The Space Group Holdings (HKG:2448) Share Price Has Gained 70% And Shareholders Are Hoping For More

Space Group Holdings Limited (HKG:2448) shareholders might be concerned after seeing the share price drop 14% in the last quarter. But that doesn't change the reality that over twelve months the stock has done really well. In that time we've seen the stock easily surpass the market return, with a gain of 70%.

Check out our latest analysis for Space Group Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year, Space Group Holdings actually saw its earnings per share drop 28%.

So we don't think that investors are paying too much attention to EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

Space Group Holdings's revenue actually dropped 9.1% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

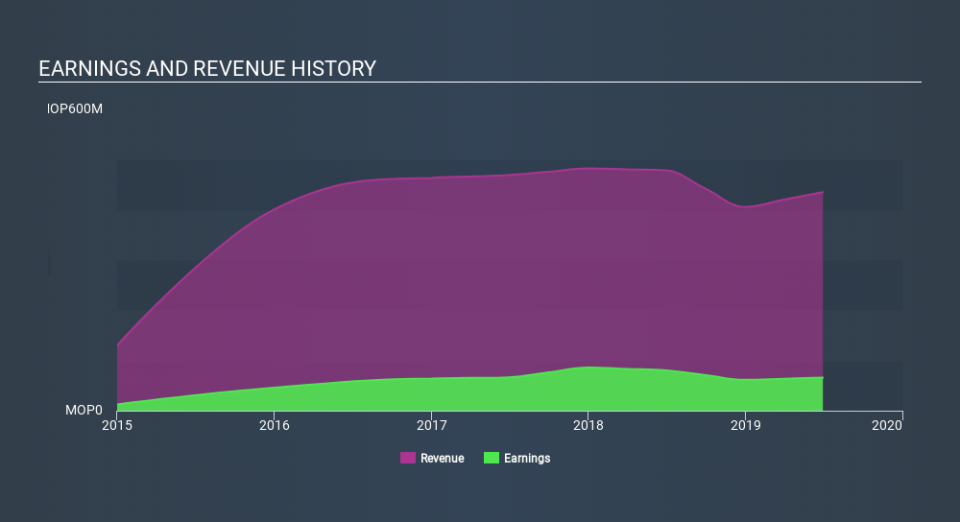

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Space Group Holdings's financial health with this free report on its balance sheet.

A Different Perspective

Space Group Holdings shareholders should be happy with the total gain of 70% over the last twelve months. We regret to report that the share price is down 14% over ninety days. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. It's always interesting to track share price performance over the longer term. But to understand Space Group Holdings better, we need to consider many other factors. Be aware that Space Group Holdings is showing 3 warning signs in our investment analysis , and 2 of those are concerning...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News