Inflation expected to have risen again in January

The Chancellor is expected to be dealt a Valentine’s Day blow as new data on Wednesday could show that inflation rose for the second month in a row.

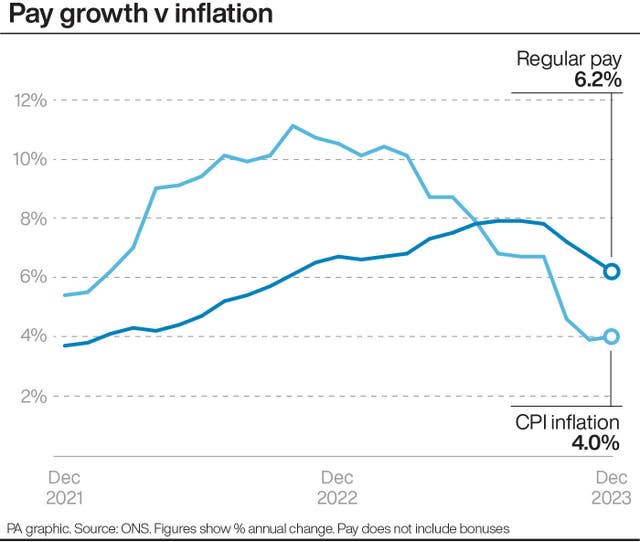

Economists expect the figures will show that Consumer Prices Index inflation – a measure of the costs that households face – rose from 4.0% in December to 4.2% in January.

It would be a blow for households because their costs are rising faster than at the end of last year, although inflation is still less than half where it was a year ago.

It could also hurt the Government’s promises to help households out by getting inflation under control, although this is only likely to be a short-term blip before inflation begins to fall again.

Samuel Tombs, the chief UK economist at Pantheon Macroeconomics who believes that inflation hit 4.1% in January, said that regardless of Wednesday’s data, inflation is likely to fall considerably, to 3.4%, this month.

Economists will be tracking the data to try to figure out what influence it might have on the Bank of England.

The Bank’s Monetary Policy Committee (MPC) is tasked with keeping inflation as close to 2% as possible.

One of the main ways it has to do this is by changing interest rates. By increasing rates it restricts the amount of money that mortgage holders have to spend, therefore reducing demand for goods and services. That can help take pressure off prices.

So if inflation is higher than the 4.1% the MPC expected in its last forecast, that could make rate setters more likely to delay cuts to the base rate.

The higher-than-expected wage rises in Tuesday’s Office for National Statistics figures will also spark worries of delays to base rate cuts. Wage rises tend to push up inflation somewhat.

“Today’s wage rises contribute to tomorrow’s spending power, impacting demand and influencing inflation, so the Bank will be keenly monitoring average earnings growth in particular,” said Rob Morgan, chief investment analyst at Charles Stanley.

“Resilient wages have been a driver of sticky consumer price inflation, and they are not falling back into line as fast as the BoE (Bank of England) would like as it looks to return inflation to the 2% target.

“What’s more, a further inflationary impulse could lie in wait in the form of an increase to the national minimum wage of almost 10% from April, which stands to simultaneously increase costs for employers and bolster household spending power, potentially exerting further upward pressure on prices.”

Martin Beck, chief economic adviser to the EY Item Club, said: “On balance, the EY Item Club thinks the latest pay data should further calm the MPC’s concerns about the threat posed by a tight labour market to achieving low inflation on a sustainable basis.

“The committee will likely want to assess the impact of April’s sizeable rise in the national living wage before it’s sufficiently reassured on that subject.

“But the EY Item Club continues to think the MPC will start cutting interest rates in May, with a series of further reductions in bank rate following over the course of this year.”

On Tuesday, figures from the US showed that inflation slowed to 3.1% from 3.4% earlier, but the slowdown was less than the drop to 2.9% that had been expected.

Yahoo News

Yahoo News