Halal mortgage expansion not exclusive to Muslim buyers in Canada

Canada's 2024 federal budget mentioned exploring halal mortgages, sparking some to claim the home financing plans would offer unfair advantages to Muslim buyers in the tight housing market. This is misleading; the loans, which do not charge traditional interest, are open to people of any faith and have fees comparable to the cost of paying conventional mortgages.

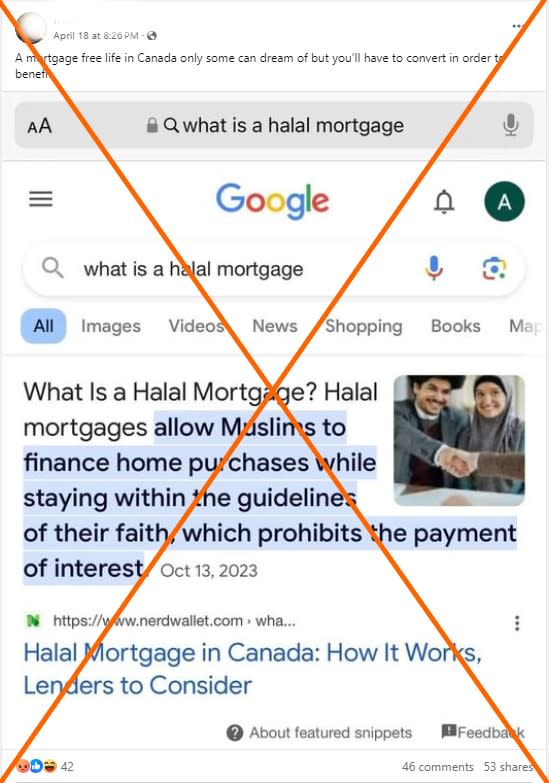

"It appears that our government is going to try to facilitate interest free mortgages through the nation's 5 major financial institutions for Muslim immigrants coming to Canada," says an April 17, 2024 Facebook post.

Other posts across Facebook, Instagram, X and TikTok claim the halal mortgages would only be available to Muslim home-buyers.

The posts come amid rising concerns about the Canadian housing crunch, a crisis sometimes blamed on population growth via immigration. The ruling Liberals made addressing housing availability and affordability a cornerstone of their annual budget released April 17 (archived here).

The document says the government is "exploring new measures to expand access to alternative financing creations, like halal mortgages." The Canadian Department of Finance told AFP in an April 24 email that such mortgages are already available in the country and are not government products.

"The government is simply looking at ways to help more Canadians become homeowners while ensuring adequate consumer protections are in place," spokeswoman Caroline Thériault said.

Furthermore, the financing option is not exclusively available to Muslims.

"The idea is if you want this mortgage, you get it -- regardless of your ethnic background or religious background," said Walid Hejazi, a professor of economic analysis and policy at the University of Toronto's Rotman School of Management (archived here).

How halal mortgages work

Hejazi said an Islamic or halal mortgage is a money-lending plan that complies with Sharia law, which forbids earning or charging interest (archived here). Christians and Jews also have rules against interest, or usury, but they have not spawned similar alternative banking products.

Hejazi said there are three popular ways halal mortgages are structured (archived here):

Murabaha, where a lender buys the house and sells it to the home-buyer for a higher price

Musharaka, where the lender buys the house and the home-buyer pays rent while paying off the principal cost in installments, increasing their share of ownership until the property is paid off

Ijara, which employs a rent-to-own model

These models involve payments totaling more than the value of the house, Hejazi said -- so halal mortgage clients often end up paying bills comparable to a conventional mortgage.

In Canada, where there are fewer regulations relevant to halal mortgages, he said buyers pay around four percent more in fees compared to conventional borrowers.

For example, mortgages using a Murabaha model are subject to double land transfer tax (archived here) due to its two transactions, which Hejazi said could be eliminated with regulatory recognition of Islamic mortgages.

"So what the government is considering is not giving preferential treatment, it's just putting everybody on a level playing field," he said.

Integration of halal mortgages

The misinformation comes amid an ongoing debate in Canada -- particularly in the province of Quebec -- over secularism and the role of religion in public life. The federal Bloc Quebecois party criticized the government's acknowledgment of halal mortgages (archived here and here).

Countries with Muslim minorities have for years adapted their financial systems to accommodate halal mortgages. Hejazi said the United Kingdom scrapped the double-stamp duty in 2003, and there is now a large network of Islamic banks offering lending options to Muslim and non-Muslim applicants.

Mohamad Sawwaf, co-founder of the Canadian halal investment hub Manzil, invoked the often-mentioned halal chicken metaphor, pointing out that anyone -- regardless of their religion -- is permitted to consume food that conforms to the rules of Islam.

"Nobody discriminates you against buying one, right?" he said. "So it's no different with halal banking."

Founded in 2020, Sawwaf's company is one of a handful of small institutions specializing in halal investment options in Canada. He said Manzil's waitlist tops 15,000 families, but because of the small scale of halal mortgages, there is less capital to fund them.

He said recognition from the Canadian Mortgage and Housing Corporation's (CMHC) mortgage bond program (archived here) would attract and assure funders.

"It doesn't even come down to the product anymore," Sawwaf said. "It's just a matter of: Can we create a system that we're used to in the conventional mortgage space to accommodate this structure?"

According to Canada's budget, the 2024 fall economic statement will provide an update on halal mortgage consultations.

Read more of AFP's reporting on misinformation in Canada here.

Yahoo News

Yahoo News