Jet Fuel Could Soon Be Made From Carbon Dioxide—Here’s How

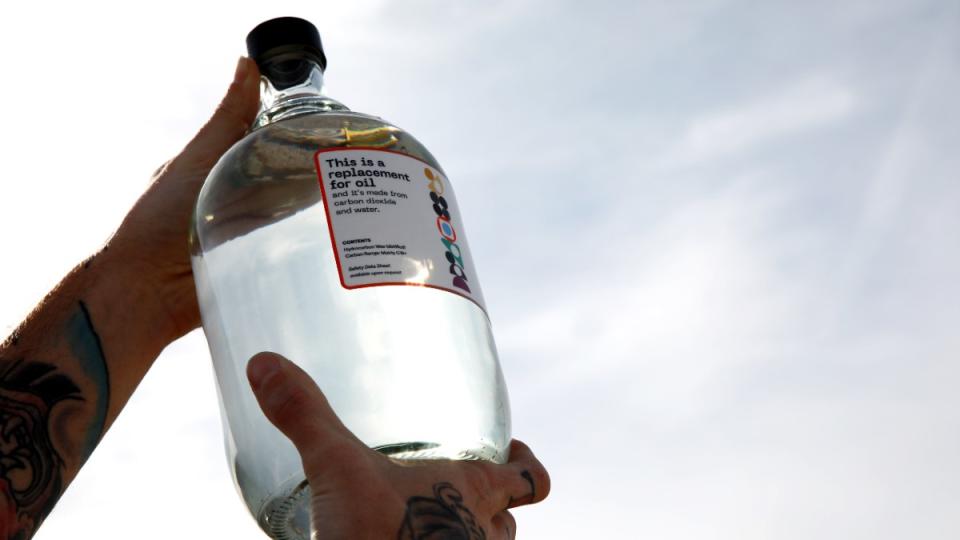

In December of 2022, Mike Leskinen stood behind a podium holding up a screw-top jug filled with a clear liquid that looked for all the world like a batch of bathtub gin. Instead, the container held a solution that sounds like something from a sci-fi novel: liquid hydrocarbons created by combining nothing but water, solar power, and carbon dioxide pulled from the air.

The resulting fluid converts into different forms, from plastic to perfume to, most importantly, jet fuel.

More from Robb Report

Taylor Swift Flew 178,000 Miles Last Year, and This College Student Can Show You Where

How Private Jets Allow Travelers to Skirt Immigration Around the World

This New Luxury Airline Aims to Bring the Private Jet Experience to Your Maldives Vacation

Leskinen, the president of United Airlines Ventures, had helped finance Dimensional Energy’s pilot plant in Tucson, where that batch of hydrocarbons served as proof of a long-brewing concept.

“In 2016, I started looking at how aviation could meet its climate goals,” Jason Salfi, Dimensional’s CEO, told Robb Report. “It struck me that we’d spent 100 years burning hydrocarbons that now filled the atmosphere, but what if we made those hydrocarbons a source of energy? Instead of pumping it out of the ground, we could run our economy on carbon that’s already above the ground.”

In the time since, Dimensional has finalized its chemical process, run the pilot plant, built a larger test plant in Vancouver and started construction on its first commercial plant, in Niagara Falls, N.Y. That facility is scheduled to begin producing three million gallons of fuel a year starting in 2027. “It’s all progressed very naturally,” Salfi says. “We’re an overnight success story . . . eight years in the making.”

Before Dimensional and its competitors—Air Company, Infinium, and Twelve—emerged, the concept of Sustainable Aviation Fuel (SAF) had become a type of catchall solution for aviation’s race to be carbon neutral by 2050. It is, in many ways, a myth.

At EBACE, business aviation’s annual European conference in Geneva, a panel of experts yesterday discussed the pros and cons of SAF, a priority for both the E.U. and U.K. governments, but no clear path has been laid out. Fuel suppliers in the E.U. have a mandate under the ReFuelEU proposal that calls for blending SAF with conventional jet fuel that would increase from 2 percent in 2025 to 70 percent by 2050.

Members of the EBACE panel pointed out that global SAF production is less than 1 percent of jet fuel consumption. “You have a number of players out there that are still going to be increasing the production of HEFA SAF from fats, oils, and greases, but we think that is nowhere what it’s going to take,” said Avfuel executive vice president CR Sincock, according to AIN.

Most aviation experts understand that these first-generation formulations of SAF aren’t a long-term answer to meaningfully lowering the aviation’s emissions. These “biofuels” from organic fodder like French fry grease don’t need to be drilled, pumped, shipped, refined, and trucked around the country, so in the context of the total production cycle, biofuels could be anywhere from 30 to 90 percent cleaner than standard jet fuel.

The average, however, hovered between 70 percent and 80 percent cleaner, Sincock told Robb Report. It’s an improvement but still not enough for the aviation world to reach its goal of carbon neutrality by 2050. Especially since creating and refining those biofuels requires large amounts of both land and water and raises questions about volume. The industry burns through 100 billion gallons of jet fuel a year and projections place that number at 150 billion by 2050.

“The actual percentage of SAF in use currently is tiny,” Sincock says. “It’s got some room to run and could scale to 5 to 10 percent of the total, but we probably aren’t going to see 50 percent.” In other words, expanded use of first-generation sustainable aviation fuel is, literally, unsustainable.

