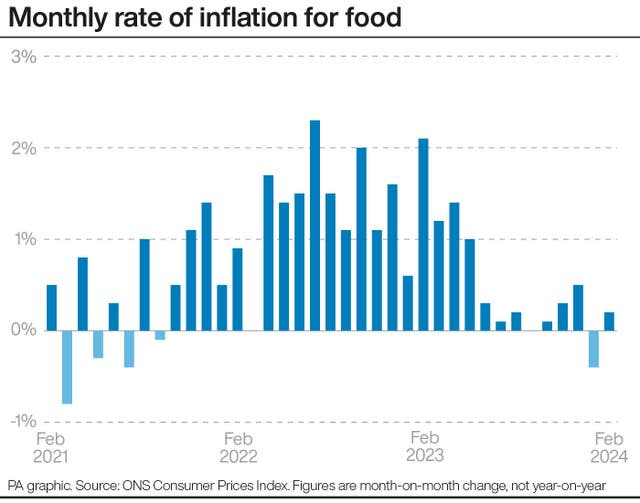

How the rate of inflation has changed for everyday groceries and services

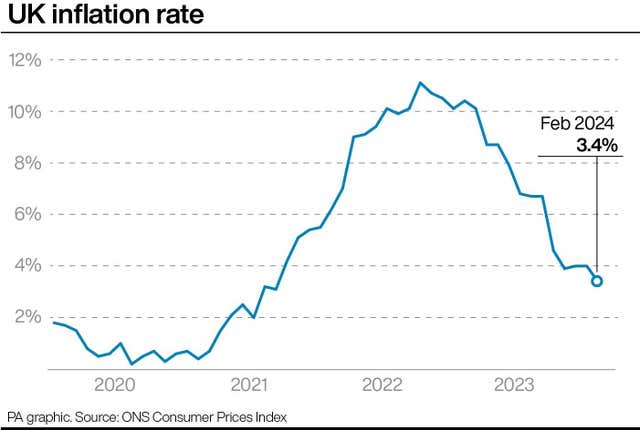

UK inflation fell to a fresh low of nearly two-and-a-half years last month thanks to a sharp slowdown in price rises for food and eating out.

The data from the Office for National Statistics (ONS) shows annual food price inflation fell to its lowest level for two years, at 5% in February.

The cost of eating out in restaurants and cafes also eased back, with the annual rate of inflation falling to 6.7% last month from 8.2% in January.

A growing number of household items are recording a slowing in the rate of inflation, while some products have seen prices fall compared with a year ago, according to the figures.

There have been sharp slowdowns in the average price of eggs, which rose by 3.2% in the year to February compared with a jump of 7.2% in the year to January; crisps (up by 6.2% in February compared with 10.8% in January); yoghurt (up 6.5% compared with 9.9%); tea (up 7.2% compared with 10.6%) and pizza and quiche (up 1% compared with 4%).

Away from groceries, the average cost of cookers rose by just 0.2% in the year to February, down from an annual rise of 5.6% in January; fabrics and curtains were up 6.2% compared with 9.1% in January; and men’s footwear was up 2.7% versus 5%.

A number of products are now recording negative inflation – in other words, prices are falling year-on-year.

The average cost of whole milk was down 10.2% in the year to February, a slightly larger fall than the drop of 10% in January, while low-fat milk fell by 6.6%, compared with a decrease of 6.1% in January, according to the Consumer Prices Index (CPI) data published by the ONS.

Butter was down 7.6% last month, similar to the fall of 7.8% in January, while second-hand cars fell by 7.3%, a steeper drop than 5.9% the previous month.

Cheese and curd fell in price by 0.3% in the year to February, following a rise of 2.5% in January.

Petrol continues to be cheaper than it was a year ago, though the drop in the year to February, down 3.9%, was smaller than the 6.4% decrease in January, reflecting the recent rise in prices at the pumps.

The same trend applies to diesel, with a smaller year-on-year drop in February (down 10.8%) compared with January (down 13.8%).

Inflation is still accelerating in some areas, however – for example, potatoes rose in price by 8.5% in the year to February, compared with 7.1% in January, while the average cost of going to the cinema, theatre or a concert was up by 8.5%, compared with 6.9% in January.

Below is a list of examples of how the CPI inflation rate has either slowed or accelerated.

Two figures are listed for each item: the average rise in price in the 12 months to January, followed by the average rise in price in the 12 months to February.

– Examples where inflation has slowed, ranked by the size of the change:

Fresh or chilled fish: Jan up 5.2%, Feb up 0.3%

Crisps: Jan 10.8%, Feb 6.2%

Fruit & vegetable juices: Jan 12.2%, Feb 7.7%

Eggs: Jan 7.2%, Feb 3.2%

Yoghurt: Jan 9.9%, Feb 6.5%

Tea: Jan 10.6%, Feb 7.2%

Sauces, condiments & culinary herbs: Jan 11.5%, Feb 8.2%

Pizza & quiche: Jan 4%, Feb 1%

Fresh or chilled vegetables other than potatoes: Jan 9.4%, Feb 6.5%

Rice: Jan 6.4%, Feb 3.9%

Fresh or chilled fruit: Jan 6.6%, Feb 4.3%

Men’s shoes: Jan 5%, Feb 2.7%

Products for pets: Jan 3.9%, Feb 1.8%

Pasta products & couscous: Jan 10.8%, Feb 8.9%

Children’s clothes: Jan 7.4%, Feb 5.7%

Breakfast cereals: Jan 8.7%, Feb 7.1%

Restaurants & cafes: Jan 8.2%, Feb 6.7%

Men’s clothes: Jan 4.6%, Feb 3.3%

Soft drinks: Jan 3.6%, Feb 2.4%

Ready-made meals: Jan 5.2%, Feb 4.1%

Bread: Jan 2.1%, Feb 1%

Women’s shoes: Jan 1.3%, Feb 0.4%

– Examples where inflation has accelerated:

Carpets and rugs: Jan 0.2%, Feb 2.3%

Cinemas, theatres, concerts: Jan 6.9%, Feb 8.5%

Potatoes: Jan 7.1%, Feb 8.5%

Hotels, motels and inns: Jan 3.5%, Feb 4.5%

Women’s clothes: Jan 6.6%, Feb 7.1%

Yahoo News

Yahoo News