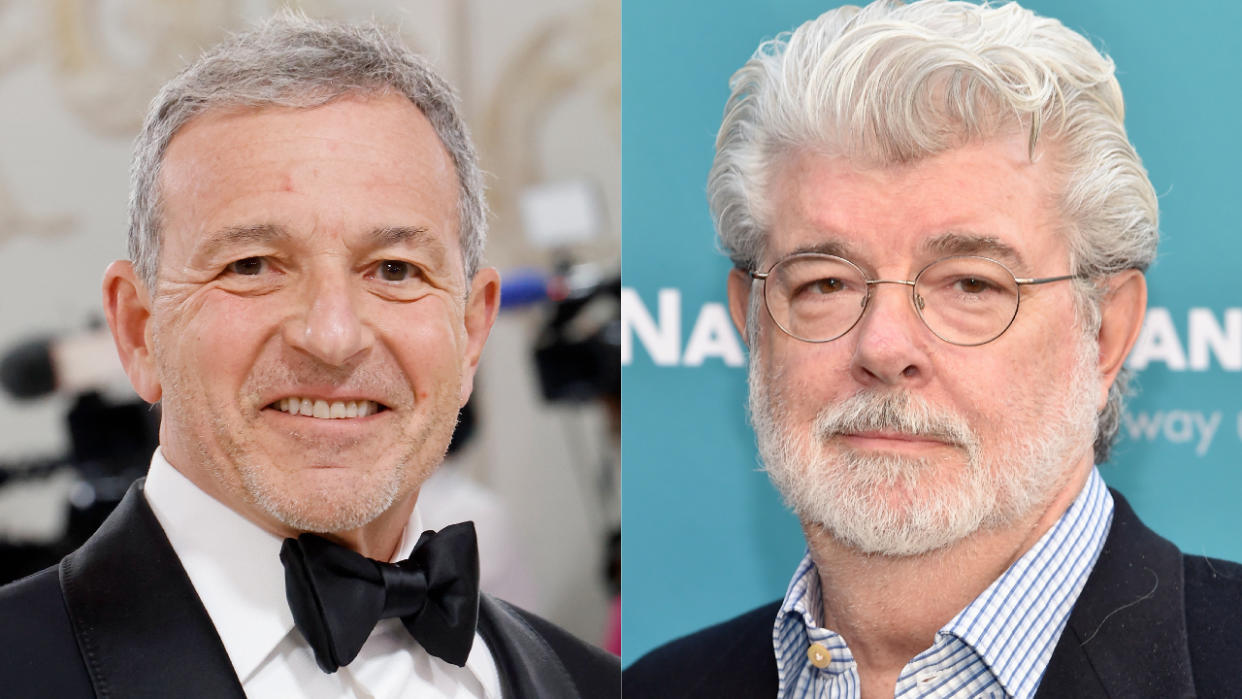

George Lucas Has Bob Iger’s Back: ‘Creating Magic Is Not for Amateurs’

George Lucas just sent the stormtroopers after Nelson Peltz. (Or if Peltz is Darth Vader in this standoff with Disney, Lucas sent the Jedi.)

The “Star Wars” creator backed Disney CEO Bob Iger in his ongoing (and going…and going…) proxy fight with activist investor Peltz. An important shareholder vote regarding the company’s board members is around the corner; we now know which way Lucas is voting.

More from IndieWire

“Creating magic is not for amateurs,” Lucas said in a statement shared with IndieWire. “When I sold Lucasfilm just over a decade ago. I was delighted to become a Disney shareholder because of my long-time admiration for its iconic brand and Bob Iger’s leadership. When Bob recently returned to the company during a difficult time, I was relieved. No one knows Disney better. I remain a significant shareholder because I have full faith and confidence in the power of Disney and Bob’s track record of driving long-term value. I have voted all of my shares for Disney’s 12 directors and urge other shareholders to do the same.”

Lucas sold Lucasfilm to Disney in 2012 for about $4 billion — half cash, half stock.

Peltz has been lobbying for a sea change — and a seat change — at the Walt Disney Company for years. He and pal Ike Perlmutter, the former Marvel boss, don’t believe Iger & co. are maximizing shareholder value. Considering Peltz’s Trian Fund Management controls 33 million shares, most of which are Perlmutter’s, we’d say they have a vested interest.

Basically, Peltz and Perlmutter want Disney to dramatically cut spending — starting with Iger’s compensation. Peltz wants himself and two buddies to join the company board of directors so they can personally cut costs. He probably already has the “For Sale” sign ready for the front lawn at Cinderella’s Castle.

Shares in Disney (DIS, roughly $115 apiece at the time of this writing) are faring significantly better than they were in the fall, but the stock remains well below its three-years-ago high of nearly $200 per share.

Peltz vs. Disney has been on and off for quite a while now. Peltz’s push dates back to Bob Chapek’s (short-lived) tenure as Disney CEO. Nelson and that Bob were allies. But then Chapek was fired, Iger returned, and the CEO-again’s giant reorg and dividend reinstatement satiated Peltz — for a while.

Disney’s annual shareholder meeting, when stockholders vote on important corporate matters (like board seats), is set for April 3, 2024. Things were already not looking good for Peltz, and Lucas’ company holdings — and his call to action — carry significant weight within the Disney-shareholder community. It’s crunch time for Peltz and Perlmutter to take drastic action — like maybe buying proxy votes online from other Disney shareholders. For the very cost-conscious duo, it’s an efficient means of gaining say over gaining shares.

Best of IndieWire

The Best LGBTQ Movies and TV Shows Streaming on Netflix Right Now

Guillermo del Toro's Favorite Movies: 54 Films the Director Wants You to See

Nicolas Winding Refn's Favorite Films: 37 Movies the Director Wants You to See

Sign up for Indiewire's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

Yahoo News

Yahoo News