How Many Subscribers Each Streaming Service Has — Spring 2024 Edition

Depending who you ask, the streaming wars are either over (and Netflix has won!) or still very much ongoing.

Well, if you came to this story, you’ve asked us. Our answer: Yes, Netflix has won first place, but the other podiums are still in play.

More from IndieWire

Historically, the way to evaluate streamers was by subscriber count. Though the industry’s grow-or-die era is over, subscribers are still very important to ranking the streaming services. Revenue may have taken over as the key-est of the KPIs (key performance metrics) for Netflix and others, but there is no revenue without subscribers. (And no ARM — average revenue/member — for Netflix, and no ARPU — average revenue per user — for everyone else who doesn’t have to sound so unique.)

We’ve recorded the subscriber counts for each of the major streaming services as of December 31, 2023. Netflix will report its Q1 results on April 18, 2024; everyone else will follow with their own updates.

Peacock: 31 million subscribers

It’s hard to write about Peacock’s small number of subscribers without acknowledging its tough start. The NBCUniversal streaming service was set to make a big splash on the market, debuting with the 2020 Olympics. But then COVID happened, and the Olympics did not. Executives had no idea what to do from there.

When Peacock launched, it didn’t have “The Office” or originals (save “Brave New World”) — or really much more to speak of at all. Summer isn’t exactly the time for TV to shine, and Hulu, which launched a dozen years earlier, still had the NBC shows anyway. Without much worth paying for, Freecock (our term for the free tier of Peacock) was born. The move generated signups, but it didn’t convert many subscribers and was discontinued (for new users) in early 2023.

Starting behind the 8-ball rarely results in a win. Peacock, which is not profitable — and management has not even put a date on profitability — is fortunate that NBCU owner Comcast has deep pockets. Those pockets got deeper (or at least more flush with cash) by selling its Hulu share to Disney, which signaled an all-in bet on Peacock.

Peacock recently hosted an exclusive NFL Playoff game, which cost a hell of a lot of money and irked a hell of a lot of football fans, but it brought in millions of new subscribers who are not (yet) officially captured in the end-of-2023 number. Streaming-measurement company Antenna estimates Peacock signed up 3 million new members for the game — and most of them have stuck around.

Max (plus HBO plus Discovery+ plus BluTV): 97.7 million subscribers

Warner Bros. Discovery reports its streaming numbers within the broader context of “direct-to-consumer” (DTC) — it does not break out Max and Discovery+. It actually doesn’t even break out streaming: WBD’s DTC tally also includes linear HBO, since that is a consumer add-on.

In the final three months of 2023, the acquisition of Turkish broadcaster BluTV brought 1.3 million subscriptions into the fold; WBD now includes them, so we now include them. In each of the first three quarters of the year, Warner Bros. Discovery lost streaming subs, a trend that reversed in Q4.

At least part of the company’s recent DTC-subscriber loss can be explained by the addition of most Discovery+ content into Max. Discovery+ remains available as a standalone streaming platform, but there is no longer a reason to have it and Max anymore, which makes the consolidation of those subs an isolated market correction. (It probably also doesn’t help that Max has made the most headlines for removing — or even killing — content.)

Warner Bros. Discovery says the company turned a profit from its DTC business in 2023. That’s still more than anyone on this list, save Netflix and Hulu, can say.

Paramount+: 67.5 million subscribers

Sometimes it is jarring to remember that Paramount+ has a subscriber total closer to Warner Bros. Discovery’s direct-to-consumer (Max/HBO/Discovery+) than Peacock’s. But that doesn’t mean Paramount+ is a success.

Paramount+ has yet to turn a profit, and it’s had plenty of time to make something of itself. Paramount+ is the rebrand of CBS All Access, which was launched in 2014. Paramount+ is expected (by management) to turn a profit in the U.S. in 2025 — if it still exists by then.

The streamer’s parent company, Paramount Global, is currently being picked apart by the investment community for the purposes of being, well, picked apart. Most recently, private equity firm Apollo Global Management offered $11 billion for Paramount’s crown jewel, its studio. Comedian-turned-media mogul Byron Allen offered $30 billion for the entire company, though the general consensus is that he doesn’t have the funding.

