We Think Wonderful Sky Financial Group Holdings (HKG:1260) Can Stay On Top Of Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Wonderful Sky Financial Group Holdings Limited (HKG:1260) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Wonderful Sky Financial Group Holdings

What Is Wonderful Sky Financial Group Holdings's Net Debt?

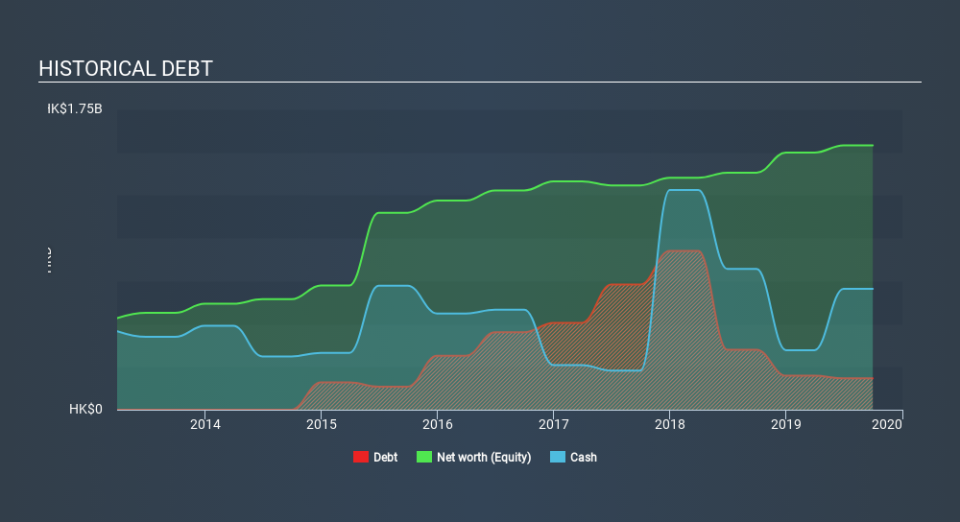

As you can see below, Wonderful Sky Financial Group Holdings had HK$182.5m of debt at September 2019, down from HK$349.4m a year prior. However, it does have HK$704.5m in cash offsetting this, leading to net cash of HK$522.1m.

How Strong Is Wonderful Sky Financial Group Holdings's Balance Sheet?

According to the last reported balance sheet, Wonderful Sky Financial Group Holdings had liabilities of HK$502.1m due within 12 months, and liabilities of HK$1.79m due beyond 12 months. Offsetting this, it had HK$704.5m in cash and HK$217.0m in receivables that were due within 12 months. So it can boast HK$417.7m more liquid assets than total liabilities.

This surplus strongly suggests that Wonderful Sky Financial Group Holdings has a rock-solid balance sheet (and the debt is of no concern whatsoever). Having regard to this fact, we think its balance sheet is just as strong as misogynists are weak. Simply put, the fact that Wonderful Sky Financial Group Holdings has more cash than debt is arguably a good indication that it can manage its debt safely.

On the other hand, Wonderful Sky Financial Group Holdings's EBIT dived 14%, over the last year. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. When analysing debt levels, the balance sheet is the obvious place to start. But it is Wonderful Sky Financial Group Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Wonderful Sky Financial Group Holdings has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Wonderful Sky Financial Group Holdings burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing up

While it is always sensible to investigate a company's debt, in this case Wonderful Sky Financial Group Holdings has HK$522.1m in net cash and a decent-looking balance sheet. So we are not troubled with Wonderful Sky Financial Group Holdings's debt use. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for Wonderful Sky Financial Group Holdings (1 is a bit unpleasant!) that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News