Investors Bet French Assets Face Months Of Volatility After Election

(Bloomberg) -- No matter which party comes out on top in Sunday’s French parliamentary election, some investors are betting the vote marks the beginning of a more turbulent period for the country’s stock and bond markets.

Most Read from Bloomberg

Kamala Harris Is Having a Surprise Resurgence as Biden’s Campaign Unravels

Singapore Couples Are Marrying Earlier to Buy Homes, Leading Some to Regret

Biden’s Fourth of July Shrouded by Pressure to Drop 2024 Bid

Nasdaq 100 Up 1% as US Yields Tumble on Fed Wagers: Markets Wrap

Traders are growing increasingly confident that the worst-case scenario — an absolute majority in France’s lower house for Marine Le Pen’s far-right National Rally — will be avoided. Still, the alternative is gridlock, preventing France from addressing its swollen budget deficit and ending President Emmanuel Macron’s pro-business reforms.

That means markets are likely to face a hangover from the political turmoil for months to come. France’s CAC 40 Index has been the worst performer among major European stock indexes since Macron called the snap election last month, while at the height of the selloff a metric of bond-market risk soared to its highest since the sovereign debt crisis.

“The market is still very cautious and not really celebrating,” said Alberto Tocchio, a portfolio manager at Kairos Partners. “It’s still concerned about a hung parliament that could become a worry over the medium term.”

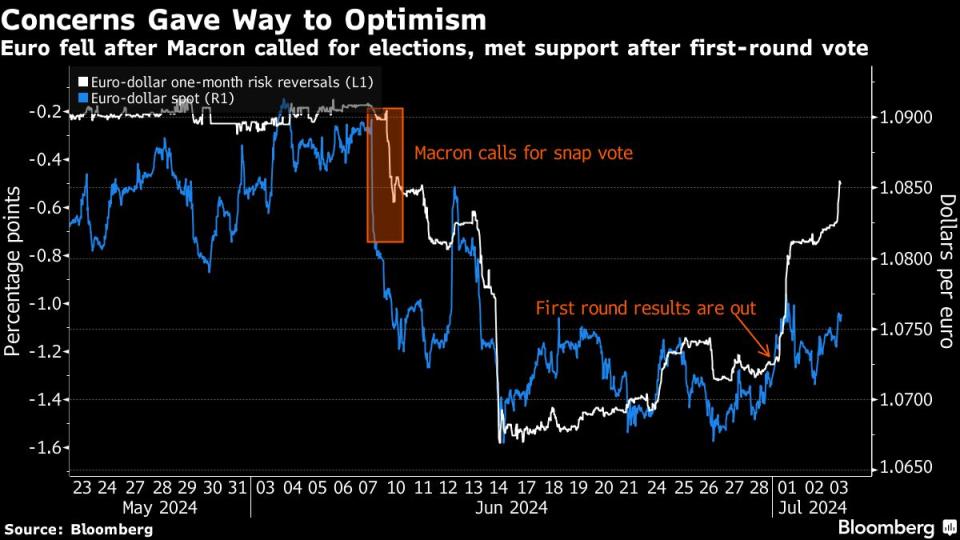

Stocks rallied this week after the first-round vote eased worries about a far-right government, and overall market stress has receded. The volatility index tracking the Euro Stoxx 50 narrowed a gap against its US equivalent after the spread soared in June to the highest level in more than two years.

Options markets are implying smaller equity moves following the second round on Sunday. Calculations by the derivatives strategy team at JPMorgan Chase & Co. predict a one-day move of 1.9% in either direction in the CAC 40, less than last week’s 2.9%.

