Paramount Global Is At a Crossroads — What Does That Mean for Paramount+?

Among the major legacy companies, Paramount Global is the most affected by changing structural forces in the media and entertainment ecosystem. In a beleaguered industry, there may not be another conglomerate as beleaguered as Shari Redstone’s media empire.

A combination of an unprofitable direct-to-consumer segment, a faltering studio operation and exposure to linear TV has made Paramount Global’s problems outweigh its many strengths, such as owning one of the most valuable TV libraries and the rights to the NFL for another decade. Not having juicy theme park revenue to fall back on, à la Disney and Universal, also doesn’t help.

Paramount faces a dilemma: Should the company combine forces with a larger company or dismantle, selling its various assets incrementally and becoming a supplier of content to other platforms in a competitive streaming industry? And what would be the role of its streaming service, Paramount+, in any of these scenarios?

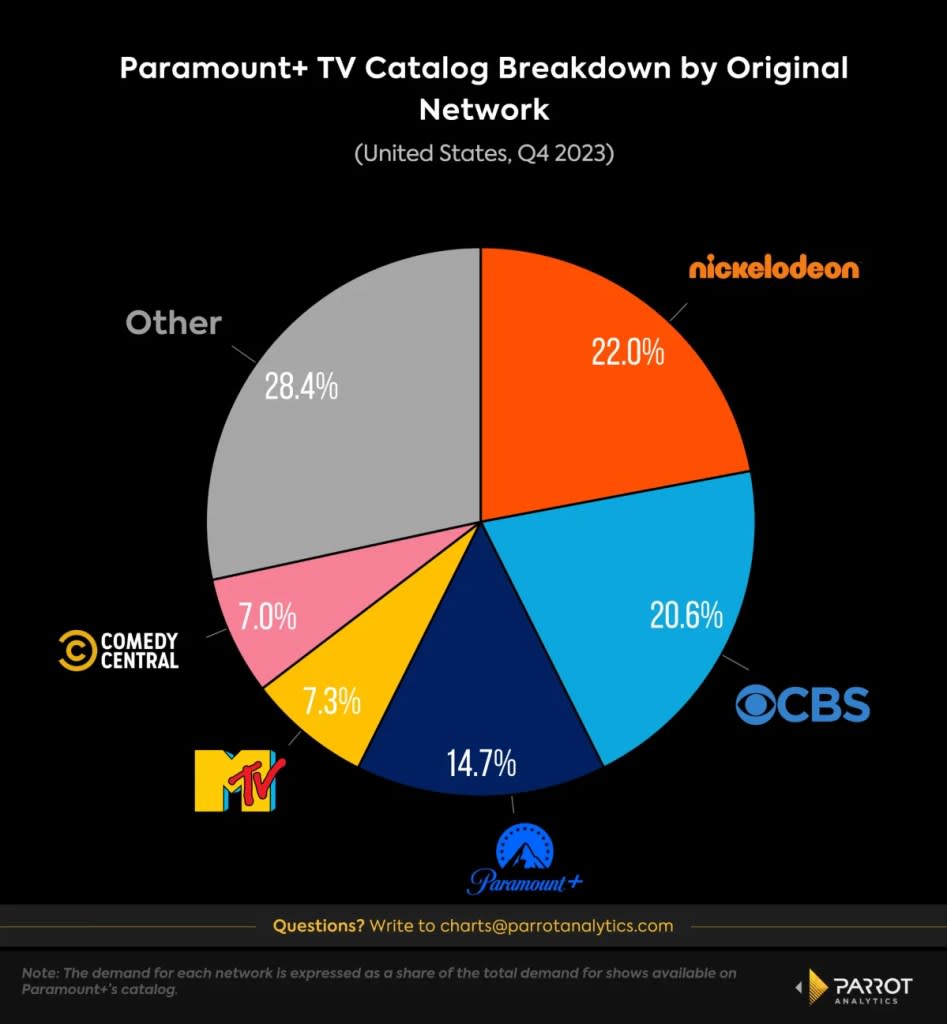

Paramount-owned networks are the main source of content for Paramount+. The four leading linear channels — Nickelodeon, CBS, MTV and Comedy Central — are responsible for around one-third of the total demand for the entire Paramount+ TV catalog. CBS shows command more than one-fifth of on-platform demand. Most notably, these shows are made up of popular and rewatchable procedurals like “Hawaii Five-0,” “NCIS,” “Criminal Minds” and “Blue Bloods.”

This breakdown shows the platform’s exposure to linear TV at a time when the model is rapidly declining. Paramount+ has popular originals, especially within the Star Trek and Taylor Sheridan franchises, but these do not yet provide a substantial enough boost for the platform’s TV catalog. Original shows are responsible for 14.7% of the on-platform TV demand, meaning they cannot support the streamer alone.

Paramount+ benefits largely from having access to titles from networks under Paramount Global’s corporate umbrella, providing the platform with a diverse library. Each network caters to a different niche.

Analysis of the platform’s demographic distribution shows that CBS originals are more appealing to old and female audiences, with a few notable exceptions. “Criminal Minds” and “Big Brother” appeal to younger audiences, and “Blue Bloods” and “48 Hours” have a predominantly male viewership. Comedy Central shows, on the other hand, skew towards an older and male viewer base. Paramount+ originals seem to draw older audiences across both genders.

MTV titles cater to young and female audiences on the platform, thanks to the network’s emphasis on reality TV. Most notably, “The Challenge” and “Jersey Shore: Family Vacation” were the most in-demand MTV shows on Paramount+ last quarter. For even younger audiences, Nickelodeon provides popular animations such as “Avatar: The Last Airbender” and “The Loud House.”

This diverse library is an asset for Paramount in a content-supplier scenario. In a streaming landscape dominated by platforms owned by tech giants, segments of Paramount’s library could attract many potential buyers looking to enhance their streaming services and with more financial resources to expend.

Daniel Quinaud is a senior data analyst at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.

The post Paramount Global Is At a Crossroads — What Does That Mean for Paramount+? appeared first on TheWrap.

Yahoo News

Yahoo News