Senators demand accessible, affordable flood insurance during hearing

WASHINGTON, Jan. 25 (UPI) -- Lawmakers on Thursday stressed the urgency of renewing the National Flood Insurance Program, with reforms to rein in ever-increasing premiums that are becoming harder for homeowners to afford.

The Senate Banking Committee is working to reauthorize the National Flood Insurance Program before its March 8 expiration date, which has already been extended multiple times as Congress has struggled to pass the budget and other legislation.

The latest version of the bill proposes to limit price increases, provide swift payments for homeowners and increase oversight for insurance vendors.

"Congress cannot allow the NFIP to lapse," said Sen. Tim Scott, R-S.C. "Whether you're in Ohio or California or the New Jersey-New York area, the number of flood insurance policies in place is essentially nonexistent. Floods don't simply happen when you live near the water. Floods today happen throughout the country."

Destructive hurricanes and torrential rainfall and other weather disasters are adding to the urgency to provide affordable insurance across all coastal and inland states.

Sen. Sherrod Brown, D-Ohio, pointed to drastic flooding events from coast to coast just this month, including in Rhode Island, California and Louisiana.

The insurance program, funded through the Federal Emergency Management Agency, serves residents with rates based on their property's elevation within a zone on a Flood Insurance Rate Map.

Homeowners with a federal mortgage living in designated flood zones must buy flood insurance, while those living outside of the mapped areas may opt into a federal or private plan.

The proposed legislation intends to counter the increase in premiums from FEMA's Risk Rating 2.0, implemented in April 2023. The new program incorporates more factors in calculating premiums, including how close a home is to a body of water and the estimated cost of rebuilding after damage.

Of the 3.4 million single-family homes with policies under the federal program, only about 625,000 homeowners would see rates decline.

Since the introduction of the risk-rating change, senators have expressed concern of policyholders dropping their coverage because of higher rates, even as flood risk for all homes is increasing as a result of climate change.

Sen. Bob Menendez, D-N.J., noted that the program has lost 100,000 policyholders so far, and FEMA estimates it could lose 1 million by the end of the decade.

"Families who are forced to drop their flood insurance coverage due to rising costs and later suffer damage in future disasters, that's the ultimate disaster for them," Menendez said.

FEMA caps rate increases at 18% per year, as informed by flood mapping data and catastrophe models. The proposed reauthorization would implement stricter rate caps at 9%, protecting policyholders from price spikes.

Senators on both sides of the aisle criticized the increase in premiums, noting that they are becoming less affordable for working, middle-class American families.

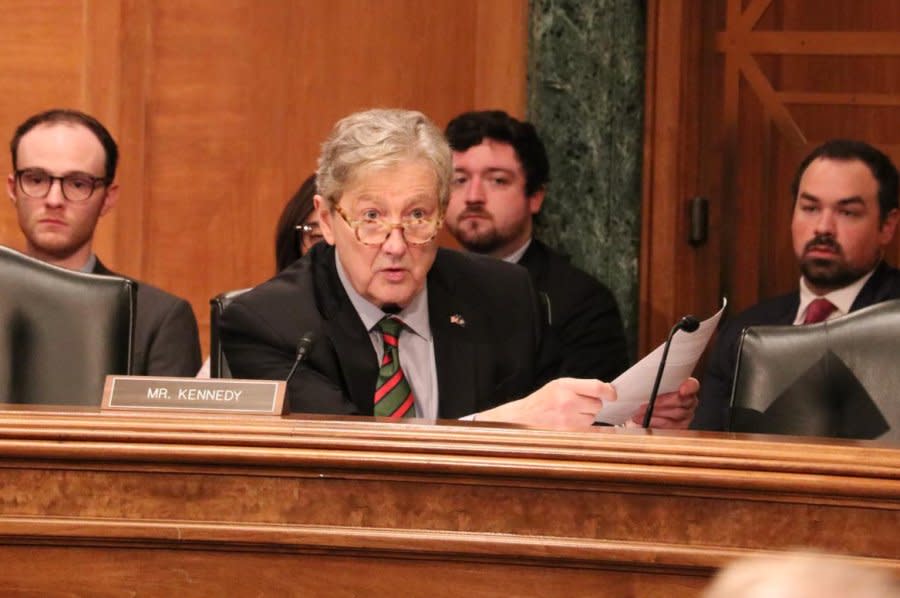

"This is just an excuse to raise premiums," said Sen. John Kennedy, R-La., adding that he has seen price increases of between 300% and 500% in various counties of Louisiana.

"The whole purpose of the National Flood Insurance Program is to provide a product that people can afford. FEMA lied, and they're not going to do any better," Kennedy said.

In response to a lawmaker's question, Michael Hecht, the president of the economic development agency Greater New Orleans Inc., said only about 4% of U.S. homeowners have flood insurance, "though that number should be much, much greater."

Daniel Kaniewski, managing director at insurance firm Marsh McLennan, also called for the legislation to get ahead of flood damage by including incentives for building in areas with less flood risk in the first place.

"Hazard avoidance is at the center of our universe," he said.

Yahoo News

Yahoo News