The likeliest possibility sees billionaire David Ellison buying out the Redstone Family’s controlling stake in Paramount Global, and using those voting shares to merge the company with his Skydance. It’s a much cheaper way to tap into the Paramount studio’s value. Paramount+ doesn’t have much of a future in some of these scenarios.

Apple TV+: Unknown

Apple has never shared a subscriber count for Apple TV+, but we’ve all been working diligently on our best guesses.

Third-party estimates from 2022 and 2023 pegged Apple TV+ around 25 million (or so) subs. It’s progress. Back in 2021, a disclosure as part of an agreement with IATSE indicated that Apple TV+ had fewer than 20 million subscribers. By 2023, as IndieWire reported, the parameters of the International Alliance of Theatrical Stage Employees’ streaming deal suggested Apple TV+ had over 20 million subs.

Highly unspecific, we know. The website Statista published a forecast in May 2023 that suggested Apple TV+ would have 42.1 million subs by the end of the year. That, however, appears to be based on data from February 2022. By the end of 2024, the estimate called for 44.1 million Apple TV+ subs.

IndieWire reached out to Statista for information on its methodology — we did not immediately receive a response.

Apple’s services — encompassing Apple Music, Apple iCloud, Apple Care, Apple Arcade, Fitness+, News+, Apple TV+, and more — crossed 1 billion paid subs combined last summer. (Together, those form Apple One, but there are definitely nowhere near 1 billion Apple One subscribers — otherwise, there would be a billion Apple TV+ subs, by default.)

Most of those memberships are definitely not for Apple TV+, and Apple TV+ definitely does not have most of those members.

Apple TV+ is the lone service on this list without an ad-supported tier. (Apple’s MLS Season Pass streaming service, which is available as an add-on or standalone, has ads.)

Amazon Prime Video: Unknown

Likewise, Amazon has never stated how many Prime Video members it has. That is not its only similarity to Apple.

Like Apple’s Apple One, Amazon’s Prime members automatically have the video-streaming service. Also like Apple TV+, one could save a few bucks by subscribing just to Prime Video.

Most Prime Video members are just Prime members — the fast, free shipping on retail products is just too useful for families to pass up. Most Prime members (probably) don’t watch much Prime Video.

In his final letter to shareholders, in April 2021, Amazon chair Jeff Bezos first revealed Prime had more than 200 million members. That means that by default Prime Video has had more than 200 million members since then. Doesn’t mean they all use it.

The similarities between how Apple and Amazon handle their video-streaming businesses are not really a coincidence. Apple and Amazon are the two biggest companies in the world; they can absorb a loss leader.

Netflix: 260.28 million subscribers

Netflix (essentially) started the whole streaming thing — and it has been king of the jungle ever since. There have been bumps along the road.

Netflix seemed mortal back in 2022 when it shocked the industry with a loss of subscribers. But then, someone in Los Gatos got a bright idea: What if we stopped allowing families and friends to share one Netflix account between several households? Jackpot.

The streaming industry follows its leader. When Netflix added ads, others added ads. When Netflix cracked down on password sharing, the others followed suit. Since introducing “paid sharing” (what Netflix officially calls its password-crackdown program) in the U.S. and elsewhere, Netflix has announced the addition of nearly 28 million new subscribers. Though the program is now global, there are still more thieves out there.

According to a new study of more than 2,500 U.S. households performed by Leichtman Research Group (LRG), 10 percent of Netflix users are still borrowing the service. If that feels low, it is — according to recent history, at least. In 2022, LRG found that 15 percent of Netflix users were borrowing someone else’s paid account; the rate was 14 percent in 2020 and 16 percent in 2018.

Disney+: 111.3 million subscribers (plus 38.3 million Disney+ Hotstar subscribers)

Including Disney+ Hotstar, the overall Disney+ universe now reaches roughly 150 million subscribers.

