Russia Cuts Oil Exports After Pledging Redress for Excess Output

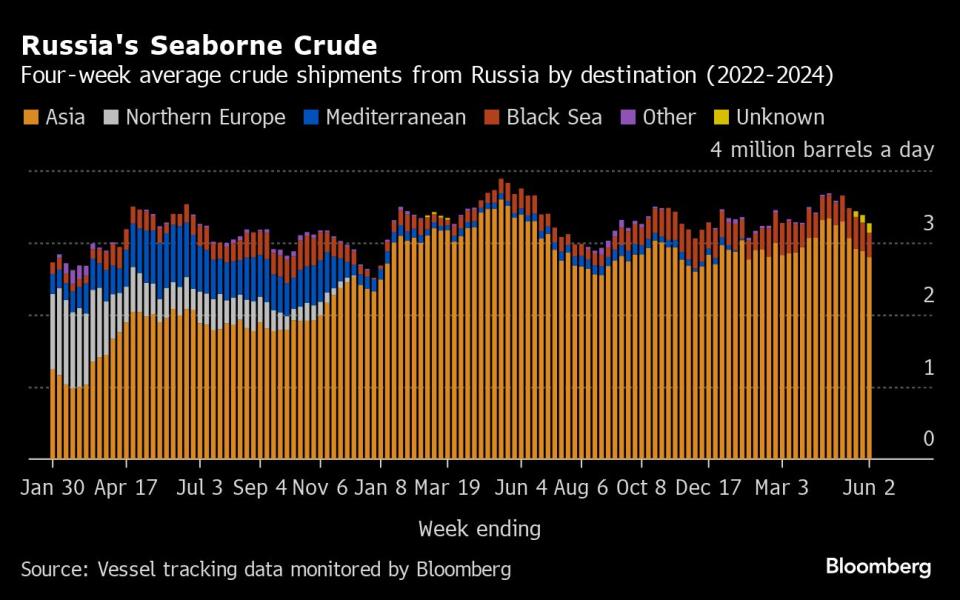

(Bloomberg) -- Russia’s four-week average crude exports fell for a fourth week, with shipments hitting the lowest level since mid-February before a meeting of the OPEC+ producer group that was held on Sunday.

Most Read from Bloomberg

Modi Vows to Retain Power Even as Party Loses India Majority

Short Sellers in Danger of Extinction After Crushing Stock Gains

BlackRock, Citadel Back Texas Stock Exchange in Challenge to NYSE

Bonds Rally as Traders Reload Fed Bets After Data: Markets Wrap

Russia had pledged to compensate for overproduction against its April output target, which it blamed on the “technicalities’’ of making significant output cuts. Falling crude exports may indicate that Moscow is following through on its promise, though production and exports are not perfectly correlated.

Exports in April were about 120,000 barrels a day above a target set for that month, but flows in May fell about 170,000 below a separate, less restrictive, goal. From this month, Russia no longer has an export target after it came into line with its OPEC+ colleagues and replaced a complicated combination of production and exports ceilings with simplified output-only limits that are preferred by the group.

Though weekly export volumes were stable, a small gain in prices saw the gross value of Russia’s shipments edge higher in the seven days to June 2.

The Kremlin continues to test US-led restrictions on its oil shipments.

Russia is developing closer relationships in the Middle East, most recently adding Oman to its growing list of partners in the region. Moscow already co-chairs a key committee of the OPEC+ group of oil producers with Saudi Arabia, while much of the trading of Russian oil moved to the United Arab Emirates after being shut out of Europe following Moscow’s 2022 invasion of Ukraine.

With ship-to-ship transfers off Greece hampered by naval exercises in the bay favored for such activities, switches are taking place elsewhere, with several cargoes moved from one vessel to another off the coast of Oman and, more recently, near Morocco.

Separately, two sanctioned Russian tankers have loaded cargoes of crude at Novorossiysk in recent weeks. The Bratsk, until recently named the NS Burgas, took on about 1 million barrels of Urals crude on May 23 and is now headed through the Red Sea, bound for Singapore. The first sanctioned vessel to load, the SCF Primorye, disappeared for about two weeks from AIS tracking east of Singapore, a popular location for hidden ship-to-ship oil transfers.

