UK Economy Stalls as Rain Holds Back Retail and Construction

(Bloomberg) -- Britain’s economic recovery ground to a halt in the run-up to the general election, a setback for Prime Minister Rishi Sunak, who has campaigned on evidence the economy is turning the corner.

Most Read from Bloomberg

Hunter Biden Was Convicted. His Dad’s Reaction Was Remarkable.

US Inflation Broadly Cools in Encouraging Sign for Fed Officials

Fed Officials Dial Back Rate Forecasts, Signal Just One ‘24 Cut

Stock Bull Run Breaks Record on Fed Decision Day: Markets Wrap

Blinken Casts Doubt on Cease-Fire Hopes After Hamas Responds

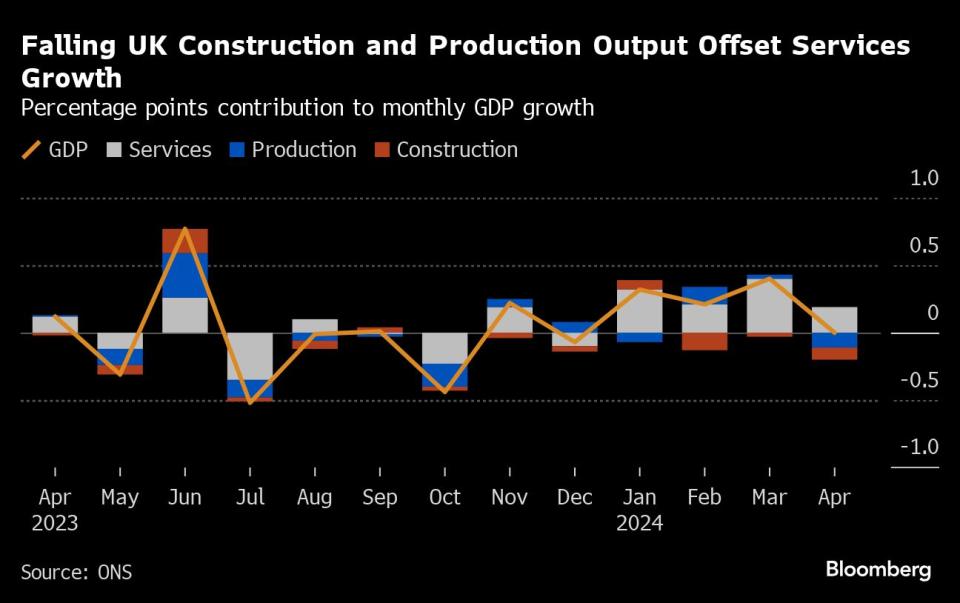

Gross domestic product was flat in April compared to the previous month, a slowdown from 0.4% growth in March, the Office for National Statistics said on Wednesday. Economists had expected a 0.1% drop in output.

A rebound from last year’s recession appears to be losing momentum after the highest interest rates in 16 years continued to weigh down the finances of both businesses and consumers.

“The UK remains fragile on its route to a sustained economic recovery,” said Hailey Low, associate economist at the National Institute of Economic and Social Research. “The broader perspective remains an economy grappling with stagnation.”

The Labour opposition sought to capitalize on the weaker growth figures that undercut Sunak’s claims that the economy is improving.

“Rishi Sunak claims we have turned a corner, but the economy has stalled and there is no growth,” said Rachel Reeves, Labour shadow Chancellor. “These figures expose the damage done after fourteen years of Conservative chaos.”

What Bloomberg Economics Says ...

“The economy is cooling after it returned to growth with a bang at the start of the year. In the context of the election campaign, the number won’t do much to boost Prime Minister Rishi Sunak’s chances of re-election. For the Bank of England, the print shouldn’t carry much bearing. Our base case is softer headline and services inflation will clear the way for a rate cut in August.”

—Ana Andrade and Dan Hanson. Bloomberg Economics. Click for the REACT.

Conservative ministers have repeatedly touted first-quarter growth figures showing the UK matching the fastest expansion in the Group of Seven nations. The opening sentences of the Conservative manifesto released Tuesday boasted that “growth has returned” following last year’s slump.

Chancellor of the Exchequer Jeremy Hunt pointed to figures for the trailing three months showing growth of 0.7%.

“There is more to do, but the economy is turning a corner and inflation is back down to normal,” Hunt said in a statement. “This election is choice. Under the Conservatives, we can keep the economy growing with our clear plan to cut taxes on work, homes and pensions. Or we can risk all that progress with Labour’s £2,094 of tax rises on every working family.”

Wet weather contributed to a drop in retail sales and construction output, while manufacturing also fell more sharply than expected.

A 1.4% drop in manufacturing output was driven by weakness in pharmaceutical products and the production of food, drinks and tobacco.

