Lack of money for tax cuts persuades Rishi Sunak to call general election

Rishi Sunak decided on an early election after Treasury officials concluded there would be no money for “meaningful” tax cuts in an autumn budget.

Jeremy Hunt had just £6 billion left in the Treasury coffers after the spring Budget, in which he cut National Insurance by 2p. That £6 billion figure would need to have swollen to £30 billion for any significant giveaways in autumn.

By way of comparison, Lord Hammond, the former Chancellor, liked to have £60 billion left over at the end of every budget to leave enough headroom for debt reduction and unexpected events – 10 times what Mr Hunt was left with in March.

It meant Mr Sunak and Mr Hunt would have needed to borrow money for a pre-election tax cut, which they are very much against; hope for a windfall from economic growth, which is unpredictable; or make sizeable spending cuts elsewhere, which the Treasury doubted was possible in the time available.

Mr Sunak’s announcement of an uplift in defence spending to 2.5 per cent of GDP further squeezed the amount of money left for an autumn budget, and there were fears that economic variables, such as inflation and growth, could go against the Government.

Mr Sunak knew that an underwhelming pre-election budget would have done more damage than going to the polls before a budget was due, and it became a major part of his thinking as he made up his mind about an early election.

One Whitehall source explained: “By the time you have factored in the increased defence spending, the need to keep some money back for extra NHS spending going into the winter, the compensation payments for the victims of the infected blood and Post Office scandals, there wouldn’t have been any money left for a people-pleasing budget with meaningful tax cuts.

“It’s possible that the Bank of England might have implemented one or two interest rate cuts before the autumn and the growth forecasts could have improved, but that is by no means guaranteed.

“There is also an expectation that inflation will creep back up from the 2.3 per cent that has just been announced. The assumption is that 3 per cent will be the new normal, at least while energy prices stay as high as they are.

“Geopolitically things are very volatile as well so there were just too many risks in going long.

“If there had been a budget there would have been an awful lot of Tory MPs disappointed with what was in it.”

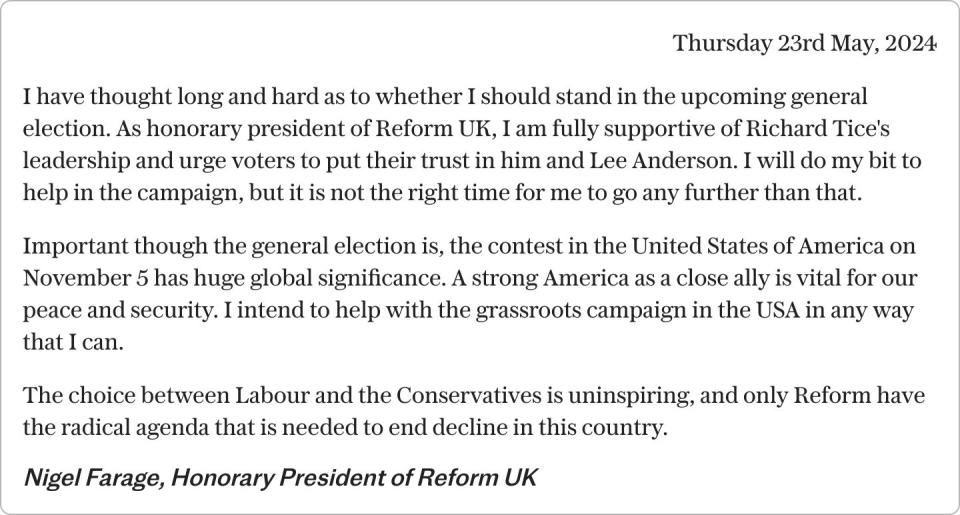

Plenty of other factors played into Mr Sunak’s decision to go for a July 4 election, including a desire to wrong-foot Nigel Farage, which proved successful when the Reform UK honorary president decided six weeks was not long enough to mount a winning campaign to become an MP.

The economy, though, is the battleground on which Mr Sunak has chosen to fight the election, and Carl Emmerson, deputy director of the Institute for Fiscal Studies, agrees that an autumn budget would have come with its problems.

“The public finances are clearly in a very weak state,” he said, “and the spending plans pencilled in for the next parliament are already questionable.

“The Chancellor might have had head room for a very modest tax cut but would still be left with questions over how that would ultimately really be paid for.”

Government debt is high, partly because of the huge borrowing to fund the Covid pandemic response, and predictions of growth are “a long way from stellar”, Mr Emmerson said.

“The Chancellor could have cut spending to pay for tax cuts but it’s much more about ‘are these funding plans credible?’”

This week the International Monetary Fund warned Mr Sunak that the Government was on course to miss its debt target and should not cut taxes before the election.

A Downing Street source said Mr Sunak had not sought or been given Treasury advice about an autumn budget.

They said that “ultimately it is the Prime Minister and the Chancellor that would have to decide” on spending priorities, and that “it is wrong to say that tax cuts would be impossible because he would have to have made a choice elsewhere”.

Mr Sunak has made it clear he has plans to reduce the welfare budget, which would leave room for tax cuts, but government sources conceded that there was not time before the autumn to implement a long-term plan for welfare reform.

Yahoo News

Yahoo News