Labour Vows ‘Tax Dodger’ Crackdown to Fund Health Pledges

(Bloomberg) -- Shadow Chancellor Rachel Reeves pledged to tighten a crackdown on non-domiciled residents and expand tax-compliance investigations if Labour wins the looming general election, as she sought to plug gaps in the UK opposition’s spending plans.

Most Read from Bloomberg

US Slams Strikes on Russia Oil Refineries as Risk to Oil Markets

Bond Trader Places Record Futures Bet on Eve of Inflation Data

Iran’s Better, Stealthier Drones Are Remaking Global Warfare

Ukraine Says It’s Behind Blaze on Russian Warship in Baltic Sea

Vowing to “take on the tax dodgers,” Labour’s finance minister-in-waiting said she could raise £5.1 billion ($6.5 billion) per year by the end of the next parliamentary term by boosting the number of fraud probes by the UK tax authority, HM Revenue and Customs. Some £555 million of additional money would fund 5,000 extra tax-compliance officers to chase funds owed to the government, she said in a statement.

Reeves told BBC Radio that the announcement will help Labour deliver promises of an extra 2 million appointments on the National Health Service, 700,000 more emergency dental appointments and free breakfast clubs in all primary schools to help parents return to work. “That’s not small change,” she said. “That’s a massive difference.”

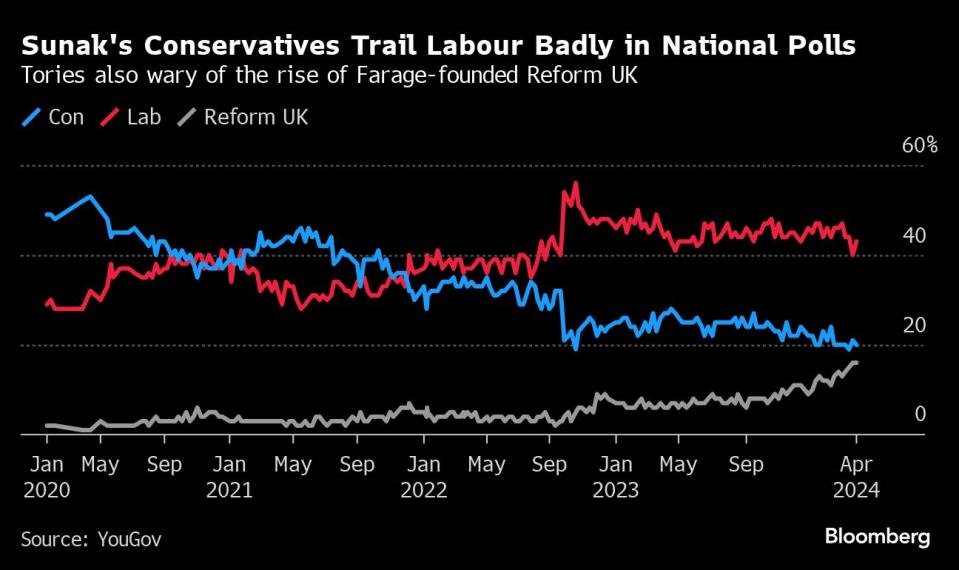

Riding high in polls which suggest they’ll win a general election expected later this year, Reeves and Labour Leader Keir Starmer have been under pressure to explain how they’d plug a gap in their funding plans that opened up when the governing Conservatives adopted some of the opposition’s fund-raising policies in the budget in March. Instead of spending the expected windfall on health and education services, as Reeves would’ve done, Chancellor of the Exchequer Jeremy Hunt used it to cover the cost of a cut to the national insurance levy on pay.

Labour said that even though the Tories had announced plans to scrap the tax regime surrounding so-called non-doms, it had left loopholes in its reforms. It vowed to scrap a 50% discount in the first year of the new rules, raising £600 million, and said foreign assets held in trusts would be subject to UK inheritance tax, raising potentially another £430 million a year.

Under the current regime, non-domiciled residents ranging from middle-ranking bankers to multibillionaires don’t pay UK taxes on their overseas earnings for as long as 15 years. More than one in five bankers earning more than £125,000 claimed non-dom status at some point, according to 2022 research by the London School of Economics and the University of Warwick.

Labour also sought to raise more money by plowing resources into HMRC, whose data shows the difference between taxes owed and taxes collected in 2021-22 was £36 billion. The party said that investigations into offshore, corporate and wealthy taxpayers had been cut in half in five years, and that more of the money owed could be collected by boosting staffing at the tax collector.

“It is wrong that a minority continue to avoid paying what they owe,” Reeves said in Labour’s statement. “The plan we are announcing today will give HMRC the resource it needs to go after those who are avoiding or evading tax.”

Prime Minister Rishi Sunak must hold a general election by January and has said that his “working assumption” is that a nationwide vote would take place in the second half of the year.

Labour currently leads the Tories by around 20 points in opinion polls, though the party has faced criticism from its own supporters for not unveiling more adventurous policies that boost spending in the country’s ailing public services. However Reeves said she would always ensure that plans the party announces are fully funded, and blamed the government for a dearth of resources.

“The economic inheritance that the next government will have, whoever it is, will be dire, including the highest tax burden in 70 years, the first parliament ever where living standards are worse at the end than they were at the beginning and indeed a debt to GDP ratio that’s almost 100%,” Reeves told BBC radio. “This is the worst economic inheritance since the Second World War, and it will constrain what an incoming government can do.”

Most Read from Bloomberg Businessweek

How Bluey Became a $2 Billion Smash Hit—With an Uncertain Future

Everyone Is Rich, No One Is Happy. The Pro Golf Drama Is Back

Power Bills Will Keep Rising Even After the Fed Tames Inflation

©2024 Bloomberg L.P.

Yahoo News

Yahoo News