Online tech meets offline shopping at retail's big show

BI Intelligence

This story was delivered to BI Intelligence "E-Commerce Briefing" subscribers hours before appearing on Business Insider. To be the first to know, please click here.

At the National Retail Federation's (NRF) annual Big Show, BI Intelligence analysts in attendance learned that prominent retailers and their technology partners — including Neiman Marcus, Intel, and Alibaba — are focused on how to bring the best of online shopping to offline retail.

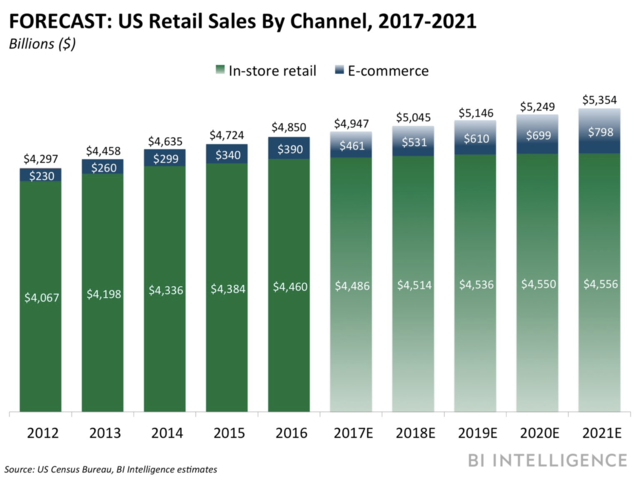

For context, e-commerce payments volume was estimated by BI Intelligence to have surged 18% to hit $461 billion in 2017, while offline retail merely inched ahead an estimated 1% to $4,486 billion in the same period — a primary factor behind continuing store closures.

Retailers with physical storefronts are fighting back by adopting the convenience and personalization of online shopping.

Neiman Marcus focused on online-influenced shopping. Presenting at the Big Show, the luxury retailer’s president and CEO Karen Katz shared that its top priorities are making sure online shoppers can locate items in the store, find clothing items worn by social media influencers in-store, and buy items online to pick up in the store, according to EssentialRetail.

Intel demoed in-store optimization and personalization. Intel showed how its internet of things (IoT) and data management tools could help retailers optimize in-store shopping through a variety of demos, including smart mirrors, smart shelves with computer vision, and an advanced data management platform. One demo, for example, showed that an opted-in consumer could walk into a retailer and have their face automatically scanned, allowing store associates armed with tablets to greet them by name and offer personalized product recommendations.

Alibaba is introducing a flurry of in-store transformations. The Chinese retail titan took the stage to share many different examples of innovative in-person retail experiences. These included a “vending machine for cars” that allows buyers to test drive vehicles without speaking to humans, grocery stores that use automation to ship online orders to customers' homes, and cashierless stores.

Ultimately, these innovations will help retailers decelerate, but not stop, store closures. Looking ahead, BI Intelligence projects that e-commerce volume will nonetheless grow 73% by 2021 to reach $798 billion, while physical commerce volume will grow only 1.6% to $4,556 billion. In order to grow or maintain their share of an effectively stagnant brick-and-mortar pie, retailers must invest in bringing in-store experience to parity with online through greater personalization and efficiency.

Jonathan Camhi, research analyst for BI Intelligence, Business Insider's premium research service, has laid out the case for why retailers must transition to an omnichannel fulfillment model, and the challenges complicating that transition for most companies. This omnichannel fulfillment report also detail the benefits and difficulties involved with specific omnichannel fulfillment services like click-and-collect, ship-to-store, and ship-from-store, providing examples of retailers that have experienced success and struggles with these methods. Lastly, it walks through the steps retailers need to take to optimize omnichannel fulfillment for lower costs and faster delivery times.

Here are some of the key takeaways from the report:

Brick-and-mortar retailers must cut delivery times and costs to meet online shoppers’ expectations of free and fast shipping.

Omnichannel fulfillment services can help retailers achieve that goal while also keeping their stores relevant.

However, few retailers have mastered these services, which has led to increasing shipping costs eating into their profit margins.

In order to optimize costs and realize the full benefits of these omnichannel services, retailers must undertake costly and time-consuming transformations of their logistics, inventory, and store systems and operations.

In full, the report:

Details the benefits of omnichannel services like click-and-collect and ship-from-store, including lowering delivery times and costs, and driving in-store traffic and sales.

Provides examples of the successes and struggles various retailers have experienced with omnichannel delivery.

Explains why retailers are having trouble managing costs with their omnichannel fulfillment efforts, which are eating into their profits.

Lays out what steps retailers need to take to optimize costs for their omnichannel operations by placing inventory where it best meets customer demand.

Interested in getting the full report? Here are two ways to access it:

Subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you'll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. >> Learn More Now

Purchase & download the full report from our research store. >> Purchase & Download Now

See Also:

Yahoo News

Yahoo News