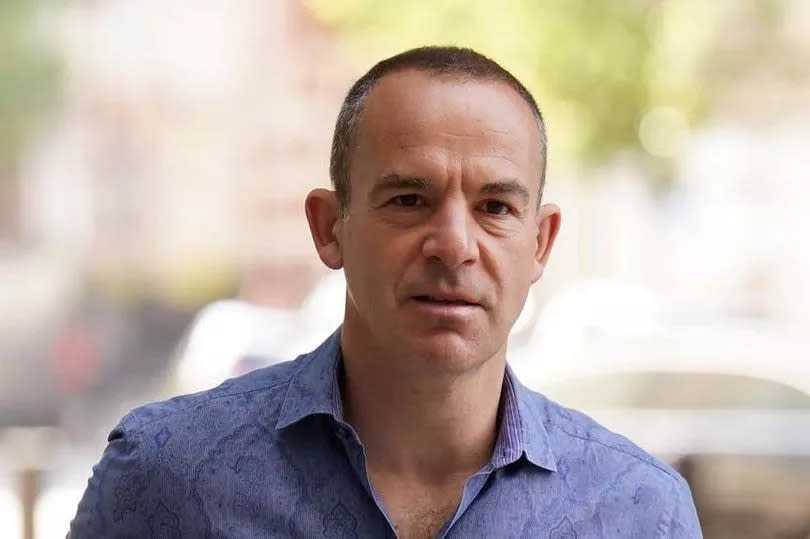

Martin Lewis explains how to turn £800 into £5,400 or more with eight simple steps

Money-saving guru Martin Lewis has revealed a simple eight-step process that could turn a modest £800 into a whopping £5,400.

The financial expert, known for his regular appearances on TV, radio and podcasts, insists this 'trick' could work for anyone aged between 40 and 73. In a newsletter for his MoneySavingExpert website, Martin provided a detailed breakdown of the strategy, as reported by Wales Online.

He advised, "There is a potentially unbeatable opportunity everyone aged 40 to 73(ish) needs to consider. You've got until April 5, 2025 to buy back any missing national insurance years from 2006 to 2016. This can prove very lucrative, as some are on course to make over £50,000 in boosts to their state pension by following this guide."

READ MORE: Record number of people use new rule to wipe out £30,000 debts

Martin also emphasised the importance of considering this approach even if you're under 40, demonstrating that there might still be money to gain. The scheme he highlights is based on the concept of 'buying back' National Insurance years.

Your state pension upon retirement depends on the number of full 'qualifying' national insurance (NI) years you've accumulated. To clarify further, Martin stated: "Most collect NI years through working and paying NI, but you can also get them if you're claiming benefits or caring for others (if you're not sure what this is about, see how the new state pension works ),"reports the Manchester Evening News.

"In general, you need around 35 full NI years to get the maximum state pension, though some will need a lot more (we've seen examples of people needing 44+ years) depending on your age and NI record up to now."

He continues: "Normally you can buy back up to six years, but when the 'new' state pension was introduced, transitional arrangements were put in place to let you plug gaps all the way back to 2006. This was due to end on April 5, 2023, and then July 31, 2023, but because so many people were trying, the necessary government phone lines got clogged up, so the date has been extended to April 5, 2025."

One of the followers of Martin Lewis related their success story after implementing his advice, stating they had managed to enhance their pension by £49 a week. Commenting on this, Martin said: "To put that in context, Martine paid up to £5,000 (it may've been far less) to increase her state pension by £2,550 a year. If she lives for the typical 20 years after state pension age, that'd be a total uplift of around £51,000... and it's inflation-proofed."

Martin breaks down the process:

Step 1: Observe Martin's NI record decoder

Martin recommends viewing his dissection on how the scheme operates on YouTube or hearing him on his BBC podcast.

Step 2: Verify if you're missing any NI periods

He recommends initially checking your national insurance record for any gaps - it will show 'full year' or 'year is not full'. If there are gaps, utilise the Government's State pension forecast calculator to see if your pension could be boosted from its current amount.

Step 3: Verify if you can fill the gap for free with NI credits

If you've been caring for a child, on sick pay, unemployed and seeking work or in various other situations, you might qualify for free NI top-ups. Information on how to apply for any NI credits manually can be found on the Government's national insurance credits page.

Step 4: Decide whether you should pay

For those at or nearing pension age, it may be relatively simple to pay to fill the gaps. Those closer to 40 may naturally fill the gaps over the rest of their working life - but could also opt to pay to fill them.

For those under 40, it likely won't make sense.

Martin advised: "Call the Department for Work and Pensions' helplines to understand if paying to plug any NI record gaps will actually result in you being paid more state pension."

An HMRC spokesperson explained: "Most people no longer have to phone DWP or HMRC to see how filling gaps would change their State Pension as there is now an easy and simple online service which allows them to check to see if they have any gaps they can fill in their NI record, what filling those gaps would cost and how much more they would receive in State Pension - and if they decide to fill any gaps they can pay online there and then."

Customers can easily access the 'Check your State Pension forecast' tool via GOV. UK or through the HMRC app.

However, before making any payments, the Government advises using the new online service that shows some individuals how much their state pension could increase by and the number of National Insurance years needed. This service also facilitates secure online payment for missing years, but it's crucial only to proceed if you're certain it's beneficial for you.

Those who haven't reached state pension age should contact the Future Pension Centre on 0800 731 0175, while those who have should reach out to the Pension Service on 0800 731 0469.

The Government's online service, in conjunction with the Future Pension Centre or the Pension Service, can advise you on whether purchasing additional National Insurance (NI) years will enhance your state pension entitlement. However, it's crucial to take into account the wider context, which the Government helplines won't assist with.

Consider:

Step 8: Method of Payment

If you've consulted with the Future Pension Centre or the Pension Service and wish to buy extra NI years online, you can access the service through the 'Check your State Pension forecast' page on Gov.uk. It's also available via the HMRC app.

If you've had a discussion with the Future Pension Centre or the Pension Service but are unable or unwilling to use the online service for top-up, decide how many NI years you want to purchase, contact HMRC to get an 18-digit reference number, then forward the payment to HMRC. The processing of the payment may take up to 60 working days, after which your NI record should be updated.

Yahoo News

Yahoo News