Poland Keeps Rates Steady Despite Lower Inflation Prospects

(Bloomberg) -- Poland’s central bank held interest rates steady for a fifth month in the face of steadily easing inflation as concerns over consumer prices rising later this year prevail.

Most Read from Bloomberg

Chemical Linked to Cancer Found in Acne Creams Including Proactiv, Clearasil

How Trump’s Ex-Treasury Chief Landed 2024's Highest-Profile US Bank Deal

New York to Deploy National Guard to NYC Subways to Fight Crime

NYCB Raises More Than $1 Billion in Equity Led by Steven Mnuchin’s Firm

The rate-setting Monetary Policy Council kept the benchmark rate on hold at 5.75% on Wednesday, in line with the forecast of all 35 economists surveyed by Bloomberg. Today’s meeting was seen as a potential moment for policymakers to shift gears, but uncertainty over a zero-tax rate on food and a power price cap gave the panel reason to pause.

Prime Minister Donald Tusk has signaled that Poland may restore a 5% value-added-tax rate on food, with the final decision on the issue expected this week. The premier also said the government is working on measures to protect consumers from rising power prices, but policy tools are unlikely to be of the same scale as existing ones.

“Should higher VAT on food products be restored and energy prices raised, inflation might increase significantly in the second half of 2024,” the bank said in a statement. Price growth in the coming quarters is burdened with “substantial uncertainty,” policymakers said.

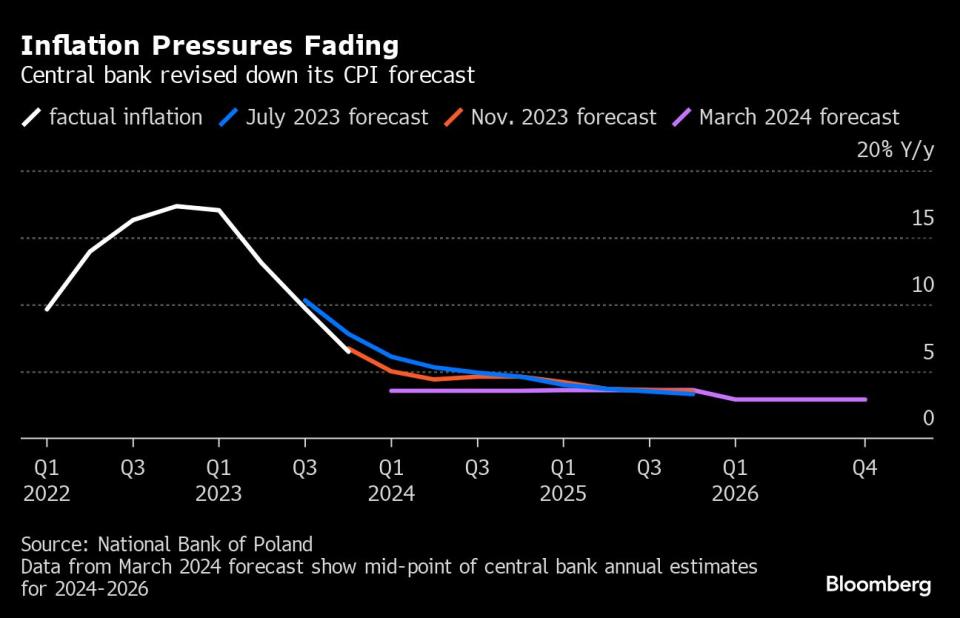

Inflation plunged to 3.9% in January from a peak of 18.4% in February 2023. Still, the lack of clarity is reflected in the central bank’s latest projection, which sees this year’s inflation at between 2.8% and 4.3% — lower than in the previous report — with gross domestic product accelerating to as much as 4.3%, more than the bank expected in November.

National Bank of Poland Governor Adam Glapinski last month signaled that the benchmark rate would remain steady through the rest of the year given the uncertainties, although some officials still see room to reduce borrowing costs.

“We can see significant concerns over inflation beyond the first quarter,” said Monika Kurtek, chief economist at Bank Pocztowy. “I’d expect no decisions to change rates in the coming months. Perhaps, only at the end of the year, maybe on the occasion of the November projection, some room for a rate cut may come up.”

The zloty gained as much as 0.4% against the euro on Wednesday — approaching a four-year high and the best performance by an emerging-market currency following South Africa’s rand. Short-duration bonds declined, driving yields higher.

Focus is now on Glapinski’s press conference scheduled at 3pm local time on Thursday.

There is room for a small rate cut at the end of the year in light of expected easing in the US, the euro area and in the region, Bank Millennium analysts led by Grzegorz Maliszewski said in a note.

“Both the conference and the projection will not fundamentally change expectations for the rates path in the coming months,” the analysts said. “The MPC has been communicating its desire to stabilize them for longer.”

--With assistance from Barbara Sladkowska, Konrad Krasuski and Wojciech Moskwa.

(Updates with details from central bank from fourth paragraph, economist comments)

Most Read from Bloomberg Businessweek

How Apple Sank About $1 Billion a Year Into a Car It Never Built

The Battle to Unseat the Aeron, the World’s Most Coveted Office Chair

Humanoid Robots at Amazon Provide Glimpse of an Automated Workplace

Immigration Rage Drowns Out the US Labor Market’s Need for Workers

©2024 Bloomberg L.P.

Yahoo News

Yahoo News