Further questions over 'Making Tax Digital' as HMRC demands 7p from 83 year-old

Britain's pensioners face being "left behind" when HMRC introduces its computerised taxation system, known as Making Tax Digital.

The controversial policy to move all of the country's tax systems online will begin to take effect in April for VAT payments, with income tax expected to follow after 2020. Experts have warned many pensioners, who tend not to be as computer literate as their younger counterparts, could struggle to adapt.

HMRC has already introduced the personal tax account, which allows you to view your tax liability online, but this has already caused chaos for some elderly people.

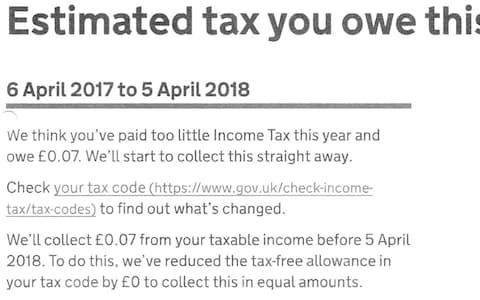

John Doe, an 83-year-old British pensioner living abroad, described his contact with the tax office as “funnier than a Whitehall farce”. This year he believes HMRC mistakenly predicted his pension would rise by 5pc, when in fact Mr Doe’s income would rise by only 1pc.

This led to the wrong tax code being applied to him. He flagged this with HMRC and it was corrected, but it appears that every time he logged into his digital tax account his tax code was recalculated. The catalogue of errors culminated in a demand from HMRC for 7p in unpaid tax.

HMRC told Mr Doe it would not be pursuing the “debt” due to its size. Mr Doe said: “It’s laughable. I get taxed when I get my pension, so I don’t how any of this has happened.”

Paddy Millard, the founder of independent charity Tax Help for Older People, warned that as much as 20pc of Britain's population could be impacted by the programme to digitise tax returns.

"Pensioners often don't trust computers. They read all the stories about people being defrauded online and I have every sympathy with them," he said. "The trust in HMRC's IT needs to be strengthened, they need to show their IT works.

"Frankly it doesn't at the moment. Otherwise I wouldn't be in my 14th consecutive year of them failing to get my tax liability right. It will leave at least 20pc of the population behind - probably more.

"Tax is inevitably going digital and for those who can manage it that's fine, but there need to be quill and paper alternatives."

The Government has delayed its original proposals following a number of criticisms, including the effect of the changes on elderly taxpayers.

Around 27,000 pensioners currently fill in a tax return because their state pension is above the personal tax allowance of £11,500. A new process known as "simple assessment" will mean, in cases in which the Government already holds information, there will be no need to file a tax return. According to HMRC this is still "four or five months away".

Sarah Ghaffari, a tax expert at the Institute of Chartered Accountants in England and Wales, said that after simple assessment is introduced pensioners will need to log in to their personal tax account to check their calculated liability is correct.

"The personal tax account is already live but not every piece of information is moving through yet," she added. "Eventually companies which pay dividends to people will need to find a way to update those accounts and everything will be there.

"They haven't got the whole picture in there yet and unfortunately that means people will still need to contact HMRC."

She also said that the full implications of Making Tax Digital are not yet clear and the situation could still change before 2020. The first legislation relating to it will be announced next month, although this is expected to focus solely on VAT with income tax to follow at a later date.

An HMRC spokesman insisted there will always be an option to continue receiving tax information on paper. On simple assessment, he added: "We will be sending taxpayers a Simple Assessment notice, setting out their tax liability without the need for them to submit a self-assessment return at all."

Telegraph Money first contacted HMRC querying the treatment of Mr Doe on August 1.

Yahoo News

Yahoo News