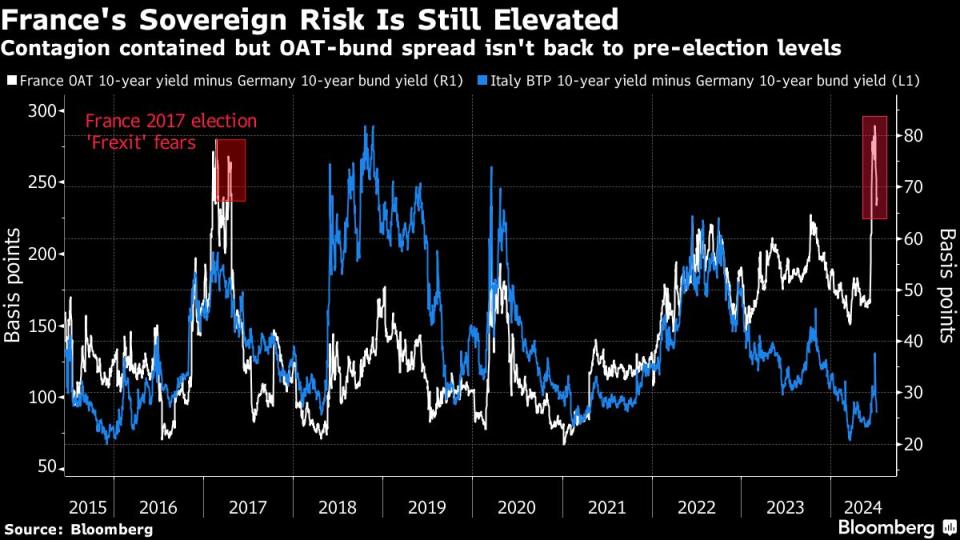

Still, the CAC 40 remains 3.8% below levels seen before the June 9 snap election call. The premium that investors demand to hold French government bonds over German ones stands at less than 70 basis points, below the peak of 86 basis points in the wake of the election call but well above the level of 50 basis points from early June.

The pullback has also removed the valuation premium that investors had awarded to French stocks over the past year. The CAC 40’s valuation relative to Germany’s DAX Index is now near the lowest since before the US regional banking crisis early last year.

And at a price-to-earnings ratio of almost 14, the broader MSCI France Index trades in line with its pan-European counterpart.

For investors willing to look past short-term risk, there’s a bull case for French stocks: The broad-based selloff has made some more attractive, since they’re backed by a robust earnings outlook. Moreover, French companies generate more than 60% of their revenue outside Europe, according to data from Goldman Sachs Group Inc., limiting any impact from geopolitical turmoil at home.

“It feels like France in general just got sold off and nobody looked at the exact risk to certain names or the exposure to France,” said Madeleine Ronner, who manages global equities at asset manager DWS Group. While Ronner hasn’t added to her exposure to France in the past month, she said she would consider buying next week “if the selloff is big enough.”

Over at BlackRock Inc., Helen Jewell, chief investment officer of the fundamental equities EMEA unit, says corporate earnings also are likely to be more protected than “the market is currently pricing in.”

“There’s an opportunity to buy interesting, quality companies at a lower price,” Jewell said, adding that she sees attractive bets in luxury goods and aerospace and defense.

In the bond market, investors are likely to impose a more elevated interest rate on French government borrowing for years to reflect existing fiscal challenges. That includes a 5.5% deficit that breaches the European Union’s 3% limit and a debt load the International Monetary Fund said will rise to 112% of economic output in 2024.

The spread between France and Germany’s 10-year yields could initially tighten if there’s a hung parliament, since that would reduce the risk of much higher public spending, but strategists say it’s unlikely to go back to the levels seen before Macron called the snap election.

“The level of French spreads is somewhat irrelevant in the absence of reassurance about the direction of future fiscal policy,” said Benoit Anne, a managing director at MFS Investment Management. He warned about pricing out risk too early while the country’s political and economic outlook remains clouded.

Plenty of investors were voicing the need for caution, not least because it’s hard to predict how citizens might vote if a candidate they previously backed is no longer running. Traders are going into the second-round vote holding close to the most futures contracts on French bonds in at least a year. Given yields have also moved higher in recent weeks, it suggests they’re betting on higher government borrowing costs.

In currency markets, options data suggests traders aren’t confident that recent gains in the euro will hold, and buying protection against a drop over the next month still trades at a premium. Morgan Stanley recommended clients stay short the common currency versus the dollar, predicting it can fall below $1.05 from about $1.08 now on a combination of factors that include low-quality European growth and political risks from Germany.

Credit investors are more optimistic and have already moved to price out any extreme outcomes from the debt of French companies — which make up about a fifth of the total European credit market.

The gap between the spreads of European high-grade bonds over those of US counterparts has gone back to levels seen on June 10 — the day after the election was called — thanks to this year’s biggest daily drop in the risk premium of euro debt, according to data compiled by Bloomberg.

And the renewed bullishness could have further to run.

“Under most outcomes we do not expect much volatility after the French elections, with many investors hoping for an opportunity to buy the dip,” JPMorgan Chase strategists led by Matthew Bailey wrote in a note.

Over at Goldman, though, partner Rich Privorotsky said his bank’s clients paint a very different picture.

“The feedback for US investors is that they won’t touch the geography until after the event,” Privorotsky wrote in a note to clients, referring to the French elections. There’s “some additional push-back that a hung parliament is still pretty negative,” as it could leave fiscal issues unresolved or show no progress on reform.

--With assistance from James Hirai, Tasos Vossos, Vassilis Karamanis and Aline Oyamada.

Most Read from Bloomberg Businessweek

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

©2024 Bloomberg L.P.

Yahoo News

Yahoo News