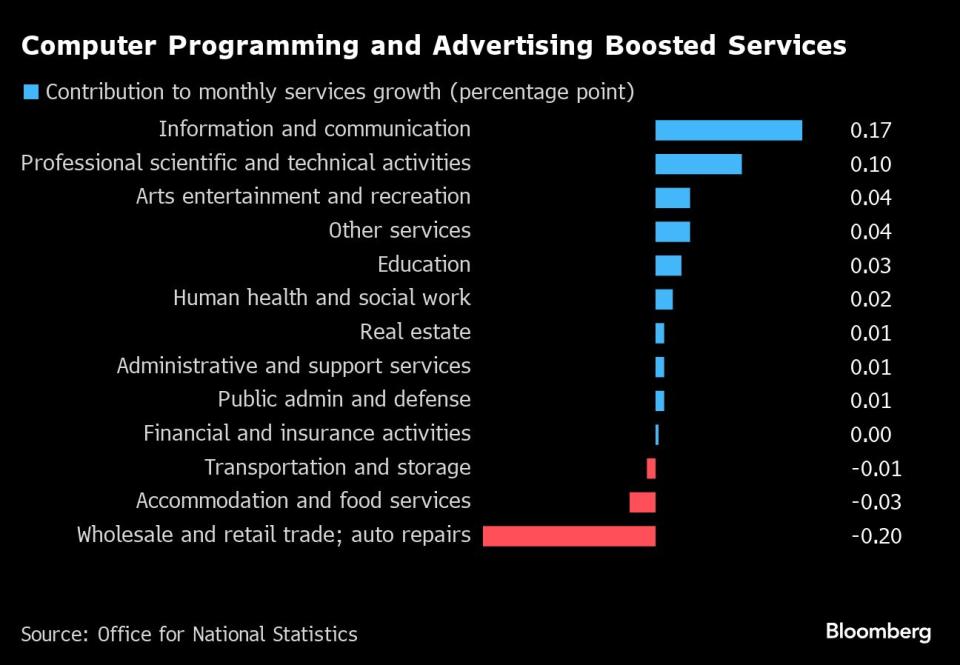

Services turned in 0.2% growth in the month, which was stronger than the expectation for a small drop. That was driven by computer programming, consulting and publishing. There were also gains in arts, entertainment and recreation.

The ONS said that output in consumer-facing services slipped by 0.7% in April with wet weather hitting the retail sector. Rainfall was 155% of the long-term average in April, according to the Met Office.

“After one of the wettest Aprils since records began it’s no surprise that rain dampened consumer spending,” said Ben Jones, lead economist with the CBI. “Consumers and firms alike are going to start to feel the benefit of lower inflation, which in turn should boost confidence and support spending.”

The Bank of England hopes that slower demand will rein in inflation, allowing it to reduce borrowing costs later this year. But investors are betting any move won’t come until August at the earliest.

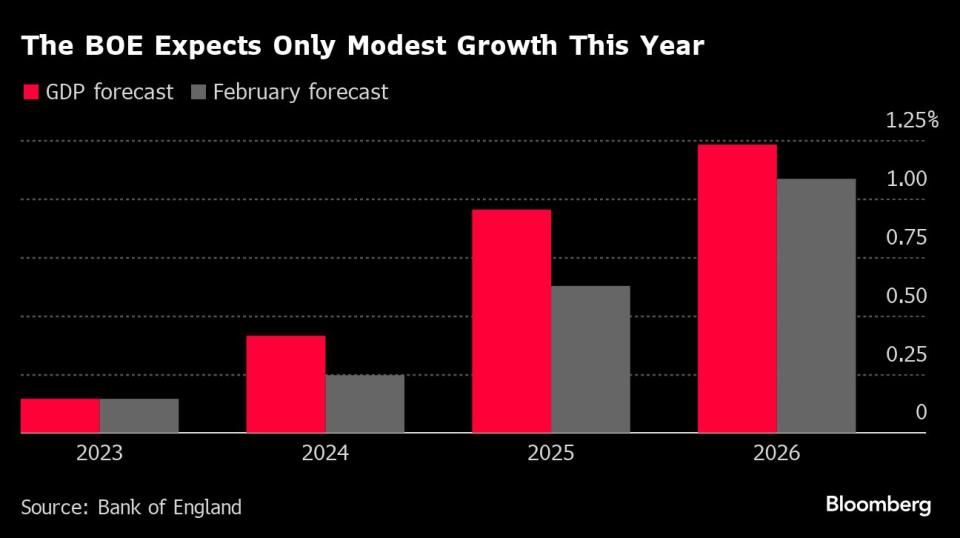

But the outlook for the rest of the year remains one of relative stagnation. Private sector economists anticipate a meager 0.6% expansion for the whole of 2024, up from just 0.1% last year, but well below the trend levels the UK enjoyed in previous decades.

“Despite the stalling of the recovery in April, the dual drags on economic growth from higher interest rates and higher inflation will continue to fade throughout the year,” said Paul Dales, chief economist at Capital Economics. “That will generate a bit of an economic tailwind for the next government.”

Bloomberg Economics is expecting growth to slow to 0.4% in the second quarter from 0.6% in the first. In May, the BOE penciled in 0.2% growth for this and coming quarters.

The BOE is watching economic data for signs that inflation is abating, allowing it to loosen rates. Investors have backed away from bets that policy makers move next week, pricing in the first reduction in November.

“Despite these disappointing GDP figures, a June interest rate cut looks improbable with the Bank of England likely to be a little wary of shifting policy in the middle of a general election campaign,” said Suren Thiru, economic director at the Institute of Chartered Accountants in England and Wales.

Sunak has warned voters that it will take time to feel the benefits of an improving economy and lower inflation. Many households are still being squeezed, with wages in real terms having only recovered to levels seen in 2008.

It was the final official growth numbers before the election, except a second estimate of first quarter GDP due later this month.

Britain’s unemployment rate ticked up unexpectedly in the three months through April to 4.4%, the most in 2 1/2 years. New job vacancies declined, but wage growth held firm well above the level the BOE says is compatible with its 2% inflation target.

Separate figures showed the UK trade deficit widened slightly in the three months to April, by £0.3 billion to £10.1 billion, after remaining relatively stable over the last year.

The increase was driven by goods imports, with Britain buying more machinery and transport equipment and fuels from overseas, while goods exports were flat.

--With assistance from Andrew Atkinson.

(Updates with comment from the Chancellor from the eighth paragraph.)

Most Read from Bloomberg Businessweek

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

As Banking Moves Online, Branch Design Takes Cues From Starbucks

Food Companies Hope You Won’t Notice Shortages Are Raising Prices

©2024 Bloomberg L.P.

Yahoo News

Yahoo News