A third of Gen Z and millennial homebuyers plan to use family money for a down payment amid sky-high housing costs

More than a third of Gen Z and millennial homebuyers anticipate their families to help with the cost, Redfin says.

Younger Americans face bigger financial hurdles to buying a home compared to their parents' generation.

A new group of nepo babies is emerging through the country's housing affordability crisis.

Over one-third of prospective Gen Z and millennial homebuyers expect their families to help cover the down payment for a home purchase, according to a Redfin-commissioned survey of 3,000 people in the US.

Taking a closer look, roughly one in six people under the age of 43 said they'd tap into their family inheritance to pay the up-front cost, and 13% said they planned to live under their parents' or other family members' roof.

It's worth noting that only 18% of millennials leveraged a family cash gift for their down payment in 2019, though this number jumped to 23% by 2023 as the country grappled with all-time high median home prices as well as multi-decade highs in the 30-year mortgage rate.

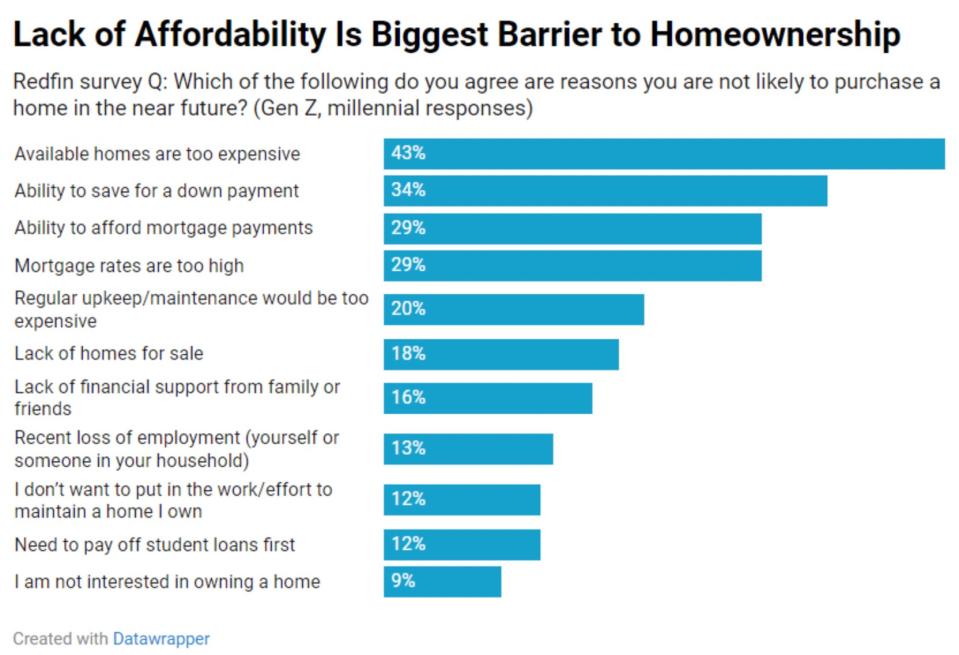

Nearly half of Gen Zers and millennials say they aren't keen on buying homes soon due to sky-high prices. About a third struggle to save for a down payment, while others blame steep mortgage rates for keeping them sidelined.

"Nepo-homebuyers have a growing advantage over first-generation homebuyers. Because housing costs have soared so much, many young adults with family money get help from Mom and Dad even when they have jobs and earn a perfectly respectable income," said Redfin chief economist Daryl Fairweather.

Even though lots of young Americans are pulling in decent income, with 60% able to stash money away for a house and 39% eyeing side hustles, they're still spooked by the whopping 40% spike in home prices since before the pandemic.

"The bigger problem is that young Americans who don't have family money are often shut out of homeownership. Many of them earn a perfectly good income, too, but they aren't able to afford a home because they're at a generational disadvantage; they don't have a pot of family money to dip into," Fairweather said.

The housing crisis also widens wealth gaps in America, leaving many younger people struggling to keep pace with more privileged peers and shutting them out of a significant source of wealth accumulation.

"The American Dream is just as much about class mobility as it is the home with a white-picket fence, and the housing affordability crisis has made both elements of the dream harder to attain," she added.

These days, in order to afford the median-priced home in the US, buyers need to earn $114,000 annually, 35% more than the median household income of $84,072, Redfin said in a separate report this week.

Read the original article on Business Insider

Yahoo News

Yahoo News