Global Markets Brace for Yuan Big Bang When China Holidays End

(Bloomberg) -- Investors are scouring the market for cheap hedges against losses in China’s yuan, just as the world’s second-biggest economy prepares to return from a week-long holiday for the Lunar New Year. With implied volatility across all tenors falling to levels not seen since 2022, options have emerged as the most cost-effective vehicle for protection against a bigger-than-expected yuan depreciation.

Most Read from Bloomberg

Trump Keeps NY Empire Intact as Judge Rescinds Asset-Sale Order

Record US Stock Rally Is Under Threat From a World in Turmoil

Systemic Risk Concerns Grow Among Money Managers as Real Estate Woes Cause Turmoil

Wall Street’s Moelis Bet Big on the Middle East. Now He’s Cashing In

For the offshore yuan, short-dated implied volatility gauges have been declining since their October 2022 peak. Both one- and three-month implied vols are now at or near two-year lows, meaning that option buyers can scoop up inexpensive protections. Nine-month implied vol — which spans the US presidential election on November 5 — hasn’t fallen as much as its front-end peers. Still, the measure now trades around 5.3%, approaching levels last seen in August 2022 before volatilities soared.

“All the political points are to be earned bashing China at this point,” said Brent Donnelly, President of Spectra FX Solutions LLC and a veteran FX trader with previous stints at HSBC, Citigroup and Nomura. He recommended in early February a one-year 7.60 USD/CNH call to clients when the pair was trading at 7.2250 — an inexpensive hedge that’s likely to work well no matter who wins in November. China’s own economic woes are also putting its currency in a bind, with many paths to depreciation and very few ways to strengthen, he added.

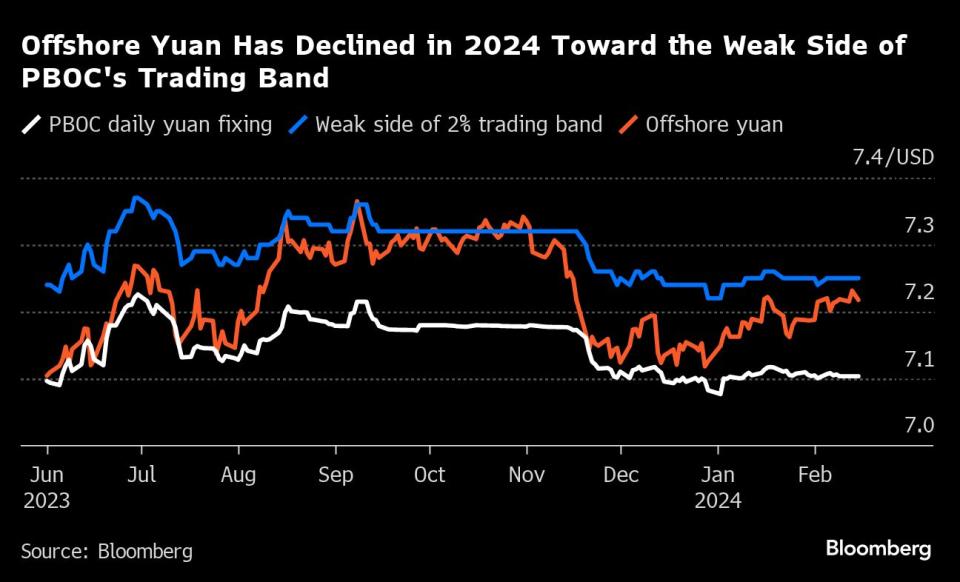

Societe Generale strategist Kiyong Seong echoed that sentiment last week, telling clients to take advantage of “multi-year low” prices and buy three-month USD/CNH risk reversals as a depreciation hedge. The yuan’s low volatility stems largely from PBOC fixing, which hasn’t moved much over the past couple months, according to the French bank. The currency is allowed to move 2% in either direction of the daily reference rate and it would be “inevitable” for the central bank to devalue its fixing if the yuan weakens past 7.25 — the weak side of the band, Seong noted. “The subsequent bearish market reaction would be strong, pushing USD/CNH toward the closely guarded 7.30-7.35 range.”

US data last week also underscored persistent price pressure, dimming hopes of a Fed cut in the first half of 2024 and ramping up pressure for a weaker yuan. Citigroup, Societe Generale and former Treasury Secretary Larry Summers are all telling investors to brace for the potential of Fed hikes, instead of cuts that are already in the price.

--With assistance from Tania Chen.

Most Read from Bloomberg Businessweek

How Paramount Became a Cautionary Tale of the Streaming Wars

‘Playing God’: This Labor Activist’s Relentless Emails Force Companies to Change

©2024 Bloomberg L.P.

Yahoo News

Yahoo News