How the US and Europe Argued Their Way to a Russian Assets Deal

(Bloomberg) -- Since the early days of Vladimir Putin’s invasion of Ukraine, about $300 billion of his central bank’s money has been earning income in accounts in places like Belgium.

Most Read from Bloomberg

Wells Fargo Fires Over a Dozen for ‘Simulation of Keyboard Activity’

Apple to ‘Pay’ OpenAI for ChatGPT Through Distribution, Not Cash

Tesla Investors Back Musk’s $56 Billion Pay Deal, Texas Move

Hunter Biden Was Convicted. His Dad’s Reaction Was Remarkable.

Tech Powers Stocks as Adobe Surges in Late Trading: Markets Wrap

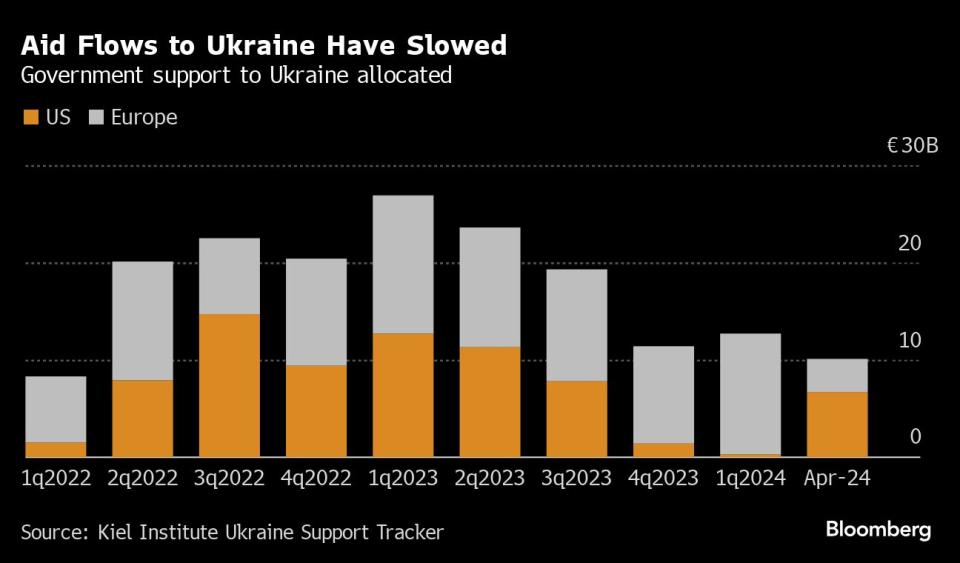

With the war dragging well into its third year and questions surfacing about how long the US and its allies can keep up the flow of aid to Ukraine, the G-7 have agreed to put the money to use to help fund Kyiv’s fight. After months of debating whether to seize the cash, the compromise will generate about $50 billion — for now.

The US had pushed to take the Russian assets outright, but European officials rejected that, fearing potential fallout given that the majority of the money is held on their turf. The US then suggested a complex cocktail of financial engineering that calls for granting a loan to Ukraine secured by the future interest the Russian assets will earn.

The G-7 leaders are set to approve a version of that this week, with final details to be worked out so that Ukraine can start receiving the funds by the end of the year.

Even this approach would have seemed unthinkable a year ago because of the precedent it would set and the risks it would carry.

Now officials say it could be a first step toward bolder actions in the future. Still, the Western allies’ differences over just how far to push their might in global finance and trade have exposed the fault lines of financial warfare, complicating attempts to raise pressure on the Kremlin.

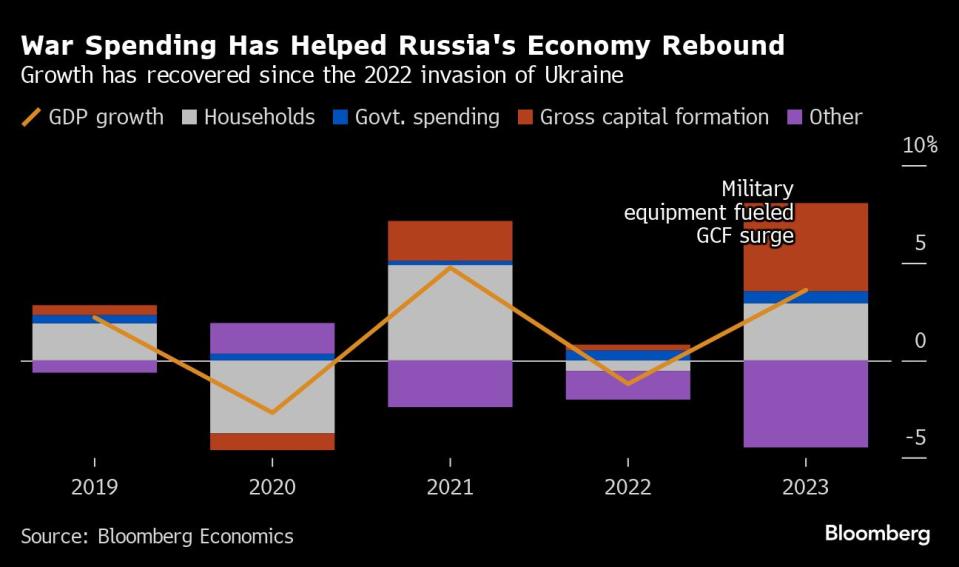

As a result, after more than two years of the toughest financial assault the West has ever mounted, Russia’s economy is still growing. The Kremlin has found ways around sanctions with the help of friendly countries like China. Its war machine is in many areas outproducing those of Ukraine’s allies.

