A Stock Trader’s Guide to Navigating the French Election Turmoil

(Bloomberg) -- The prospect of a change in the balance of power in France has investors on edge, with banks, highway operators and utilities among the stocks with most on the line.

Most Read from Bloomberg

How Long Can High Rates Last? Bond Markets Say Maybe Forever

Jain Raises $5.3 Billion in Biggest Hedge Fund Debut Since 2018

BuzzFeed Struggles to Sell Owner of Hit YouTube Show ‘Hot Ones’

S&P 500 Holds Gains Even as Nvidia Keeps Falling: Markets Wrap

Weighed down by potential risks around tax hikes, higher borrowing costs and possibly even nationalizations, those sectors have been at the forefront of a $240 billion rout in the Paris bourse since President Emmanuel Macron called a snap parliamentary vote on June 9. A UBS Group AG index tracking stocks exposed to election risks has slumped 9% in that time.

And with Macron’s party and its allies trailing far-right politician Marine Le Pen’s National Rally, as well as the left-wing New Popular Front in polls, investors have much to ponder ahead of the two-round vote, the outcome of which will be known on July 7.

While Macron will remain president, losing control of parliament would hinder his pro-business agenda. Already, the possibility of highway nationalization — mooted by Le Pen before the 2022 election — has hit shares in toll-road operators Vinci SA and Eiffage SA. The leftist alliance has floated higher taxes on wealth, dividends and share buybacks, while the far right is skeptical on renewable energy and electric vehicles.

“Few, if any, sectors or stocks will benefit from this atmosphere,” said Alexandre Hezez, chief investment officer at Groupe Richelieu. “The most at-risk sectors are those with high beta related to political risk, significant exposure to France and the EU, and high debt levels.”

Here are the major stocks and sectors that could be most impacted by the election:

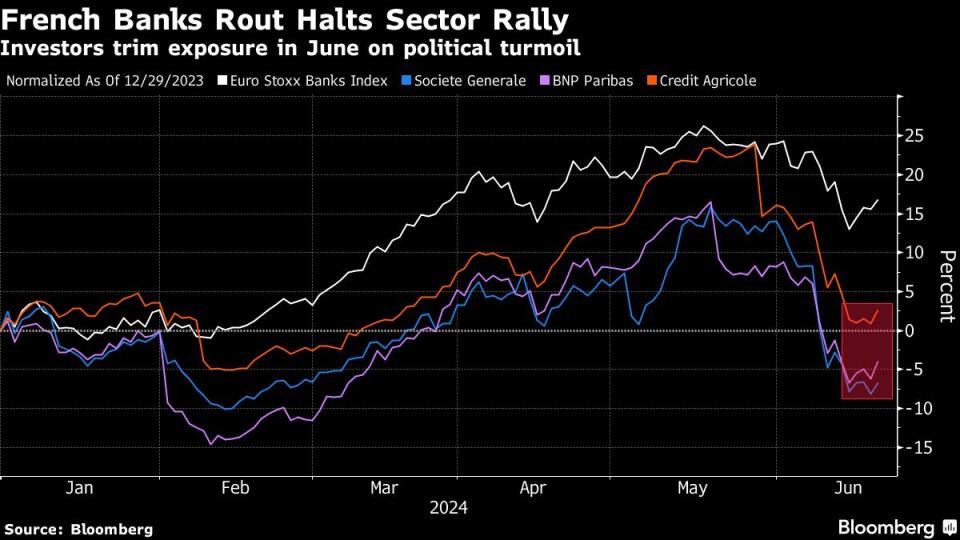

Banks

Populist spending increases that lift borrowing costs are at the forefront of concerns for banks. That’s reflected in declines of more than 10% in shares of France’s three largest lenders — Societe Generale SA, Credit Agricole SA and BNP Paribas SA — since the election was called, far steeper losses than in European peers.

Banks are vulnerable to a so-called sovereign-bank loop, where they suffer losses via holdings of sovereign debt and take an indirect hit from the effects of implementing new spending measures. Sluggish growth and slowing loan volumes are further headwinds. The leftist coalition also seek to increase banks’ mandatory capital buffers and raise transaction taxes.

“Banks hold a large amount of debt and would likely suffer most from higher credit costs or any sharp increase in borrowing,” said Goldman Sachs Group Inc. strategist Lilia Peytavin. “Investors also worry about windfall taxes or capital gain taxes on dividends.”

AXA Investment Managers is among investors who have cut exposure to French banks, with portfolio manager Gilles Guibout seeing the higher bond yield premia as a lasting trend.

While the selloff has wiped a collective €16.2 billion ($17.3 billion) from the value of Societe Generale, Credit Agricole and BNP Paribas, the latter is least dependent on France for revenue.

Transport & Infrastructure

A key point of uncertainty centers around toll-road operators. Even if nationalization — favored by the far-right — doesn’t happen, the incoming government could try to cap prices, hike taxes or terminate concessions ahead of schedule.

