UK House Prices Grow Again in June, Nationwide Says

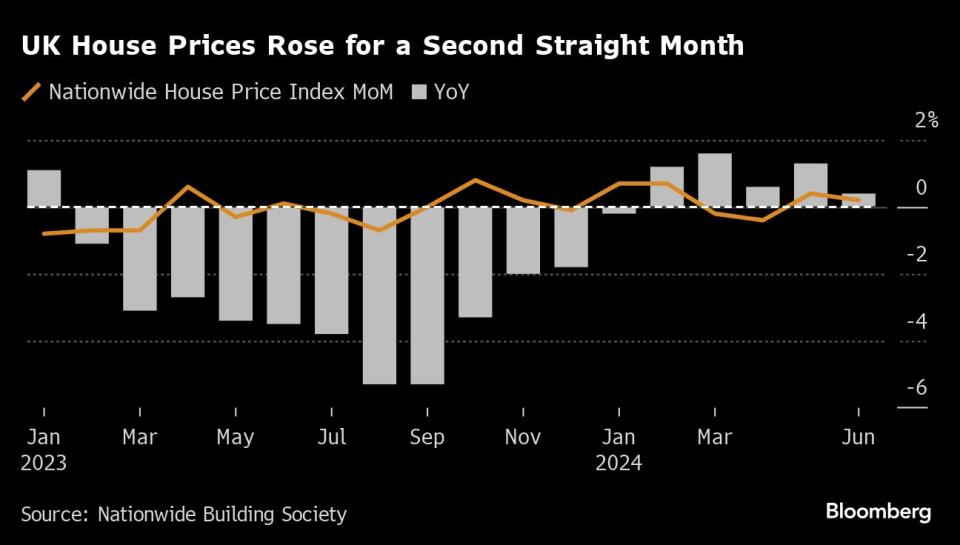

(Bloomberg) -- UK house prices increased for a second month in June, in signs the market is stabilizing after last year’s dip, according to one of the top mortgage lenders.

Most Read from Bloomberg

Democrats Weigh Mid-July Vote to Formally Tap Biden as Nominee

Trump Immunity Ruling Means Any Trial Before Election Unlikely

Beryl Becomes Earliest Ever Category 5 Hurricane in Atlantic

‘Upflation’ Is the Latest Retail Trend Driving Up Prices for US Consumers

Trump Isn't Going to Like the Supreme Court's Immunity Decision

Nationwide Building Society said its measure of prices rose 0.2% in June after an 0.4% gain the month before. Economists had expected no change.

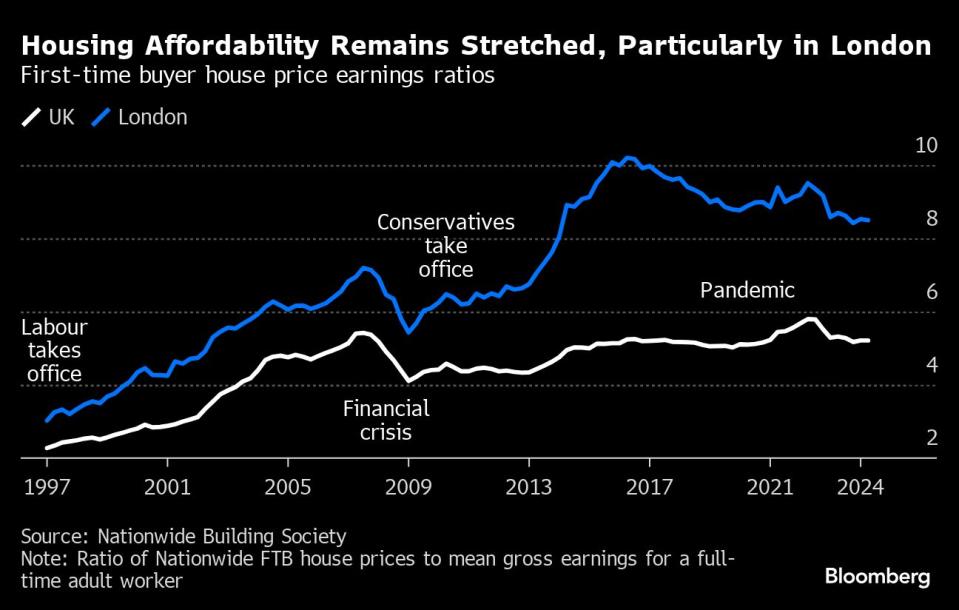

Prices are now 1.5% above a year ago, with interest rates at a 16-year high contributing to affordability concerns for people who need a mortgage. Nationwide said it’s seen an increase in the portion of cash buyers in the market.