If the cargoes ultimately end up being delivered to oil refineries, it could pave the way for other sanctioned tankers owned by state-controlled Sovcomflot PJSC to return to work. The company has renamed and reflagged at least 10 of its 21 ships that were listed by the US Treasury Department for breaching a G7-led price cap on Russian oil.

Crude Shipments

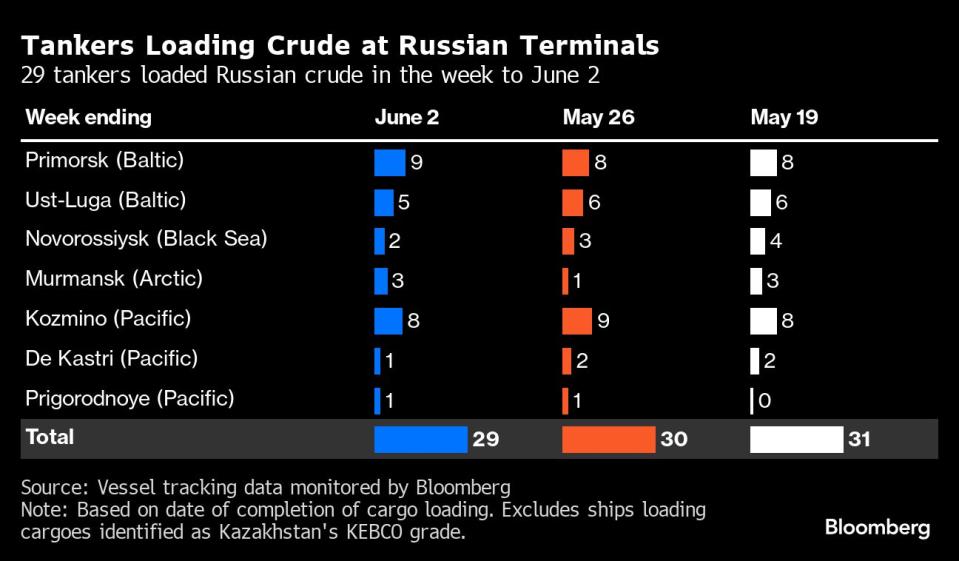

A total of 29 tankers loaded 22.53 million barrels of Russian crude in the week to June 2, vessel-tracking data and port agent reports show. That was virtually unchanged from 22.54 million barrels the previous week.

