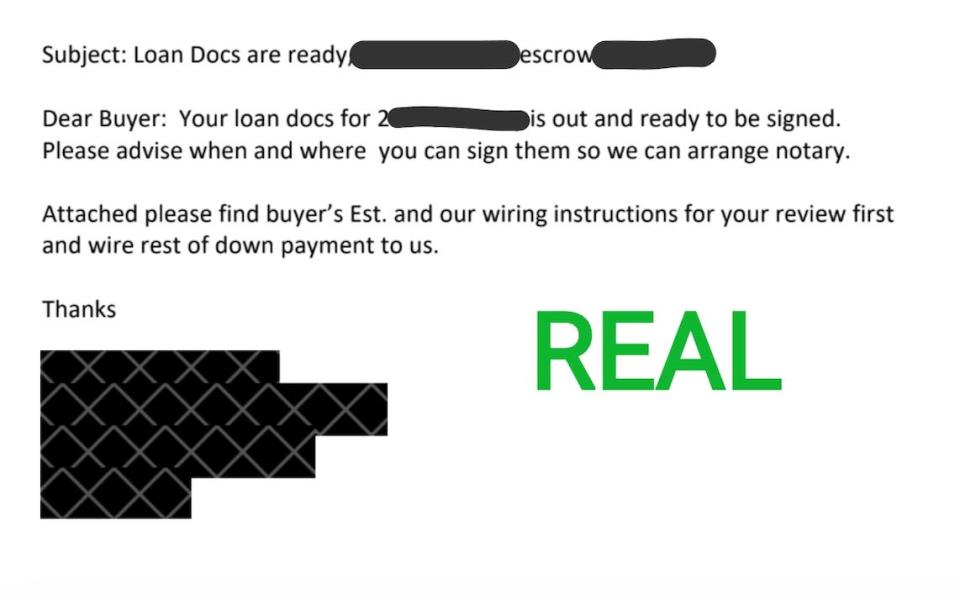

Then, about three and a half weeks later, I received an email on a Friday morning from who I thought was my escrow officer.

The format was the same, the signature was the same, and the names at the top were the same as previous messages, but it was a fake email.

Upon receiving it, I phoned the escrow office because you're supposed to call to make sure it's not a fraud email, but I didn't get through. I responded to the email asking them to confirm the amount, and they replied with an amount that was only $3 off the correct number (later, my escrow officer told me the figure was identical to another closing disclosure he had).

So I went and wired the money. I ended up wiring our $167,000 life savings to criminals.

Initially, we were excited because there was all this pent-up anxiety and wondering when the house purchase was going to happen. I even hung out with my real-estate agent the same day.

I was so trusting of everything that I emailed the scammers to follow up and confirm they received the transfer.

I didn't hear back from them. They were gone.

The realization

A week later, I got an email from my real escrow officer. It had the same format, same signature, same everything.

They were telling us we were clear to close, and the attachment on the email showed the balance due for our downpayment. I immediately thought, "That's not right."

I was still unaware that the money had been stolen. I was thinking that these people just didn't have their shit together. But then, when I called my escrow officer, he had me read him the wire instructions of the first email.

"That's not us," he told me.

That moment was like a punch in the stomach. He told me to go to my bank and file a claim.

My dad died when I was in my 20s, and it felt like that. It's almost like you're in a dream. I was standing out in front of the bank, watching the cars go by.

By the time I met with the branch manager, I was spiraling.

"You're not getting that money back," she said. I just stared at her lips, watching the words leave her mouth.

The method

It turns out that the scammers hacked into the escrow office's email server through a process called business email compromise.

With real estate wire fraud, they target mom-and-pop independent brokers, escrow, or title companies like the one we used.

Criminals get into the server, and they just sit there, wait, and watch all of the communication back and forth between everyone working together through the escrow process.

They study the language you use to communicate, with the goal of mimicking it, which is known as social engineering. They typically hit victims — like me — on a Friday so they have time to move the money out of the country before banks open on Monday.

The police traced the money to an offshore crypto exchange, but it was already too late.

The aftermath

On one hand, I feel so stupid, but we were the least knowledgeable party in this transaction. We were surrounded by so-called professionals who were supposed to have our best interests at heart.

But they aren't responsible for this legally. We are.

The detective involved told me our best chance to get the money back would be through a civil suit against the escrow company, but we didn't have the money to pursue that.

We had a powerful law firm helping us out at one point, but they couldn't litigate for free. So, the statute of limitations for a potential negligence lawsuit ran out, and we let it go.

From the escrow office's perspective, it's not their fault I sent the money, but they did have our personal information, which the criminals were able to get.

When I called a family member for legal advice, he offered to loan us the money so we wouldn't lose the house. Thankfully, we were still able to get it, but we're paying him back in monthly installments.

It's now been two years, and we've been forced to go from victims to advocates. This month, I'm speaking at the California Association of Realtors' annual meeting for Riverside County.

We've started a GoFundMe fundraiser to get that money back and raise awareness about real estate wire fraud. It's all we can do at this point.

We lost our life savings because of the internet. Now we're trying to use the internet to get it back.

The United States Secret Services describes business email compromise (BEC) as "a sophisticated fraud scheme targeting businesses that use wire transfers as form of payment." It estimates current daily losses due to the scheme at about $8 million globally.

Have you ever been a victim of wire fraud? Are you a cybersecurity expert with tips or guidance? Reach out to this reporter via email at jhart@businessinsider.com.

Read the original article on Business Insider

Yahoo News

Yahoo News