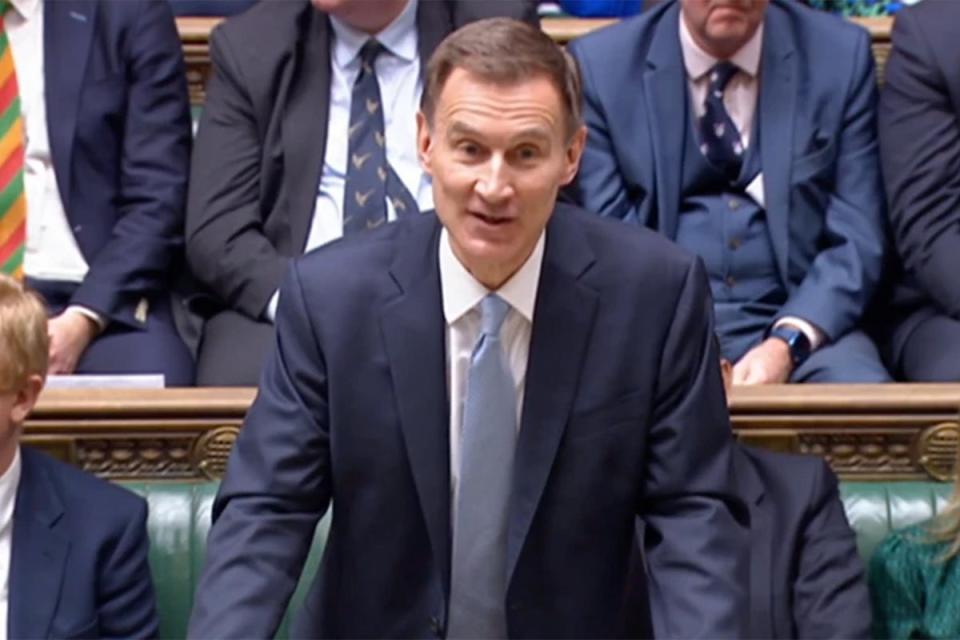

Jeremy Hunt lifts child benefit high-income charge threshold in Budget surprise

The high-income child benefit charge threshold will be raised from £50,000 to £60,000 and the taper will extend up to £80,000, Jeremy Hunt has said.

In a surprise announcement during Wednesday’s Budget, the chancellor said the threshold will rise from April, lifting 170,000 families out of paying the charges altogether.

The move has been hailed as a “win” by Martin Lewis, while the chief of the Institute for Fiscal Studies (IFS) called it “radical”. However, Sir Keir Starmer questioned whether the pledge was a “reckless” empty promise, while Labour MP Jess Phillips accused Mr Hunt of merely undoing an “unfairness” established by a government that he served in as a cabinet minister.

Currently, if you earn £50,000 or more before tax each year you can still claim child benefit, but you have to start paying a “child benefit tax charge” above that threshold.

If you live with a partner and you both earn £50,000 or more, whoever earns the most will have to pay the tax charge - no matter who makes the claim for child benefit.

If you earn over £60,000, the amount you pay in charges will cancel out the amount you gain in child benefits.

It has been criticised as unfair because if both parents earn under £50,000 they can keep all of their child benefit, while if one earns over, they are hit with the charges.

Meanwhile, the IFS has said parents hit by the charge who earn between £50,000 and £60,000 have effective tax rates for income tax and national insurance of 54 per cent for one child, 63 per cent for two children and 71 per cent for three children.

Chancellor Jeremy Hunt said child benefit is withdrawn when one parent earns more than £50,000 a year, saying: “That means two parents earning £49,000 a year receive the benefit in full but a household earning a lot less than that does not if just one parent earns over £50,000.

“Today I set out plans to end that unfairness. Doing so requires significant reform to the tax system including allowing HMRC to collect household-level information.

“We will therefore consult on moving the high-income child benefit charge to a household-based system to be introduced by April 2026.

“But because that is not a quick fix, I make two changes today to make the current system fairer.”

He explained: “I confirm that from this April the high-income child benefit charge threshold will be raised from £50,000 to £60,000. We will raise the top of the taper at which it is withdrawn to £80,000.

“That means no one earning under £60,000 will pay the charge, taking 170,000 families out of paying it altogether. And because of the higher taper and threshold, nearly half a million families with children will save an average of around £1,300 next year.”

Mr Hunt also promised a consultation on the household-based system “in due course”, with this being introduced by April 2026.

In response to the chancellor’s announcement, Sir Keir said the cost of childcare is a “huge challenge for millions”.

But he added: “All is not as it seems and with just over three weeks to go, he has to come clean because up and down the country parents need to know is will they get their entitlement in April, or is it just another of their reckless promises on governing? Headlines over delivery, promises without plans, policies that unravel at the first contact with reality.”

The Labour leader branded the chancellor’s Budget “the last desperate act of a party that has failed” and accused the Conservative government of “delusion”.

Ms Phillips, the former shadow minister for domestic violence and safeguarding, took a swipe at the chancellor’s child benefit announcement on social media, posting on X: “Love Jeremy Hunt is undoing an unfairness in child benefit that a government he was a cabinet minister in started. Cheers dude.”

However, welcoming the move, Money Saving Expert (MSE) founder Mr Lewis wrote on X on Wednesday: “We got the win on child benefit!

“Chancellor tipped me off before budget, said this was due in large to MSE/my shows campaigning – all based on all those of you who messaged me to say it was the key thing to put to him.”

IFS director Paul Johnson said: “Radical change this – allowing HMRC to collect household-level information so as to reform high-income child benefit charge. In short term threshold raised from £50k to £60k. Lose all child benefit only at £80k. This doubles period over which taper works so cuts marginal tax rates.”

Yahoo News

Yahoo News