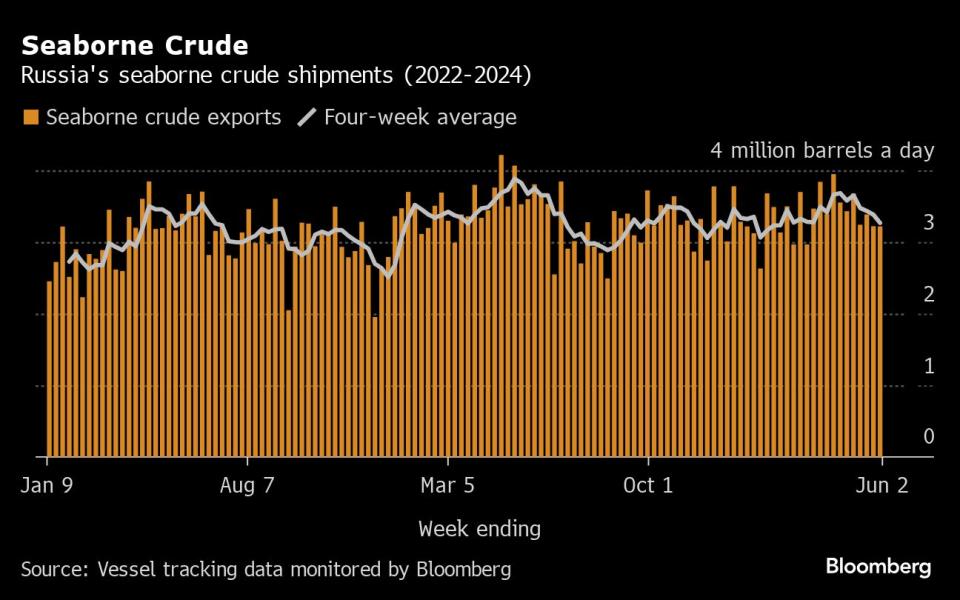

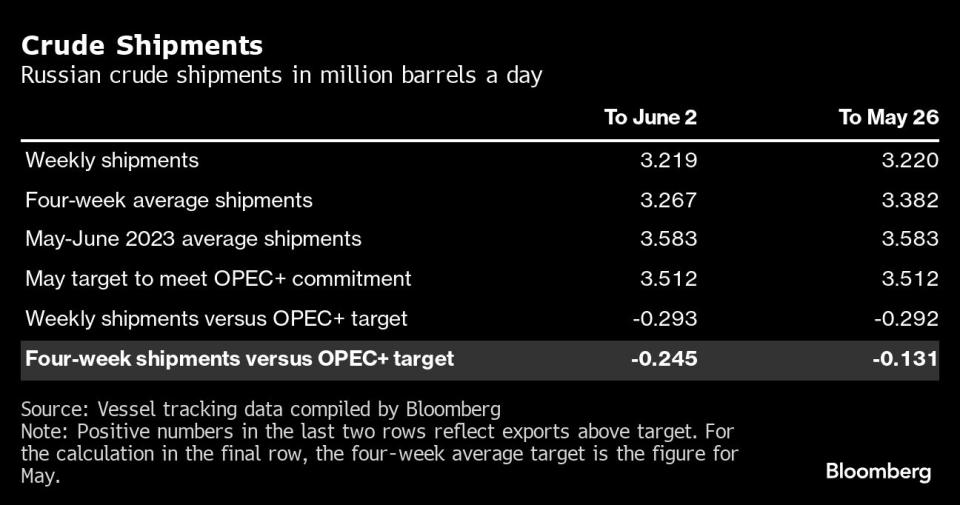

Russia’s seaborne crude flows in the week to June 2 were steady at 3.22 million barrels a day. The less volatile four-week average fell, down by about 115,000 barrels a day to 3.27 million, for the fourth straight decline.

Fewer shipments from the Black Sea port of Novorossiysk and the Pacific ports of Kozmino and De Kastri were partly offset by two more departures from the Arctic terminals at Murmansk.

Crude shipments so far this year are running about 5,000 barrels a day above the average for 2023.

Russia told OPEC+ that it would cut crude exports during May by 71,000 barrels a day from their average May-June level. Weekly shipments were about 290,000 barrels a day below the target, while the four-week average was about 245,000 barrels a day below. Seaborne shipments in the first three months of the year exceeded Russia’s target level for that period by just 16,000 barrels a day, while April flows were about 120,000 barrels a day above that month’s target. Russia has no oil export targets beyond the end of May.

OPEC+ oil ministers met on June 2 and agreed to stretch most output targets to the end of 2025. The group decided to extend the second round of voluntary reductions, to which Russia eventually contributed 471,000 barrels a day, only until the end of September. After that, they will be relaxed over the following 12 months, as long as market conditions allow.

Three cargoes of Kazakhstan’s KEBCO were loaded at Novorossiysk during the week.

