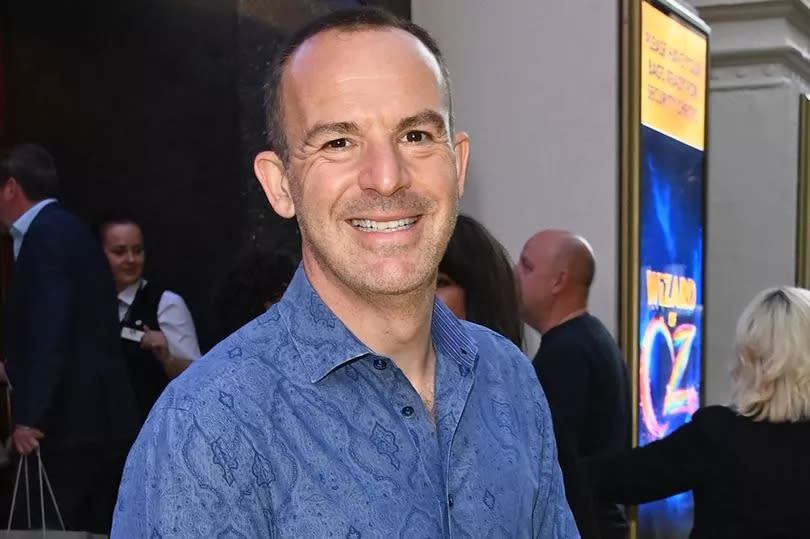

Martin Lewis explains credit card hack for savers to ‘get £500 free money’

In a rare occurrence, Martin Lewis shared a unique money-saving tip but urged the majority of his fans not to follow it. Dubbing the trick “postgrad level”, the Money Saving Expert insisted that the complicated process of Stoozing is only for those nearing his own financial guru-status.

On the Martin Lewis podcast, the expert explained Stoozing, multiple times to help his confused cohost Nihal Arthanayake, as a way savers can essentially make “free money” by working banks' zero percent interest credit card system. Although, he cautioned that they knowingly do this to the detriment of their credit score.

Sharing a disclaimer before even going through the process, Martin warned that Stoozing is “only for those that are really financially savvy and disciplined, have done their reading and know exactly what they are doing”. Summarizing the tactic he said: “You deliberately create yourself zero per cent debt and build your money up in savings.”

Through Stoozing, savers put their income into savings and live off a credit card. With a quick example, Martin explained that the current top savings account is offering a five per cent interest rate so putting £1,000 in would earn savers £50 in “free money”, putting £10,000 would earn £500 and so on.

Simultaneously, they need to pay off the interest on the credit card so it doesn’t pile up as the months go on. The Money Saving Expert explained: “Do your spending on your credit card, allow it to build up to your credit limit… then take the money that builds up in your bank account and save that in a high-interest savings account or cash ISA.

“Do it for as long as the zero percent period is, you’ve got to do it on a zero percent card, for a year or two years and make money.” But he also warned it “will decrease your credit score somewhat” so those attempting Stoozing should not be looking to apply for debts like a mortgage.

The Money Saving Expert website revealed this complicated strategy is nothing new as Martin first addressed it in the early 2000s, when zero percent credit cards started. The site claims some who started Stoozing then “now report thousands in total gains.”

Yahoo News

Yahoo News