A second generation SAF has emerged—called alcohol-to-gas—that used heat and pressure to convert woody biomass like feedstocks, stumps, wood chips, saw dust and grasses into a liquid that could be filtered and refined into fuel, but it was expensive and not fully scalable either.

Enter Gen 3, also known as eSAF or Power-to-Liquid (PtL), offering a promise that seems almost too good to be true—which, to an extent, it is. The production process uses existing, above-ground carbon, but burning the resulting fuel emits carbon, so SAF doesn’t reduce atmospheric carbon. It only allows planes to operate at net-carbon neutral.

While it’s possible to pull carbon directly from the air, all the current makers of eSAF take CO2 from factories with high emissions, such as concrete, steel, and ethanol production facilities. “Piping those exhaust streams directly into our system is the most efficient approach,” says Gregory Constantine, CEO of Air Company in Brooklyn, N.Y., another eSAF producer. “Also, it allows for the highest greenhouse gas emissions reductions.”

Other players in the field include California based Twelve, in Berkeley, and Infinium, in Sacramento. Each of the four have slight operational differences but all undertake the same basic task—making synthetic aviation fuel from CO2, water and green energy. An IATA report estimated that eSAF will eventually account for 65 percent of aviation’s push to carbon neutrality, so those four companies may not be alone for long.

Air Company’s Constantine, who allows that his long-term plan is licensing the technology to “existing infrastructure players,” says: “We need more people involved, more ideas and more solutions to emerge. We don’t want to be the only ones doing this because of the size of the market. It’s about getting to scale.”

Scale. That’s the one word that comes up repeatedly when talking eSAF. Everyone’s chasing the concept, but a realistic solution remains distant. The fuels should become commercially available within three years, but the manufacturers say it’ll be five to 10 years before they’re in broad use. At least any growth spurt won’t be slowed by infrastructure concerns. Unlike earlier forms, the new SAF doesn’t need to blend with traditional fuel to run in existing engines, and it’s compatible with current distribution systems.

“It’s a tremendous opportunity because it bridges the gap between those in oil and gas today and the exact talent pool we need for production,” Salfi says. “So it’s not about switching out one form of infrastructure for another but about leveraging the trillions of dollars of intellectual and physical capital already existing to transition to a less carbon-emissive economy. We view this sector as a job-creating force.”

But that force still needs to overcome a large obstacle—the interrelated issues of money and power. “It’s going to come down to economics,” says Kevin Noertker, CEO of Ampaire, a builder of hybrid-electric aircraft who has worked with eSAF. “It’ll be hard to achieve full-scale adoption if they’re charging a premium. Aviation has historically been very price sensitive.”

Currently, eSAF costs about twice as much as standard aviation fuel, although, “when oil prices shot up, it closed the gap,” says Sincock. Still, the carbon-neutral fuels are working through a classic chicken-egg loop—the price is high because there isn’t enough renewable energy, but the expansion of renewables takes time because it’s expensive.

“Scaling takes years,” Sincock says. “The production process is electric intensive, which is a huge cost to the producers. As the supply of green electric increases and the cost approaches the cost of traditional energy, the price of the fuel will come down.”

That need for cheap and abundant clean energy is why Dimensional has set both its Vancouver and Niagara Falls facilities along rivers, where they can tap into steady hydroelectric electricity, and why Twelve has made a similar choice with the commercial facility it is building in Moses Lake, Wash. As Air Company’s Constantine says, “We’re starting in places where low-cost green power is available.”

“Anyone who has their own private jet can be a huge force for good,” Salfi says. “What could otherwise be vilified as excess, could instead be a huge part of the world turning away from fossil fuels. If I could go to a group of private jet owners and book sales at a premium, it would allow me to build other projects that will serve the market as we watch the entire energy grid come down in price.”

The government could help, too. The Inflation Reduction Act gives credits for certain means of hydrogen production, and there are additional subsidies that pay $85 a ton for carbon reuse and $1.50 a gallon rebate for carbon neutral fuel, but it’s uncertain which, if any, will apply to eSAF. “Those benefits are still going through the government’s rulemaking process, so we don’t know exactly how they’ll be apportioned,” Salfi says. “Before we can activate around them in terms of financing, we need to know what applies and the term so we can calculate the economics.”

While the industry may be waiting for those decisions, it isn’t sitting still. Infinium is already producing fuel at a plant in Texas and has 11 other projects in the works. Dimensional and Twelve have embarked on their first commercial facilities, and Air Company says it is working on the development of a commercial production facility, aiming to be operational by the end of the decade.

IATA calls eSAF a “mid-term solution” for aviation’s drive to carbon neutrality, with the assumption that hydrogen and electric will also eventually play a defining role.

Constantine says eSAF won’t be the only way to use all that carbon floating around the atmosphere. It can be turned into plastic, perfume, and even drinkable alcohol. “There are a number of other applications,” says Constantine. “We’ve got a contract with NASA. If we ever get to Mars, the atmosphere is 92 percent CO2 and we can advise them on how to use it.”

Best of Robb Report

Sign up for Robb Report's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

Yahoo News

Yahoo News