Flows by Destination

Asia

Most Read from Bloomberg

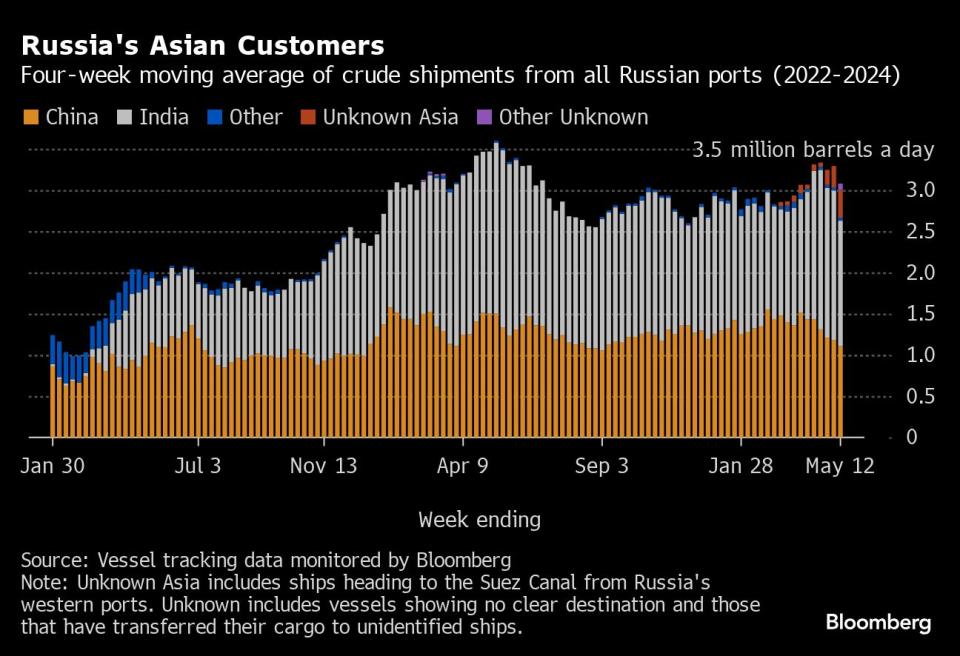

Observed shipments to Russia’s Asian customers, including those showing no final destination, fell to an eleven-week low of 2.93 million barrels a day in the four weeks to June 2, from 2.99 million in the four-week period to May 26.

About 1.09 million barrels a day of crude was loaded onto tankers heading to China. The Asian nation’s seaborne imports are boosted by about 800,000 barrels a day of crude delivered from Russia by pipeline, either directly, or via Kazakhstan.

Flows on ships signaling destinations in India averaged about 1.53 million barrels a day.

Both the Chinese and Indian figures are likely to rise as the discharge ports become clear for vessels that are not currently showing final destinations.

The equivalent of about 180,000 barrels a day was on vessels signaling Port Said or Suez in Egypt. Those voyages typically end at ports in India or China and show up as “Unknown Asia” until a final destination becomes apparent.

The “Other Unknown” volumes, running at about 130,000 barrels a day in the four weeks to June 2, are those on tankers showing no clear destination. Most originate from Russia’s western ports and go on to transit the Suez Canal, but some could end up in Turkey. Others may be moved from one vessel to another, with most such transfers now taking place in the Mediterranean, or more recently off Morocco.

Russia’s oil flows continue to be complicated by the Greek navy carrying out exercises in an area that’s become synonymous with the transfer of the nation’s crude. The activities, which briefly halted on May 19, resumed and ran until June 3.

Europe and Turkey

Most Read from Bloomberg

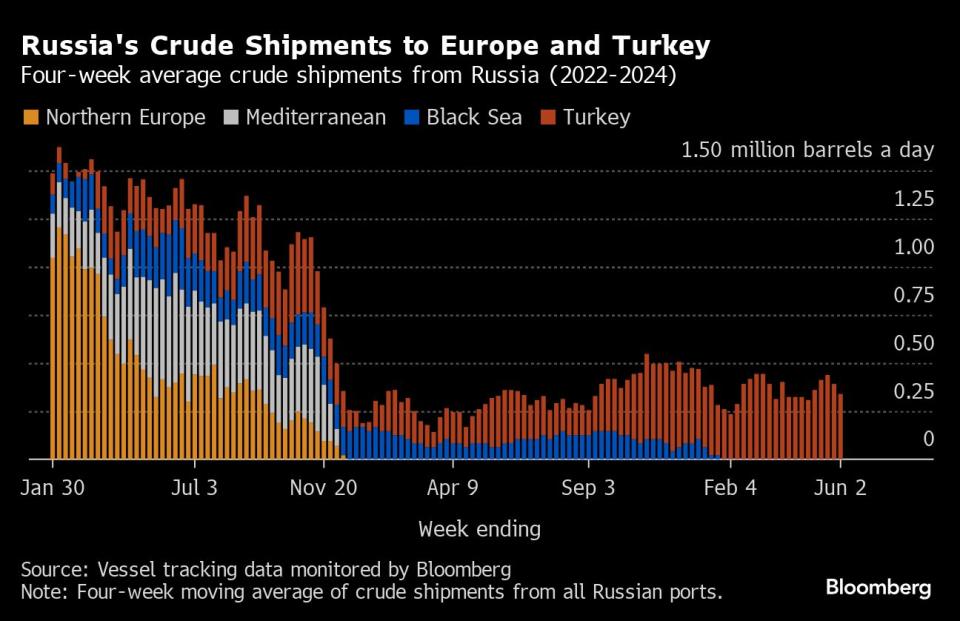

Russia’s seaborne crude exports to European countries have ceased, with flows to Bulgaria halted at the end of last year. Moscow also lost about 500,000 barrels a day of pipeline exports to Poland and Germany at the start of 2023, when those countries stopped purchases.

