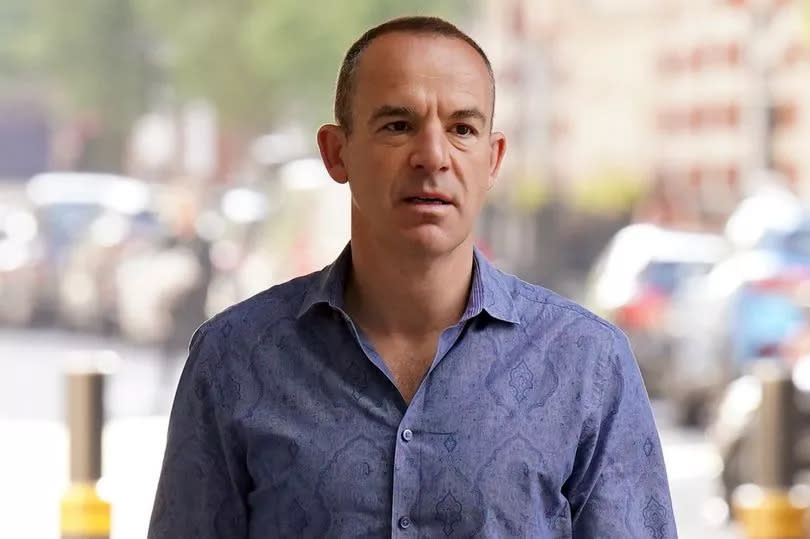

New Martin Lewis £1,100 car finance refund update for people still waiting on response from finance firm

Martin Lewis has issued a new update for everyone who has used an online template tool on MoneysavingExpert.com to generate a complaints letter for possible car finance refunds worth around £1,100. Earlier this year, the consumer champion revealed that millions of people who bought a car, van, campervan or motorcycle on finance before January 28, 2021 may be owed thousands of pounds after being charged ‘hidden commission’.

He explained that drivers typically paid £1,100 more interest on a £10,000 four-year car finance deal when there was a discretionary commission arrangement - but added that the bigger the loan, the more money you could be owed. However, a decision by the Financial Conduct Authority (FCA) on whether or not compensation payouts could be due is not expected until September 25, 2024.

In the update on social media, Martin said that MSE.com is launching a new survey next week to “find the state of the nation for each firm” after someone reached out to say he’s not had a response to a letter he sent three months ago.

Mike posted on X: “Martin I emailed vauxhall finance in Feb about the FCA concerns. They have yet to reply. What can I do?”

Martin responded: “To all who haven't had replies about car finance mis-selling. Next week we're going to launch our 2nd survey on this to find the state of the nation for each firm, then figure through what to do. So pls watch this space.”

The latest figures from MSE.com suggest that more than 1.2 million people have used the online template to start the potential refunds process since February 6.

The financial guu’s last big update on the issue - which he said could become the “UK’s second biggest reclaim after PPI” - hinted that compensation could be coming as Lloyds, owner of Black Horse, has set aside £350m for potential costs and payouts.

Martin is urging people to log a complaint letter “sooner not later - as the unknown means there’s the risk people may be ineligible if they wait to claim”.

At the time, he explained: “It’s because we don’t know what the FCA will say in September that eligible people should look at logging a complaint sooner not later - as the unknown means there’s the risk people may be ineligible if they wait to claim. The regulator’s own website information indicates timing may be an issue and says ‘so, if you think you could be running out of time, you should consider complaining to your provider now’.”

Full car finance refund guide on MSE.com

To help everyone who has already emailed their complaint, Martin and the team of experts have put together a complete next steps list.

This covers:

What to do if you complained but had no response yet

What to do if your complaint has been acknowledged, but no more information has been given

What to do if you’ve had a response with options

The full guide, plus the template letter and an indication on when specific finance firms are likely to respond can be found on MSE.com here.

MSE.com's five car finance commission mis-selling need-to-knows

This is for those who bought a car, van, campervan or motorbike on PCP or Higher Purchase deals (not leasing) for primarily personal use between April 2007 and 28 January 2021.

Lenders said brokers and car dealers had discretion to push the interest rates higher, and the more they did that, the more commission they’d receive. These were called discretionary commission arrangements (DCAs) and customers were rarely told about them. Around 40% of these car finance deals had DCAs, meaning millions overpaid without knowing. So without checking, people won’t know if it happened to them.

In January 2021, the FCA banned DCAs, and in January 2024, it launched a huge mis-selling investigation. The deadline for dealing with complaints has been extended until the FCA reports its findings on 25 September 2024.

Martin Lewis believes it is unlikely the FCA would’ve launched such a huge public investigation unless it had strong evidence of systemic mis-selling. Yet he says until the FCA reports its findings, nothing is certain - and as one big risk is that there is a time bar placed on complaints, urges people to log a complaint as soon as possible, to avoid the risk of being timed out.

There is no need to use a no-win, no-fee claims firm. With the totally free MSE tool, found here, you just answer a few questions on your car finance agreement (answers aren’t recorded, so as not to inadvertently data-mine) and then the tool builds an email to request information on whether you had a DCA, then logs a complaint.

Yahoo News

Yahoo News