French Stocks See $210 Billion Wipeout From Macron’s Vote Call

(Bloomberg) -- French stocks lost about $210 billion in market capitalization this week, about the size of Greece’s economy, following President Emmanuel Macron’s decision to call a snap election. The CAC 40 index erased all gains for 2024.

Most Read from Bloomberg

Flesh-Eating Bacteria That Can Kill in Two Days Spreads in Japan

Southwest Plane Plunged Within 400 Feet of Ocean Near Hawaii

Danes Asked to Keep Supplies, Iodine Pills to Prepare for Crises

Meloni Uses the G-7 to Put Focus on the Global South — And Herself

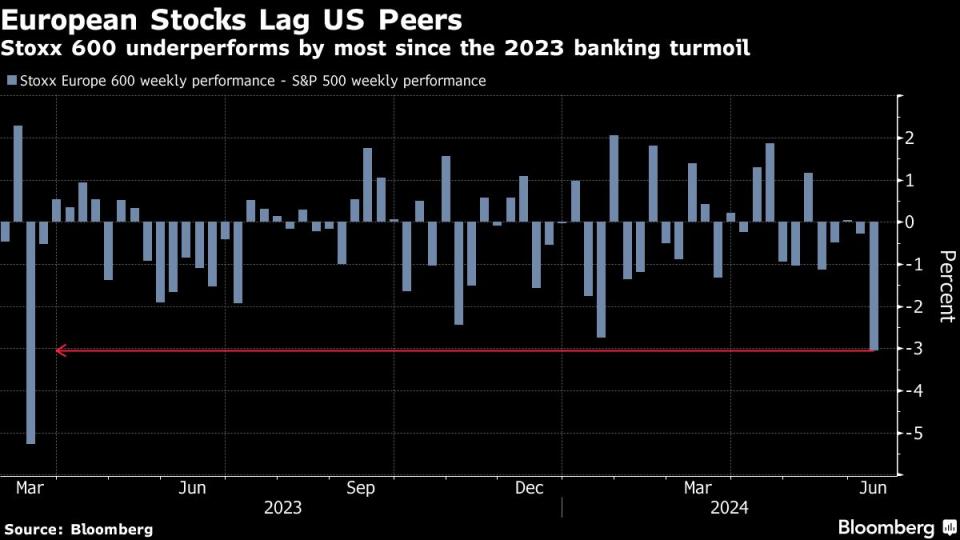

That’s weighed on the pan-European Stoxx 600 benchmark, which had its worst week since October. The index was down 1% by the close on Friday in London, with autos and industrials the biggest laggards. Defensive sectors such as health care and consumer staples outperformed, while France’s benchmark dropped 2.7%.

Defense firms declined ahead of a Swiss-hosted Ukraine peace summit and as Reuters reported that China is pushing a rival peace plan. France’s biggest lenders, including BNP Paribas SA and Societe Generale SA, dropped more than 10% over the week.

“Political uncertainty is going to keep setting the trend in European markets, at least in the short term,” said Thomas Nugent, equities portfolio manager at Mapfre AM. The Spanish asset manager has increased its equity exposure on the expectation corporates will have a better second half of the year than the first.

Concerns that Marine Le Pen’s far-right National Rally party may usher in looser fiscal policies if it wins legislative elections have fueled a decline in French bonds, driving yields over safer German peers to the highest level in seven years. On Friday, Finance Minister Bruno Le Maire warned that victory by a new left-wing alliance would lead to the country’s exit from the European Union.

“Macron’s gamble on new elections could go badly wrong after the left-wing parties agreed to unite, which would undermine strongly Macron’s centrist alliance,” said Uwe Maderer, head of fixed income at LBBW Asset Management. “They could be nearly wiped out in the election in a worst case scenario. Much of the market pricing is still totally benign in terms of spreads, volatility and interest rate curves.”

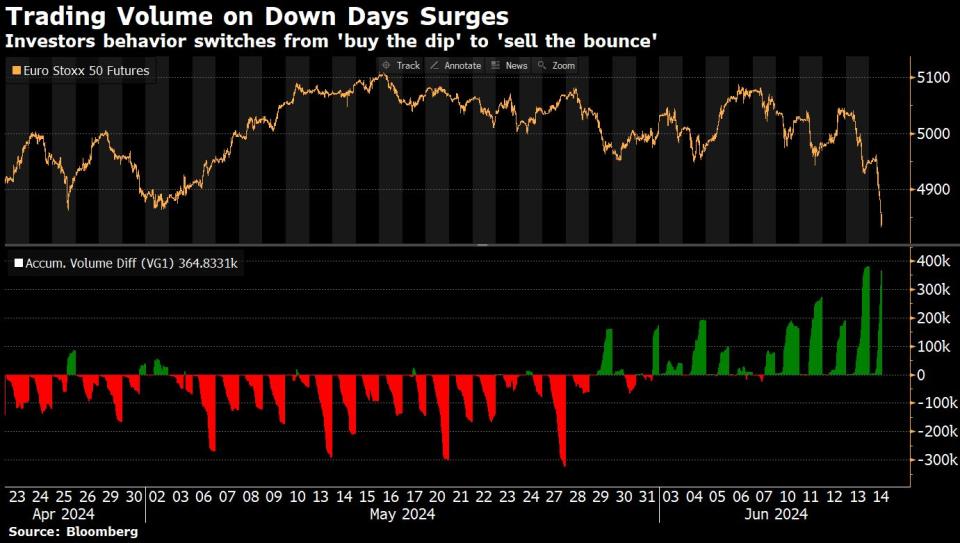

Trading patterns in Euro Stoxx 50 Futures have changed during the current draw-down. While the first half of the recent pullback saw below average turnover, trading size has picked up in June, with political events most likely sparking a higher demand of hedging and de-allocation of risk via futures. With futures quickly moving from gains to losses in early Friday trading, it suggests investors behavior is changing from buy-the-dip to sell-the-bounce.

For more on equity markets:

Homebuilders Are Set to Win UK Ballot Regardless: Taking Stock

M&A Watch Europe: Keywords Studios, Bellway, Crest Nicholson

IPOs Are Blockbuster June Attraction in Saudi Arabia: ECM Watch

US Stock Futures Fall; IN8bio, MSC Industrial Fall

It’s Coming to the Pubs: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Farah Elbahrawy, Sagarika Jaisinghani and Michael Msika.

Most Read from Bloomberg Businessweek

Grieving Families Blame Panera’s Charged Lemonade for Leaving a Deadly Legacy

Israeli Scientists Are Shunned by Universities Over the Gaza War

This Time, Higher Rates Are Boosting Spending and the Economy

©2024 Bloomberg L.P.

Yahoo News

Yahoo News