Turkey is now the only short-haul market for shipments from Russia’s western ports, with flows in the 28 days to June 2 slipping to about 340,000 barrels a day.

Export Value

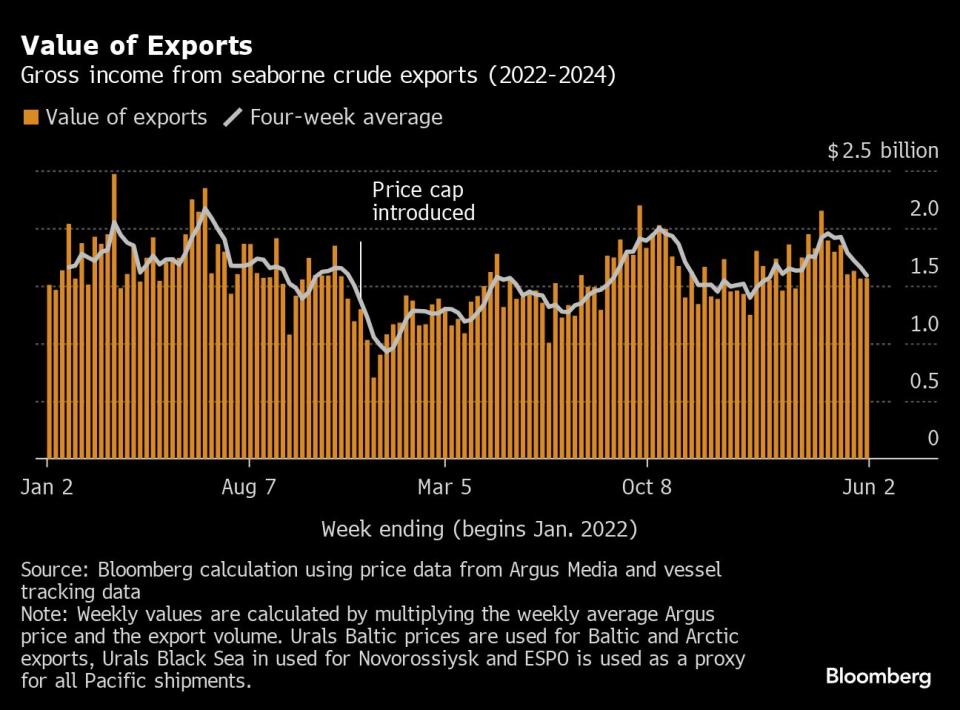

The gross value of Russia’s crude exports edged higher to $1.57 billion in the seven days to June 2 from about $1.56 billion in the period to May 26, aided by a small increase in prices. In contrast, four-week average income was down, dropping by about $72 million to $1.59 billion a week, the lowest it’s been since February. The four-week average peak of $2.17 billion a week was reached in the period to June 19, 2022.

During the first four weeks after the Group of Seven nations’ price cap on Russian crude exports came into effect in early December 2022, the value of seaborne flows fell to a low of $930 million a week, but soon recovered.

NOTES

This story forms part of a weekly series tracking shipments of crude from Russian export terminals and the gross value of those flows. The next update will be on Tuesday, June 11.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through Novorossiysk and Ust-Luga and are not subject to European Union sanctions or a price cap. The Kazakh barrels are blended with crude of Russian origin to create a uniform export stream. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies.

Vessel-tracking data are cross-checked against port agent reports as well as flows and ship movements reported by other information providers including Kpler and Vortexa Ltd.

If you are reading this story on the Bloomberg terminal, click here for a link to a PDF file of four-week average flows from Russia to key destinations.

--With assistance from Sherry Su.

Most Read from Bloomberg Businessweek

Startup Brings New Hope to the Pursuit of Reviving Frozen Bodies

The Budget Geeks Who Helped Solve an American Economic Puzzle

Disney Is Banking On Sequels to Help Get Pixar Back on Track

©2024 Bloomberg L.P.

Yahoo News

Yahoo News