Mexico Gets ‘Bad Inflation News’ as Holiday Spending Jumps

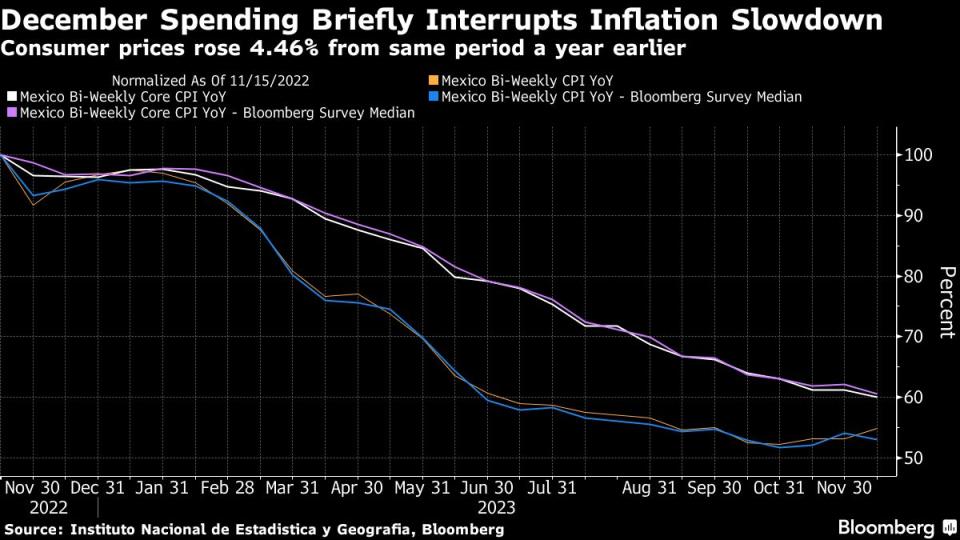

(Bloomberg) -- Mexico’s consumer prices rose more than expected in early December as increased holiday season-related spending keeps pressure on the central bank.

Most Read from Bloomberg

Manchester United Saga Ends With $1.3 Billion Ratcliffe Deal

Trump Tells Appeals Panel He Should Have ‘Absolute Immunity’

US Accuses Iran of Indian Ocean Attack as Shipping Threat Grows

Wall Street Learns That This Year, Nothing Beat Owning the S&P 500

Consumer prices rose 4.46% compared to the same period a year earlier, up from 4.33% in late November, the national statistics institute reported Thursday. The print was above the 4.36% median estimate of analysts in a Bloomberg survey.

From the previous two-week period, consumer prices rose 0.52%. Core inflation, which does not include volatile items such as fuel, slowed to 5.19% on an annual rate, from 5.3%.

“It’s bad news for inflation,” said Gabriela Siller, director of economic analysis at Grupo Financiero Base. “The bank’s board will have to be very cautious in its rate cuts so that inflation does not spike significantly and that in the medium-term it continues its downward trend.”

Mexico’s central bank, known as Banxico, has shown itself open to the possibility of discussing rate cuts early next year. The monetary authority has maintained borrowing costs at a record 11.25% for six straight meetings. It’s the only major inflation-targeting bank in Latin America that has not yet embarked on an easing cycle.

Given that many analysts forecast a slight uptick in inflation toward year-end, economists don’t see the bank shifting course, after Banxico Governor Victoria Rodriguez suggested in a local newspaper interview that a cut could come as soon as the first quarter. The only other major central bank in the region that had refrained from easing, Colombia’s, announced a 25 basis-point cut earlier this week.

“At the end of the year, there’s a seasonal effect. Parties in December increase demand, and with that prices go up. The prices of goods for dinners and presents also go up because end-of-year bonuses mean there’s more money in the economy,” said Janneth Quiroz Zamora, director of economic research at Monex Casa de Bolsa.

Airline tickets were among the biggest contributors to early December’s inflation print, rising 38.84% from late November. Certain food items such as onions also drove price rises, the national statistics institute reported.

Economists in a Citi survey released Dec. 19 expect that the central bank will begin its rate cuts in March, given that inflation will continue to slow over the course of next year. They forecast that it will end 2023 at 4.44% and 2024 at 4%. The central bank targets inflation at 3%, plus or minus one percentage point.

The US Federal Reserve’s decision to consider rate cuts during the course of 2024 also opens the door wide for Banxico to follow suit. The Mexican bank maintained its forward guidance in its December decision, saying that it would hold borrowing costs “for some time.”

--With assistance from Rafael Gayol.

(Update with bi-weekly figure in third paragraph, analyst comment in fourth, contributing factors in eighth)

Most Read from Bloomberg Businessweek

What Dermatologists Really Think About Those Anti-Aging Products

One Man’s Longevity Obsession Now Includes Fountain-of-Youth Injections

What the Oldest Lab Rodents Are Teaching Humans About Staying Young

©2023 Bloomberg L.P.

Yahoo News

Yahoo News