One millionaire leaves Britain every 45 minutes under Labour

One millionaire left Britain every 45 minutes in the year Labour came to power, figures suggest.

The UK lost 10,800 millionaires to overseas countries last year, more than double the number in 2023, according to new data.

The wealth exodus equates to 30 millionaires leaving a day – approximately one every three quarters of an hour.

It comes as Labour plans to abolish centuries-old tax laws that allow foreign investors to reside in Britain while sheltering offshore wealth from domestic taxes.

Jason Hollands, managing director of financial advisers Evelyn Partners, said the crackdown made Britain appear “hostile to wealthy people”.

“The signal it sends to people [is] that the country has a hostile attitude to wealthy people who will bring money into the UK. These people are highly portable and with a lot of digital businesses you can now work in lots of locations and you don’t necessarily have to be present in this jurisdiction,” he said.

The number of high net-worth individuals – with liquid assets of more than $1m (£821,153) – leaving the country rose by 157pc in 2024, according to figures compiled by analytics firm, New World Wealth for advisors Henley & Partners.

They showed more than 10,000 millionaires left last year, a significant rise on the previous year’s figures of just 4,300.

It came in the year a snap election was called by Rishi Sunak that saw Labour come to power with a landslide victory.

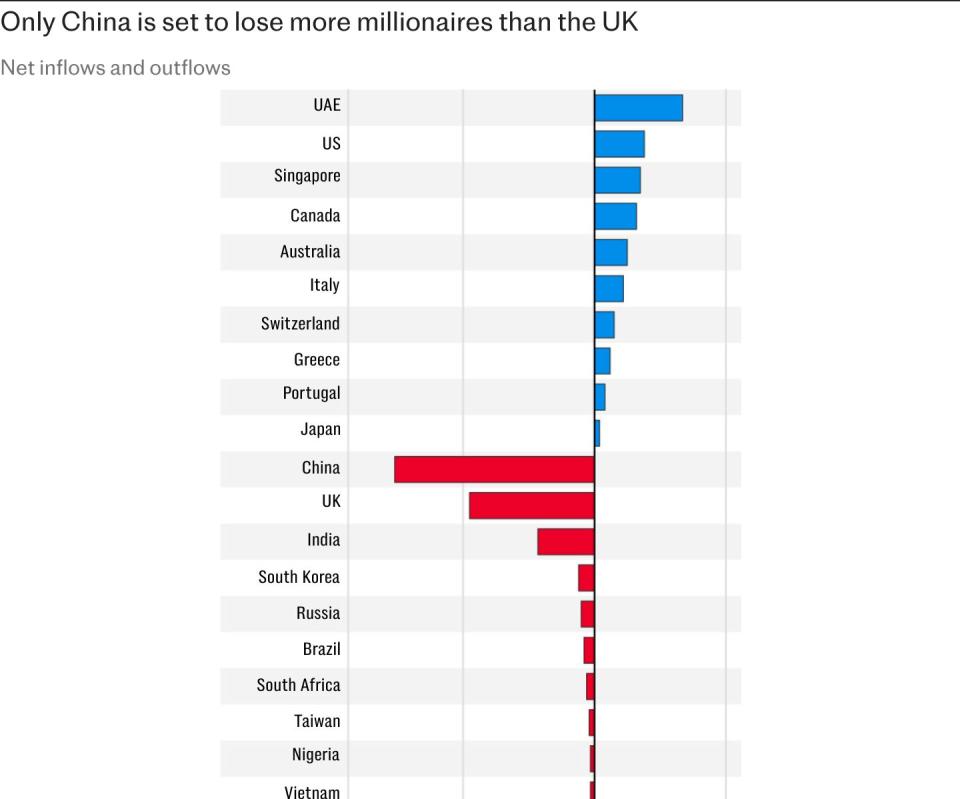

No other country except for China saw greater capital flight than the UK between January 2024 and December of 2024, according to the figures.

Italy – which unveiled an attractive flat tax rate for non-doms in 2017 – was one of the most popular destinations for those leaving, along with Switzerland, United Arab Emirates, the United States and Singapore.

New World Wealth said that 78 centi-millionaires, someone who has assets of 100 million, and 12 billionaires left the country last year.

Prominent high net-worth people to have announced their departure from Britain recently include Pimlico Plumbers founder, Charlie Mullins, and Christian Angermayer, the German technology entrepreneur, who left Britain last year for Switzerland.

Labour plans to scale back tax rules that allow wealthy individuals to reside in the UK without being liable for taxes on income and gains earned abroad.

Figures published by His Majesty’s Revenue and Customs (HMRC) from 2023 show that there were 74,000 non-doms in the UK, with 37,800 of them having lived in the UK for at least seven years, and paid a £30,000 annual fee to shelter overseas wealth from domestic taxes.

In April, a new regime – originally designed by former chancellor, Jeremy Hunt, and kept by the Labour government – will come into effect.

The new scheme only gives new non-doms coming to Britain four years in which their foreign wealth is not subject to domestic taxes. After the period elapses, they will be expected to pay the same tax as an ordinary British taxpayer.

Existing non-doms will be given a two-year transition period to the new scheme. Foreign earnings will also face the threat of inheritance tax.

The tax raid is projected to generate £2.5bn a year for the next five years, according to figures from the Office for Budget Responsibility.

Research by the Adam Smith Institute claimed in October that plans to abolish the non-dom tax status would wipe out 23,000 jobs over the next six years through lost investment and consumption.

This would cost the UK economy £600m per year in lost GDP by 2030 and £1.3bn a year by 2035 – a cumulative loss of £6.52bn over the next decade -- it was estimated.

David Hawkins, of Foreign Investors for Britain, a group representing non-doms, told The Times the Government’s policy is “a monumental act of national self-harm”.

He said: “It appears that decisions have been made not based on the evidence but based on ideology. It’s a real worry because more and more people are leaving. And it’s businesses, jobs, investment, spending into the economy and tax take and philanthropy that are hit.”

A government spokesman said: “We are committed to tax reforms that are progressive and underpinned by fairness. It is right that those who can afford to, contribute their fair share to fix the foundations to provide stability and fund public services to drive growth.

“The OBR expects the non-dom reforms to raise £33.8 billion over the next five years to help fund the investment projects needed to deliver on the Plan for Change and improve living standards across the country.”

Yahoo News

Yahoo News