Three Top China Executives Depart Consulting Firm Control Risks

(Bloomberg) -- Control Risks has seen all three of its partners in mainland China depart or plan their exits over the past year and it isn’t clear they will be replaced, a reflection of the increasingly complicated environment facing advisory firms in the world’s second-biggest economy.

Most Read from Bloomberg

US Probing Indian Billionaire Gautam Adani and His Group Over Potential Bribery

A $2 Billion Airport Will Test Modi’s Mission, Adani’s Ambitions

Fed Seen Sticking With Three 2024 Cuts Despite Higher Inflation

Bitcoin Extends Retreat From Record as ‘Bubble’ Talk Escalates

Stocks Fall as ‘Triple Witching’ Spurs Volume Jump: Markets Wrap

The departures at the UK-based company’s China offices include Chris Torrens, the Beijing-based partner for Greater China and North Asia, who left at the start of this year, according to two people familiar with the situation who asked not to be identified discussing personnel issues. Torrens is now a managing director focusing on China issues at APCO Worldwide LLC.

Another top executive set to leave is Kent Kedl, head of the Greater China and North Asia practice for Control Risks in Shanghai, who said he is retiring in the coming months. Rosie Hawes — a firm partner who had served on the British Chamber in Shanghai — left in March last year, according to one person and her LinkedIn profile.

Bloomberg spoke with six current and former employees about the situation facing Control Risks — all of whom asked not to be identified given the sensitivity of the issues. The company, which advises multinational corporations from offices around the world, has so far not added additional partners in mainland China, although it does have four partner-level officials in Hong Kong, according to its website.

While the departures are a fraction of the company’s total staff of about 90 people in the mainland, they represent decades of experience operating in China. Their exits come as the firm — like many multinationals in China — boosts local leadership on the mainland and looks to other markets in Asia for growth, one of the people said.

Read: Xi Upends the Secretive World of $10,000-an-Hour China Experts

Torrens and Hawes declined to comment when contacted by Bloomberg News. Kedl said in an email that his retirement was a “long-term plan” of his that had been under discussion with the company for some time.

Rachael Milford, a Singapore-based communications director for Control Risks, said via email that the company wouldn’t comment on personnel matters or its client roster. She didn’t respond to a question about whether the company intends to add more mainland China-based partners. But she added, “Control Risks remains committed to its business in China and its clients operating there.”

China has been a critical market for Control Risks. It lost 40% of its revenue there in recent years, a period that included the Covid-19 pandemic and a widening property crisis, according to one of the people. The revenue from its China operations had accounted for about 50% of the firm’s total business in the Asia-Pacific, the person added.

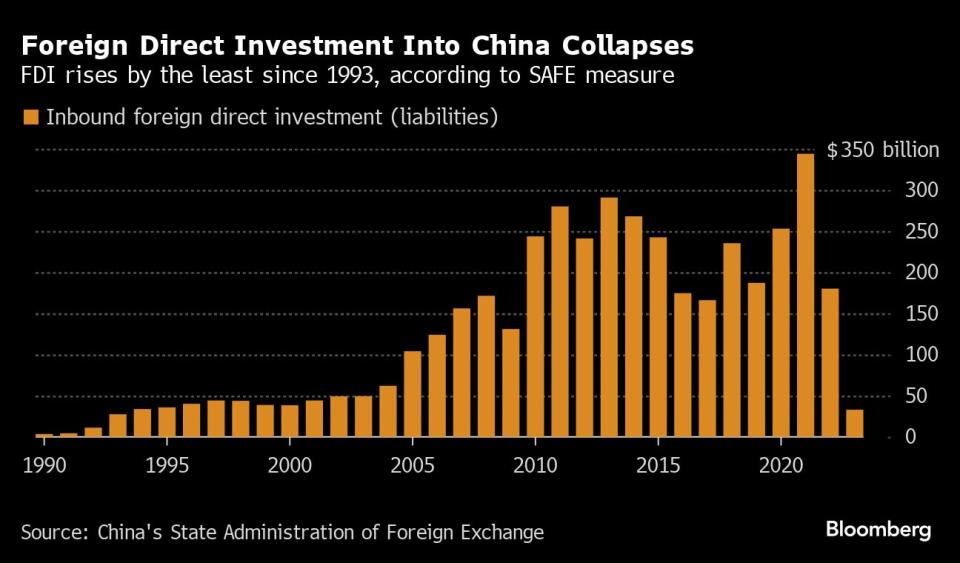

FDI Decline

Like its peers, Control Risks has been hit particularly hard by a pullback in China by multinational corporations.

Net new direct investment in China from foreign businesses hit the lowest level since the early 1990s last year, as economists downgraded long-term growth prospects for the country and geopolitical tensions between China and Western nations rose.

The company keeps a tight lid on its client list, but publicly available information shows that it has previously worked globally with Tencent Holdings Ltd.’s Riot Games Inc. and Meta Platforms Inc.’s Facebook.

Global banks including UBS Group AG and Goldman Sachs Group Inc. have cut dozens of bankers in Asia on the slowdown in China. Similarly, law firms with a presence in China have shrunk their footprint in the midst of the prolonged downturn, including layoffs from Linklaters LLP and a retreat from the market by Dentons.

Read: China’s Protest of TikTok Bill ‘Supremely Ironic,’ US Envoy Says

Hong Kong media outlet HK01 reported in December that Deloitte asked some staff in China to take unpaid leave from December to February. Deloitte did not respond to a request for comment on the report.

The industry’s broader environment is also growing more challenging at a time when national security is considered a top priority under Chinese leader Xi Jinping.

In recent months, foreign companies have discovered it’s increasingly difficult to carry out due diligence in China as authorities step up scrutiny, raid offices and, in some cases, detain employees.

Industry players like Control Risks have had to exercise greater caution to avoid offending Chinese authorities. To be on the safe side, Control Risks has had to turn down projects, according to one of the people.

Read: China Says It Caught Foreign Consultant Spying for UK’s MI6

Beijing fined US-based Mintz Group about $1.5 million for illegal data collection, months after officials raided its Beijing offices and detained five of its Chinese employees. Mintz didn’t respond to a request for comment on the fine and detentions of local staff.

In April, American consultancy Bain & Co. said Chinese authorities had questioned staff at its Shanghai office.

Security officials also publicized a raid last year at Capvision, a consulting firm with headquarters in New York and Shanghai, accusing the company of abetting espionage efforts by foreign forces. In October, the firm said it had improved its compliance system under the guidance of Chinese authorities and passed their inspection.

--With assistance from Sarah Zheng.

Most Read from Bloomberg Businessweek

An Influential Economics Forum Has a Troubling Surplus of Trolls

Gold-Medalist Coders Build an AI That Can Do Their Job for Them

©2024 Bloomberg L.P.

Yahoo News

Yahoo News