Terra (LUNA) Leads the Crypto Majors in a Breakout Session

Key Insights:

Terra (LUNA) jumps by 12%, with resistance at $110 pegging LUNA back.

A marked increase in Terra’s total value locked (TVL) has supported the current uptrend.

Technical indicators are bullish, with LUNA holding above its 50-day EMA.

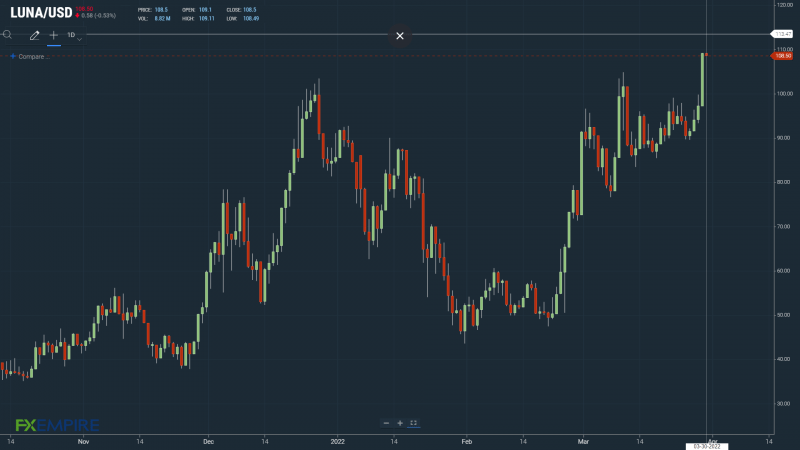

On Tuesday, it was a bullish session for LUNA. Following a 3.32% gain from Monday, LUNA jumped by 12.10% to end the day at $109.08.

LUNA struck a new ATH $109.9 to test resistance at $110 before easing back.

Bitcoin Reserve Drives Terra LTV and LUNA Price Northwards

It was a fourth consecutive day in the green, with LUNA rebounding from sub-$90 levels. The latest upswing comes off the back of Bitcoin’s (BTC) return to $47,000 levels. The LUNA Guard Foundation purchased more than $1bn in Bitcoin to hold as reserves.

For LUNA, the use of Bitcoin as a reserve and Bitcoin’s latest upswing supported Tuesday’s ATH.

Since the LGF’s Bitcoin purchase, Terra’s total value locked (TVL) has jumped by more than $10bn. Around the time of the BTC purchase, Terra’s TVL stood at $17.49bn. At the time of writing, Terra’s TVL was $29.16bn, according to Defi Llama.

Anchor (ANC) remains the dominant protocol, with a TVL of $15.17bn, followed by Lido (LDO) with a TVL of $8.75bn.

Over one month, Anchor’s TVL has surged an impressive 32.4%, with Lido up 13.2%.

What is Total Value Locked and Why Does it Matter?

The total value locked is the value of crypto assets deposited in a DeFi protocol. In recent months, TVL has drawn significant interest. Traders consider the TVL a key metric in measuring market interest and also native token value.

The market will be looking for divergence between the TVL and the market cap of a token. Buying or selling opportunities present themselves at times of greatest divergence.

LUNA Price Action

At the time of writing, LUNA was down by 0.53% to $108.50. A mixed start to the day saw LUNA rise to an early morning high of $109.11 before falling to a low of $108.49.

Technical Indicators

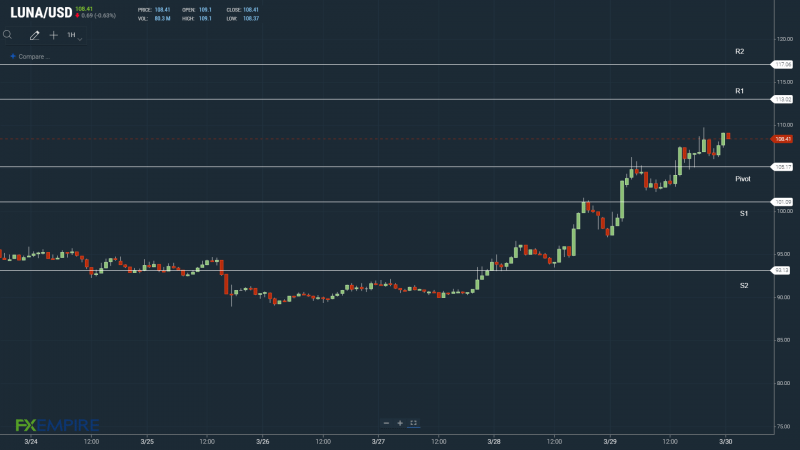

LUNA will need to avoid the day’s $105.17 pivot to make a run on the First Major Resistance Level at $113.02. LUNA would need the broader crypto market to support a breakthrough Tuesday’s high of $109.12.

Another extended rally would test the Second Major Resistance Level at $117.06 and resistance at $120. The Third Major Resistance Level sits at $130.00.

A fall through the pivot would test the First Major Support Level at $101.09. Barring an extended sell-off, LUNA should avoid a return to sub-$100. The Second Major Support Level sits at $93.13.

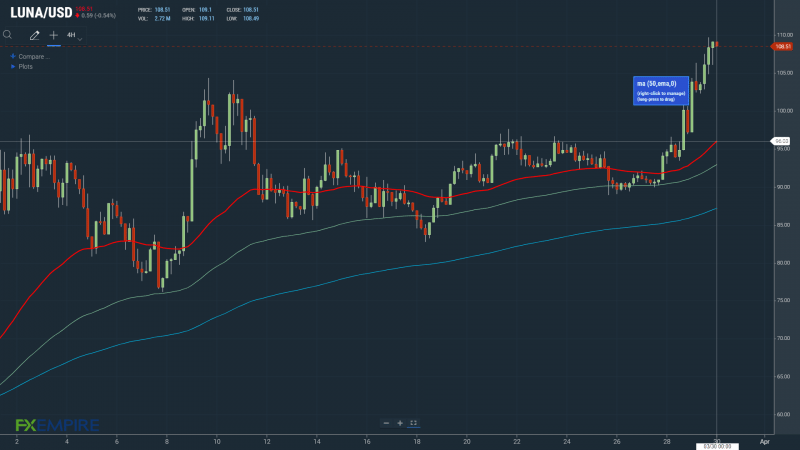

Looking at the EMAs and the 4-hourly candlestick chart (above), it is a bullish signal. LUNA continues to hold above the 50-day EMA at $96.03. This morning, the 50-day EMA pulled away from the 100-day EMA. The 100-day EMA also pulled away from the 200-day EMA, bringing resistance levels into play.

Avoiding a fall to sub-$100 and through the 50-day EMA would support a run at $120 levels.

This article was originally posted on FX Empire

Yahoo News

Yahoo News