“It’s not the nosedive that I predicted two years ago,” Daleep Singh, the White House’s deputy national security adviser for international economics told Bloomberg’s Voternomics podcast. “But I would not mistake Russia’s rebound for resilience.”

The US announced new restrictions this week, targeting the financial channels Russia uses to evade the existing restrictions. The EU is set to follow shortly.

But while there are signs the Kremlin is having a harder time sourcing key technologies and that the cost of the war is straining its budget, the squeeze so far doesn’t seem to have changed Putin’s calculus.

For Ukraine and its allies, the deal to tap at least some of the value locked in the frozen reserves is an important signal that Kyiv has a source of financial support — one tied directly to Russia, which started the conflict — for years to come, no matter what the political winds in the US and Europe.

Washington is still holding out the possibility it might in future seize some of the cash — a view some in Europe also share — but it took months of testy transatlantic negotiations to get even the current deal. Most of the money is in Europe after Putin pulled the bulk of his central bank’s assets out of the US in 2018 following earlier waves of sanctions.

“Policymakers did not have a coordinated objective or end state in mind when they decided to freeze these assets,” said Kim Donovan, a former Treasury official now at the Atlantic Council. “They were likely hoping the shock and awe of freezing sovereign assets combined with other economic measures would compel Putin to end his invasion of Ukraine.”

Why Using Russian Assets to Fund Ukraine Is Fraught: QuickTake

Nuclear Option

Freezing central bank reserves had been considered the nuclear option in the arsenal of Western economic warfare — rarely tried and potentially too destructive to use. Other countries’ willingness to hold their cash in dollars, euros, yen and pounds was a sign of their confidence in the US-led financial system.

The US was not always leading the charge. It took a call in late February 2022 from then-Italian Prime Minister Mario Draghi to reassure US Treasury Secretary Janet Yellen that the move was the right one. The two had gotten to know each other as heads of the European Central Bank and Federal Reserve respectively. Other US officials worried the move would crush the Russian economy, sending shock waves into Europe and beyond.

In fact, it took the Russian central bank only a few weeks to steady the ruble and contain the damage.

It was months before the US and its allies found out that most were stuck in Euroclear, a Belgium-based clearinghouse. There was little appetite to consider anything beyond leaving them there. Yellen said seizing them would violate US law at the time.

By last summer, the situation had changed.

Ukraine’s western-backed counteroffensive was failing to deliver a breakthrough and Russia was managing to avoid many sanctions by rerouting trade through countries who chose not to observe them.

Earlier this year, a vital $61 billion aid package to Ukraine was stuck in the US Congress. EU nations started exploring whether there was something they could actually do with the frozen assets.

Seizure was illegal, the bloc’s experts concluded, but there was a way to squeeze some value out of them without having them change hands.

Breakthrough on Profits

The Europeans settled on an approach that stretched the limits of what many thought possible: taking the profits earned on the assets in Euroclear — estimated to be worth between €3 billion to €5 billion annually — and giving them to Ukraine. Yellen gave the nod in September, signaling US backing for the EU plan.

But Washington kept looking for a way to get Ukraine more money from the reserves sooner.

The White House quietly put its support behind a bill that would give it the authority to seize the assets held in its jurisdiction. US officials then mounted a push for G-7 action, mobilizing international law experts to make the case that seizure was legal.

By February, the US campaign was in full swing. Working groups held weekly calls on legal issues, risks and how the money would be spent, as top Treasury officials lobbied allies from Tokyo to Berlin.

Moral Case

Ahead of a meeting of Group of 20 finance ministers in Sao Paulo, Yellen argued there is “a strong international law, economic and moral case for moving forward.”

Her push was met with a cool reception from European counterparts and finance ministers of other countries in attendance, who raised concerns about the US and other major economies weaponizing their currencies.

Washington’s full-court press also irritated European officials, who said the US should focus on getting the stalled aid through Congress, rather than pushing a potentially risky plan that affected assets mostly in Europe.

Faced with opposition from the likes of France, Germany and the European Central Bank, the US backed off the idea of outright seizure, turning to financial engineering. Yellen kept up the lobbying behind the scenes.

Deal Reached

By late April, Congress had approved the long-awaited assistance package to Ukraine as well as the law giving the US authority to seize the assets.

A new US proposal was circulating in European capitals and, for the first time, the response of the key holdouts was not a resounding no. As G-7 finance ministers gathered in mid-May, discussions had shifted to the details of making the approach work.

The plan called for a loan to Ukraine that would in effect pull forward the future profits on the Russian assets, without seizing the underlying holdings. That would raise enough to cover some of Kyiv’s needs into 2025 and beyond, and show Putin that the allies are committed to supporting it for as long as it takes.

This week, as G-7 leaders gathered in Italy for their annual summit, an agreement had formed around a structure for the lending. It will be based on the size of participants’ economies and provide Ukraine with about $50 billion of fresh aid starting to flow by the end of the year, according to people familiar with the matter.

“We will have the major tent poles of this decided, but some of the specifics left to be worked through by experts on a defined timetable,” Jake Sullivan, US National Security Advisor, said on Thursday in Italy. “That’s how I anticipate this will all play out.”

--With assistance from Saleha Mohsin and Jennifer Jacobs.

(Adds detail on profits earned.)

Most Read from Bloomberg Businessweek

Israeli Scientists Are Shunned by Universities Over the Gaza War

Grieving Families Blame Panera’s Charged Lemonade for Leaving a Deadly Legacy

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

©2024 Bloomberg L.P.

Yahoo News

Yahoo News