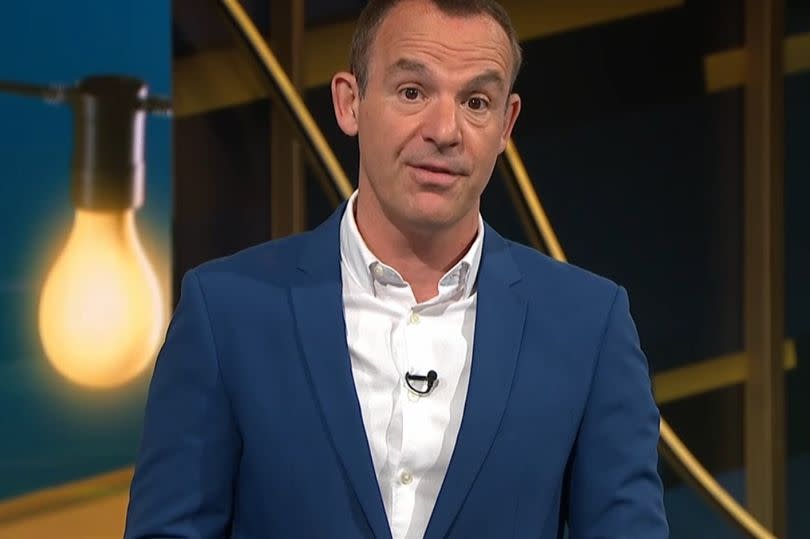

Martin Lewis warns millions of graduates could be owed money in student loan overpayments

Martin Lewis has warned millions of people across Britain with outstanding student loans that they may have excessively paid. Those affected between April 2019 and April 2023 could be entitled to refunds amounting to hundreds of pounds.

Back in October last year, the consumer advocate first flagged these overpayments following an FOI request by MoneySavingExpert.com filed with the Student Loans Company. However, in this week's publication of the Money Saving Expert bulletin, the finance whizz said "many uni leavers can reclaim unwittingly overpaid student loans".

He listed four key reasons that could have culminated in a larger population in Scotland, England, and Wales repaying more than their necessity. He said: "When I did a video explainer on this last year, it went viral and we drowned in successes". One such accomplishment stemmed from Kayleigh, who, despite only making five contributions towards her student loan, was owed a refund surpassing £800. For money-saving tips, sign up to our Money newsletter here

READ MORE: Martin Lewis says anyone with savings needs two specific things but warns about 'pants accounts'

READ MORE: All the benefits people due to reach state pension age can no longer claim

Four main causes for higher student loan repayments

A comprehensive guide explaining the overpayment of student loans and the process to receive a refund is accessible on Money Saving Expert at this link, reports the Daily Record. Here is a snapshot of the primary reasons:

You cleared the loan in certain months, despite not earning sufficient income during the entire financial year

The guidance clarifies that student loans only need to be repaid if you earn over an annual threshold, but repayments are deducted from wages monthly. This means some people may have money deducted from their wages in some months, but not others - even when their annual income is below the earnings threshold.

The income threshold is based on when you started at university and where you live - not study:

Plan 1: For those who began studying in Wales between 1998 and 2011, the repayment threshold is £24,990/yr (£2,082/mth).

Plan 2: For those who began studying in Wales between 2012 and today, the repayment threshold is £27,295/yr (£2,274/mth).

Plan 3: For postgrads in Wales the threshold is £21,000/yr (£1,750/mth)

The repayment income threshold for people in Scotland - who are on Plan 4 - is £31,395 per year, or £2,616 per month - before tax. Thai applies to graduates who started repaying their Student Awards Agency Scotland (SAAS) from 1998 onwards.

You are on the wrong student loan payment plan by default

If you haven't informed your employer which plan you're on, the UK Government instructs it to default to a Plan 1 loan, where you repay on income above £24,990 per year. Remember, all students in Scotland repay on Plan 4.

You started repaying your loan too early

The guidance outlines how people are usually only eligible to start repaying in the April after you left your course. If you mis-stated when your studies finished, or your employer got it wrong, you might have repaid too early, and are due that money back.

You had money deducted after the loan was fully repaid

After a set time the loan is wiped - often after 30 years for those currently repaying, but it does vary.

How to reclaim if you've overpaid your student loan

Martin encouraged anyone who thinks they may have overpaid their student loan to read the full guide here. If you suspect you've overpaid your student loan, you can contact SAAS on 0300 100 0609 or the Student Loans Company on 0300 100 0611. Alternatively, visit the dedicated pages on GOV.UK.

Yahoo News

Yahoo News