Omnichannel experiences are critical during the holidays

BI Intelligence

This story was delivered to BI Intelligence "E-Commerce Briefing" subscribers. To learn more and subscribe, please click here.

Most Americans plan to purchase their gifts in-store this holiday season, according to a report sent to BI Intelligence from marketing firm Fluent. Seventy-one percent of shoppers said they’d purchase their gifts in-store, while only 47% said they’d shop on the retailer’s website.

Although this is down from the more than 90% of total sales that occurred in-store in Q3 2017, it shows physical stores will still dominate this season.

Online channels will also be a huge component in consumers' holiday shopping, as 67% say they'll research products online before buying. This makes online channels the first touchpoint for reaching shoppers, meaning that if retailers don’t make good impressions via digital, it could affect offline sales. In addition to having easy-to-navigate and fast-loading sites, search capabilities enhanced by artificial intelligence (AI) could facilitate shoppers' research process, making them more likely to shop with a retailer. Moreover, retailers may be able to persuade shoppers to visit physical locations by listing in-store product availability or by allowing customers to place product holds online.

Nearly half of shoppers who receive a gift that was purchased online expect to be able to return it in-store. This provides an opportunity for retailers to boost sales after the holidays, and benefit from the increased foot traffic resulting from gift returns. For instance, startup Happy Returns, which provides return logistics for e-commerce companies, foundthat 25% of customers returning a package via one of its return centers in a partner store made a purchase at the same time. Displaying sale items clearly and bringing convenience items closer to the front of the store may help drive up such purchasing.

An omnichannel strategy will likely be increasingly important in the retail industry after the holidays as well. Retailers are already seeing success through omnichannel strategies — DSW reported that 40% of its online sales are picked up in-store, and 15-20% of shoppers who pick up online orders also buy additional items. Meanwhile, Ulta found that its omnichannel customers spend 2.7 times more than in-store-only customers. Although an omnichannel strategy can be difficult and costly to implement, it can help retailers bolster sales and turn their physical presence into an advantage.

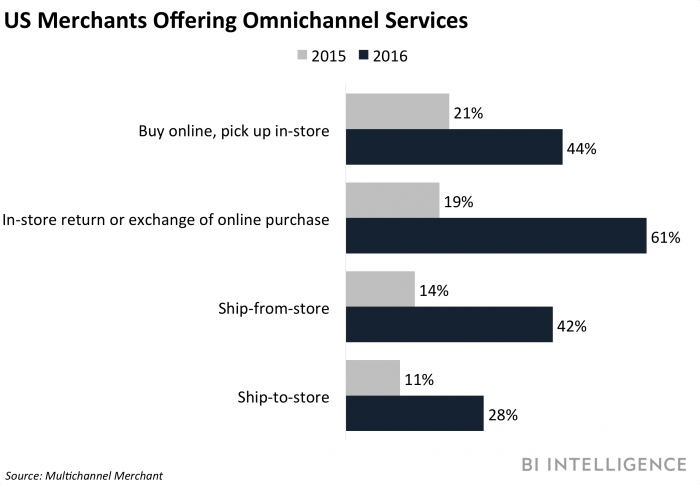

Jonathan Camhi, research analyst for BI Intelligence, Business Insider's premium research service, has laid out the case for why retailers must transition to an omnichannel fulfillment model, and the challenges complicating that transition for most companies. This omnichannel fulfillment report also detail the benefits and difficulties involved with specific omnichannel fulfillment services like click-and-collect, ship-to-store, and ship-from-store, providing examples of retailers that have experienced success and struggles with these methods. Lastly, it walks through the steps retailers need to take to optimize omnichannel fulfillment for lower costs and faster delivery times.

Here are some of the key takeaways from the report:

Brick-and-mortar retailers must cut delivery times and costs to meet online shoppers’ expectations of free and fast shipping.

Omnichannel fulfillment services can help retailers achieve that goal while also keeping their stores relevant.

However, few retailers have mastered these services, which has led to increasing shipping costs eating into their profit margins.

In order to optimize costs and realize the full benefits of these omnichannel services, retailers must undertake costly and time-consuming transformations of their logistics, inventory, and store systems and operations.

In full, the report:

Details the benefits of omnichannel services like click-and-collect and ship-from-store, including lowering delivery times and costs, and driving in-store traffic and sales.

Provides examples of the successes and struggles various retailers have experienced with omnichannel delivery.

Explains why retailers are having trouble managing costs with their omnichannel fulfillment efforts, which are eating into their profits.

Lays out what steps retailers need to take to optimize costs for their omnichannel operations by placing inventory where it best meets customer demand.

To get the full report, subscribe to BI Intelligence and gain immediate access to this report AND more than 250 other expertly researched deep-dive reports, subscriptions to all of our daily newsletters, and much more. >> Learn More Now

See Also:

Yahoo News

Yahoo News