Disney+ is expected to finally post a profit in the final quarter of its fiscal 2024, which for the Walt Disney Company ends on September 30. In its quest, no streamer has raised prices quite as often as Disney+. Doing so has increased ARPU (average revenue per user), but it’s also decreased actual users. After its latest price increase, on October 12, 2023, Disney reported a loss of 1.3 million subscribers.

Lose some, gain some.

Earlier this week, following a beta-testing period, Hulu has finally been added as a tile to Disney+ (for those who subscribe to the Disney Duo bundle). Ah, the perks of ownership. Save one final check (“To: Brian Roberts, Comcast“/”From: Robert Iger, Disney”), that is.

It’s little brother’s turn…

Hulu: 49.7 million subscribers

Hulu is just getting comfy in its new home, right next door to Cinderella’s Castle.

The general entertainment streamer was originally conceived as a digital platform for NBC, Fox, and ABC shows. CBS wanted no part: its viewers were (and plenty still are) very happy with their coaxial cable cords. CBS eventually caught up to the trend via CBS All Access, a floundering streamer we now know as Paramount+. (CBS and Viacom re-merged in 2019, which brought Paramount content back into the fold.)

After Disney bought (most of) Fox and gained majority control over Hulu, NBCUniversal saw the writing on the wall. It clawed back the next-day rights to its NBC shows to place them immediately on its own Peacock, instead of Hulu. Sure, there are some originals, and yes, it’s a good a place as any for grown-up Disney content. And Hulu + Live TV is as good a vMVPD (virtual Multichannel Video Programming Distributor, like YouTube TV) as any.

Right now, Hulu is mostly an insurance plan: When bundled together, Hulu and Disney+ (and sometimes ESPN+) have been able to keep churn (read: a user canceling a service) down to a minimum. The next thing Hulu could do to help Disney+? Teach it how to make more money than it spends.

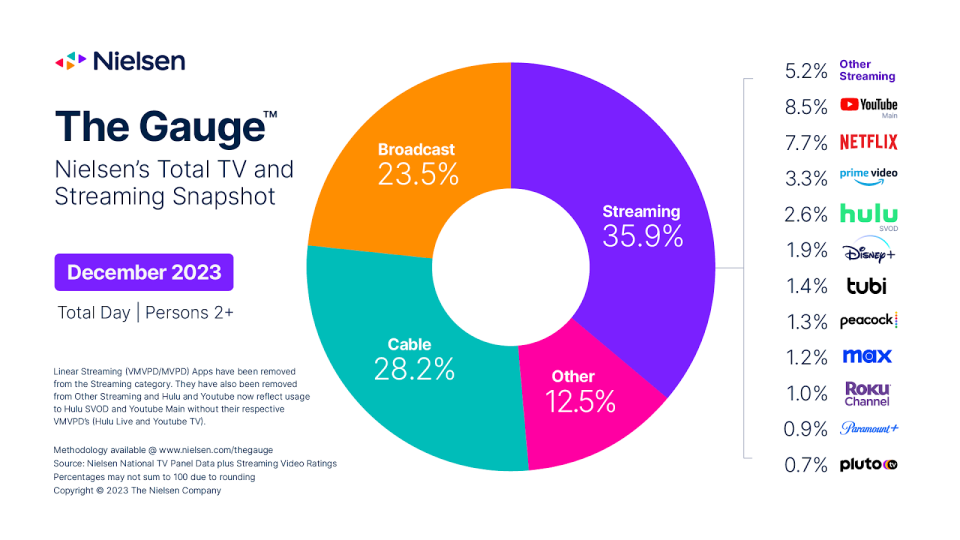

Finally, a lesson that bigger is not always better. See December 2023’s The Gauge report by the TV-ratings company Nielsen below; Paramount+ barely even makes the list, while Hulu wildly overachieves.

Best of IndieWire

The Best LGBTQ Movies and TV Shows Streaming on Netflix Right Now

Guillermo del Toro's Favorite Movies: 54 Films the Director Wants You to See

Nicolas Winding Refn's Favorite Films: 37 Movies the Director Wants You to See

Sign up for Indiewire's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

Yahoo News

Yahoo News