Shares in infrastructure and transport firms firm Eiffage, Aeroports de Paris SA, Bouygues SA, Getlink SE and Vinci have fallen as much as 12% in the past two weeks — they derive up to 70% of revenues from France, data compiled by Bloomberg shows.

Construction firms could also be impacted by the possible rollback in subsidies and changes in energy efficiency policies, Morgan Stanley strategists said.

Energy & Utilities

Surging borrowing costs would be a blow for green energy firms, already reeling from high interest rates. They, alongside other energy utilities, also could see higher taxes and the withdrawal of green financing.

The far-right seeks to reform or opt out of European rules on electricity pricing, with a skeptical stance toward renewables, particularly wind power. Investors will also watch for any changes to France’s low-carbon agenda and the role of biofuels. The left-wing coalition seeks to gradually hand control of water management to local authorities.

Green energy firm Engie SA has plunged about 8% since the snap-election call, while water and energy management company Veolia Environnement SA retreated about 7%.

CIC Market Solutions analyst Arnaud Palliez has removed Engie from his list of top picks, predicting it could be hurt by lower investment in energy infrastructure as well as any decision by the government to reduce its 24% stake.

Barclays Plc analyst Lydia Rainforth downplays risks to integrated energy stocks, including TotalEnergies SE. While acknowledging risks such as buyback taxes, Rainforth doesn’t expect the investment case for TotalEnergies to be disrupted, “regardless of who is in government in France.”

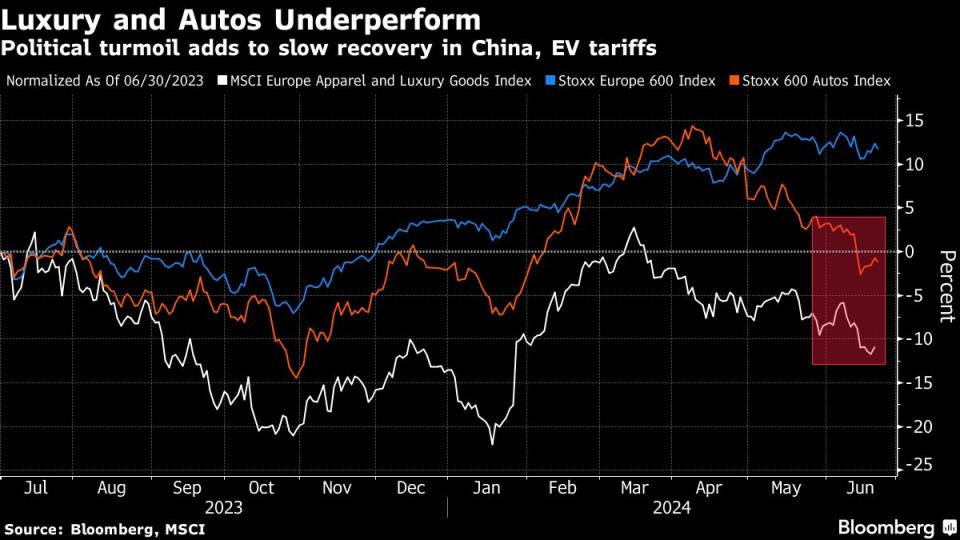

Luxury & Autos

A majority for Le Pen could derail France’s transition plan toward electric vehicles, as her party favors scrapping plans to ban the sale of new combustion engine vehicles by 2035.

Renault SA shares have underperformed the CAC 40 Index this month, as Morgan Stanley analysts flagged the risk that the government — which owns a 15% stake — pushes to keep production in France. The carmaker is also vulnerable to any broader consumer slowdown, as almost a third of sales are earned in its home market, according to data compiled by Bloomberg.

Auto parts suppliers Forvia SE and Valeo SE could be impacted by any hit to consumer demand, with their shares down 13% and 7%, respectively, since the election call.

“Despite low valuations, we would treat any fresh policy uncertainty as a negative event for the sector,” said Morgan Stanley analyst Ross MacDonald.

Meanwhile, the outlook for luxury-goods firms such as LVMH, Hermes International SCA and Gucci owner Kering SA remains broadly intact as less than 10% of their sales are generated at home. But a potential risk is that a new government adapts a stricter tariff stance, fueling a trade dispute with China, the world’s biggest luxury market.

Media & Defense

Television Francaise 1 SA and Metropole Television SA have fallen after a member of the National Rally said his party was considering privatizing the country’s state TV and radio group. Such a move would mean public TV channels and radio stations would need to compete for an already tight advertising revenue pool.

France’s defense budget is seen as relatively safe, especially as Jordan Bardella, potentially the next prime minister, has assuaged some concerns on his party’s stance on Ukraine. Still, given that Le Pen’s party’s financial ties to Russia have come under scrutiny in the past, shares of defense and aerospace firm Thales SA and aircraft supplier Safran SA have lost ground.

--With assistance from Michael Msika.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Yahoo News

Yahoo News