“While earnings growth has been much stronger than house price growth in recent years, this hasn’t been enough to offset the impact of higher mortgage rates, which are still well above the record lows prevailing in 2021 in the wake of the pandemic,” said Robert Gardner, chief economist at Nationwide. “As a result, housing affordability is still stretched.”

What Bloomberg Economics Says...

“The housing market is showing signs of resilience despite affordability issues limiting households’ buying power. We expect activity to pick up further once the general election is over and the Bank of England starts cutting interest rates, likely from August.”

—Niraj Shah, economist. Click for the REACT

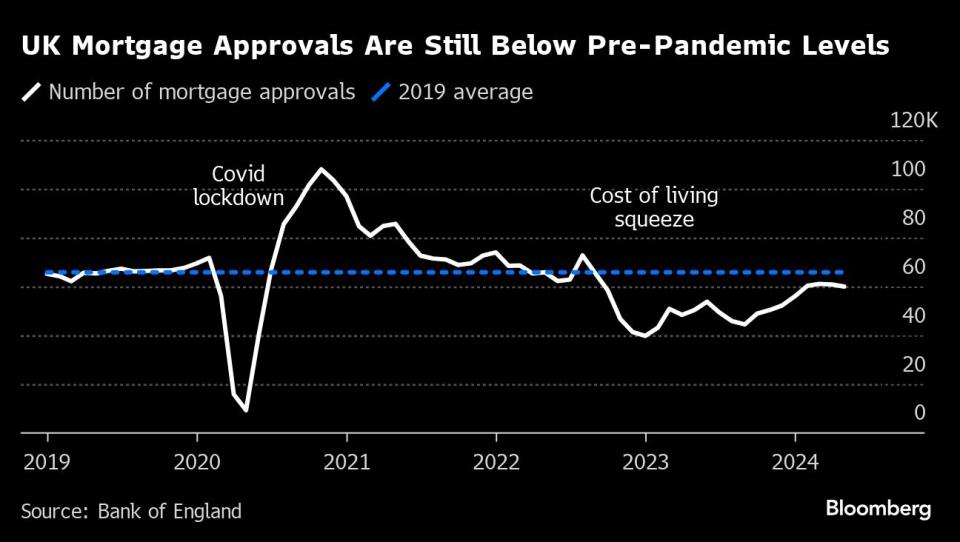

The impact of elevated mortgage costs was evident in separate Bank of England figures Monday, which showed the number of mortgage approvals slipped to a four-month low of 59,991 in May from 60,821 in April. The decline was slightly bigger than economists had forecast.

Nationwide said the number of housing transactions has fallen about 15% from 2019 levels, before the pandemic. Those involving a mortgage have fallen 25% while there’s been a 5% increase in transactions involving cash buyers.

“Today, a borrower earning the average UK income buying a typical first-time buyer property with a 20% deposit would have a monthly mortgage payment equivalent to 37% of take-home pay — well above the long run average of 30%,” said Gardner.

A separate report from Rightmove, an online property portal, found that the average price of homes coming to the market remained unchanged around record levels in June, while buyer demand rose above last year’s levels.

Prices rose 1.6% in London, the best performance in the southeast, where prices fell in some places outside the capital. Northern Ireland and the Northwest reported the strongest increases.

--With assistance from Andrew Atkinson.

(Updates with BOE mortgage approvals data)

Most Read from Bloomberg Businessweek

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

Japan’s Tiny Kei-Trucks Have a Cult Following in the US, and Some States Are Pushing Back

RTO Mandates Are Killing the Euphoric Work-Life Balance Some Moms Found

The FBI’s Star Cooperator May Have Been Running New Scams All Along

©2024 Bloomberg L.P.

Yahoo News

Yahoo News