In Setback for Disney Board, Influential Shareholder Firm ISS Backs Nelson Peltz in Proxy Fight

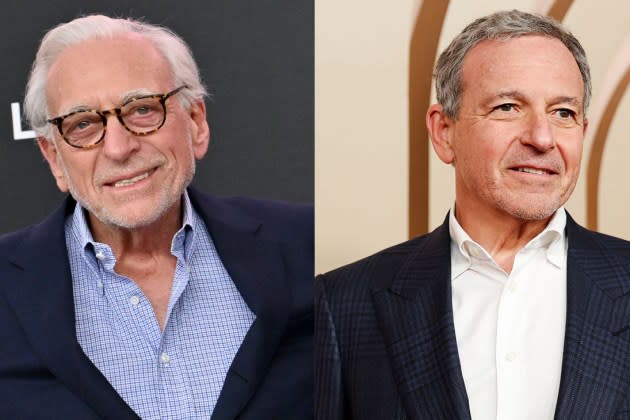

In a move that could shape the high-profile proxy fight between The Walt Disney Co. and Nelson Peltz’s Trian Partners, the influential advisory firm Institutional Shareholder Services is recommending that its clients vote to add Peltz to Disney’s board of directors.

ISS ultimately recommended a vote for Peltz, but not Trian’s other nominee, Jay Rasulo, and to withhold a vote for current Disney board member Maria Elena Lagomasino.

More from The Hollywood Reporter

Which Streaming Bundle Makes Sense to Pay For? A Startup Wants to Help Viewers Figure That Out

'Shogun' Star Anna Sawai on What's Next for Lady Mariko: "It All Just Gets Better and Better"

George Lucas Backs Disney and Bob Iger in Proxy Fight: "Creating Magic Is Not for Amateurs"

ISS released a detailed report Thursday outlining Disney’s performance, and evaluating the proposals from both Trian and another activist, Blackwells. ISS noted Disney’s underperformance in recent years, and places particular emphasis on Disney’s succession issues.

And while it praised the strategic moves made since CEO Bob Iger’s return, the firm nonetheless argued that change is needed at the board level.

“Because the company has made positive changes to its board as well as operational changes that have been well received by the market, we recognize that some shareholders may feel that the company has sufficiently course corrected. These investors have likely drawn comfort from Iger’s return. Nonetheless, given the major missteps and severe consequences of the failed 2020 succession, particularly for a company that already had a history of succession drama, it may be difficult for others to simply trust that the board, albeit refreshed, will get it right this time,” ISS wrote in its report. “These shareholders may be concerned about post-Iger DIS. Our analysis favors this latter view.

“Dissident nominee Peltz, as a significant shareholder, could be additive to the succession process, providing assurance to other investors that the board is properly engaged this time around,” the report continued. “He could also help evaluate future capital allocation decisions. Moreover, multi-year concerns surrounding Lagomasino’s role as a compensation committee member strengthen the case that Peltz’s addition, on balance, would appear a net positive.”

Disney board chairman Mark Parker responded in a statement, saying that while he is “heartened” that ISS supports Michael Froman (the other director targeted by Trian), and by the withhold recommendation for Rasulo and the Blackwells nominees, “we strongly believe that ISS reached the wrong conclusion in its recent report when it comes to adding Nelson Peltz to the board.

“ISS fails to acknowledge the breadth of perspective and expertise Ms. Lagomasino adds to the Board,” Parker continues. “The strong recent performance and results overseen by the Disney Board demonstrate our focus on long-term shareholder value creation and succession planning and our commitment to good governance practices.”

The recommendation by ISS carries substantial weight among institutional shareholders, with Iger noting himself in his 2019 memoir that the firm can influence “more than a third” of votes in a proxy. In fact, Iger recalls ISS’ recommendation 20 years ago as being critical to Roy Disney’s surprise showing in that proxy battle.

“I remember thinking that it was like we’d entered a conventional war … and now another party had launched nuclear weapons,” Iger wrote of the ISS recommendation in favor or Roy Disney’s campaign.

This time around, Disney has garnered far more support than it did 20 years ago. Perhaps most notably, the families of Roy and Walt Disney have all signed letters supporting Iger and the Disney board. Star Wars creator George Lucas is also backing the company, and another shareholder adviser firm, Glass Lewis, offered a recommendation in support of the Disney board.

“This is an unusual contest in that it involves an iconic global company, closely scrutinized and widely covered by media, and a CEO who can be characterized as a celebrity thanks to his successful track record at this company, the glamor associated with the job, and his own published autobiography,” ISS writes, noting the public attention on the fight.

But this year’s proxy fight has been public and bitter, with Peltz and Rasulo heaping criticism at the company for its stock performance, and at Iger for past succession issues, with Disney punching back by calling the activists “disruptive and destructive.”

ISS sidesteps Blackwells, noting that the firm has spent a great deal of effort firing potshots at Trian and ValueAct (an activist firm aligned with Disney), and that it does not own any substantial stake in Disney. “These inconsistencies make it hard to ascertain Blackwells’ precise intention with this campaign,” ISS writes.

Instead, it argues that Trian’s case is more persuasive, given the multibillion-dollar stake they hold, and Peltz’s experience on public company boards.

In recommending a vote against Lagomasino, ISS argues: “As DIS’ longest tenured independent director and a member of the nomination and governance committee since 2019, she arguably bears more accountability than most for the failed succession process prior to Iger’s decision to step down in 2020.”

As for Iger, ISS suggests that he is not the issue, but rather that Disney’s issues lie with the board.

“The decision to bring Iger back was the right one given his track record, as well as investors’ confidence in his understanding of the business and decisionmaking related to company strategy,” ISS writes. “While it is clear that Iger is the right CEO for DIS at the moment, there are lingering questions about the board’s ability to properly oversee the next CEO transition, whether it happens in 2026 or in later years, and the significant strategic changes the company is undertaking, particularly given the ongoing challenging industry environment.

“By definition, the decision to ask a former CEO (especially one who indicated it was time for him to retire) to return to the company to replace a successor whom the board did not adequately vet is evidence of a critically flawed succession process. In DIS’ case, shareholders paid a steep price,” the ISS report continues. “The board may argue that Iger was the only logical choice to lead the turnaround; this is a valid point, but one has to wonder where the company would be had Iger not been available, or willing, to return.”

Best of The Hollywood Reporter

Yahoo News

Yahoo News