Millions will be doomed to a difficult retirement if this tax is not scrapped

Successive governments have provided stimulus after stimulus to encourage property buying. It’s easy to understand why – housing affordability is a major challenge, especially for the young.

But by encouraging house price inflation, tax breaks could well be making the problem worse in the long run.

Just as more people face renting for longer or even paying off a mortgage into retirement, pension planning looks equally precarious, as “defined benefit” pensions have withered on the vine.

Despite this, much-needed support to encourage a culture of saving and investing has been left by the wayside.

Yes, some savings tax allowances are generous, but only for those able to fully utilise them.

The Conservative manifesto is the latest example of this trend to prioritise property over pensions. It includes several property-focused policies – among them stamp duty cuts for first-time buyers, a new version of Help to Buy, and a target to build 1.6 million homes.

Where are the policies to encourage a healthy culture of saving and investing outside of property?

There was a fleeting mention of the proposed NatWest share sale, but no detail on how this could be broadened into a wider movement.

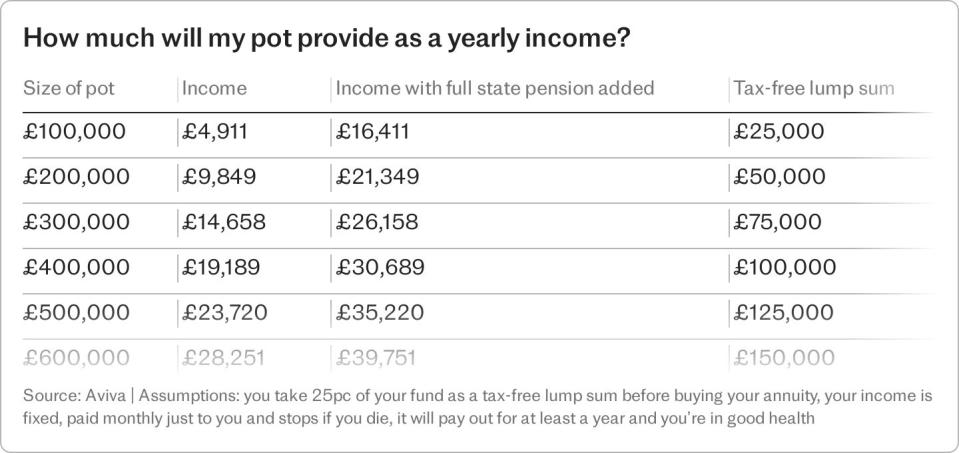

The majority of Britons are not saving enough for a comfortable retirement. According to the Pensions Policy Institute, 63pc of individuals in Britain are not on track for an adequate pension to live off in later life.

Our research has found that the average person’s property is worth six times more than the value of their pension – £250,000 compared with £37,500 (excluding those with defined benefit pensions).

Owning a home is an important aspiration for most of us. But it cannot be the be-all and end-all of personal financial planning, particularly as a property cannot always be easily sold to raise cash when needed.

We think that abolishing stamp duty on shares could be a fair and impactful policy, with wider economic benefits.

It would benefit all of us wanting to invest in UK companies and UK-domiciled investment trusts and help to encourage a much-needed national culture of share ownership.

It could also help with the UK’s dismal productivity performance, by directing savings to productive uses in the real economy.

And it’s fair because it helps those even with modest means – you can invest with most investment platforms from £250, or £25 per month, rather than the tens of thousands needed for a deposit on a home.

It’s a step towards democratising finance.

It is in policymakers’ best interests to address our property-pensions imbalance – because ultimately it will be their job to figure out how we support the millions who are heading for a difficult retirement.

Paul Diggle is chief economist at Abrdn.

Yahoo News

Yahoo News