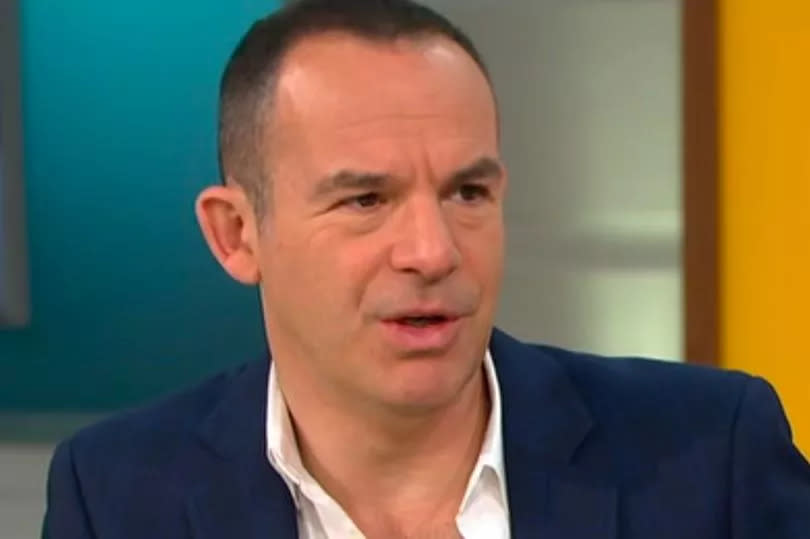

Martin Lewis issues urgent warning to all Santander customers before Monday

Martin Lewis has issued a warning to Santander customers, urging them to act before Monday as the high street banking giant is set to withdraw a major deal.

Amid the ongoing cost of living crisis, Santander is poised to slash its top-paying savings rate, delivering a blow to its customers.

From Monday, May 20, the bank will be reducing the interest rate on its easy access account, which previously offered a market-leading rate of 5.2%. The new rate will be significantly lower at 4.2%.

Read more: Martin Lewis says everyone born in these years can get £6,100 handout - but you need to act fast

Read more: Martin Lewis issues £520 warning to anyone who's been on EU flight in past 6yrs

According to moneyfactscompare.co.uk, there are currently 77 easy access accounts that offer higher interest rates than Santander's revised 4.2%. Rachel Springall from the comparison site stated: "Savers might not want the hassle of switching, but it's really quick and easy to do online, plus they can find some of the leading easy access accounts are paying around 5%.

"When it was first launched, Santander's offer caused quite a stir in the market. However, it's now time for savers to reassess whether this account remains the right choice for them. Savers should carefully review the terms and conditions of other accounts before deciding to move their money."

Rachel further advised: "Paragon Bank pays a competitive 5.05%, but it only permits two withdrawals within 12 months, so careful planning is a must."

She also emphasised the importance of staying vigilant, adding: "Savers need to keep a close eye on the top rate tables and switch quickly to not be left disappointed," reports Birmingham Live.

Mr Lewis stated: "When I first heard this was happening I thought, 'How annoying!' I'd hoped this account would keep the stellar rate for the full term, though there was never a guarantee and then it decided to slash it."

He pointed out the advantages of these accounts despite the reduction, saying: "Having said that, for most of the past few months it's been higher than any other easy-access account rate and the big advantage of choosing variable easy-access accounts like this is that, if they do let you down and ditch the very high rate, you can ditch them just as quickly and switch elsewhere."

Yahoo News

Yahoo News