UK inflation cools to 3.2% after further slowdown in food prices

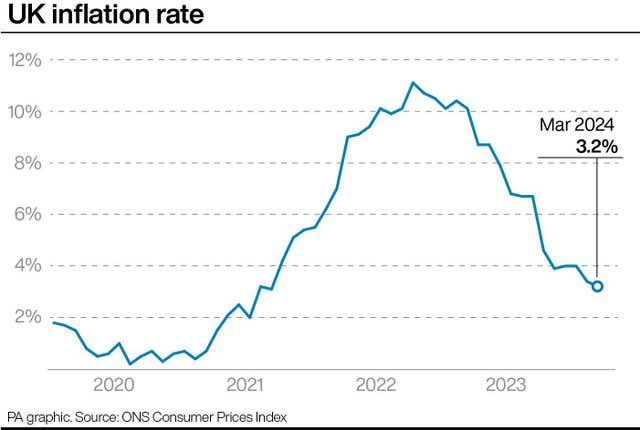

UK inflation dropped to a fresh two-and-a-half year low in March on the back of a further easing in food prices, official figures have shown.

The Office for National Statistics (ONS) said Consumer Prices Index inflation stood at 3.2% in March, down from 3.4% in February.

It marks the lowest level since September 2021, but was nonetheless slightly higher than economists expected.

Prime Minister Rishi Sunak said the figures show “that after a tough couple of years, our economic plan is working”.

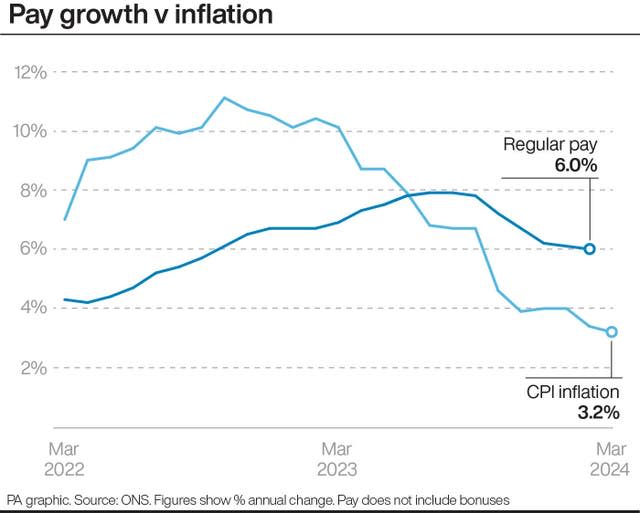

However, financial markets pushed back expectations for interest rate cuts after the figures amid concerns over persistence in services and wage inflation.

Economists had predicted a reading of 3.1% for the month.

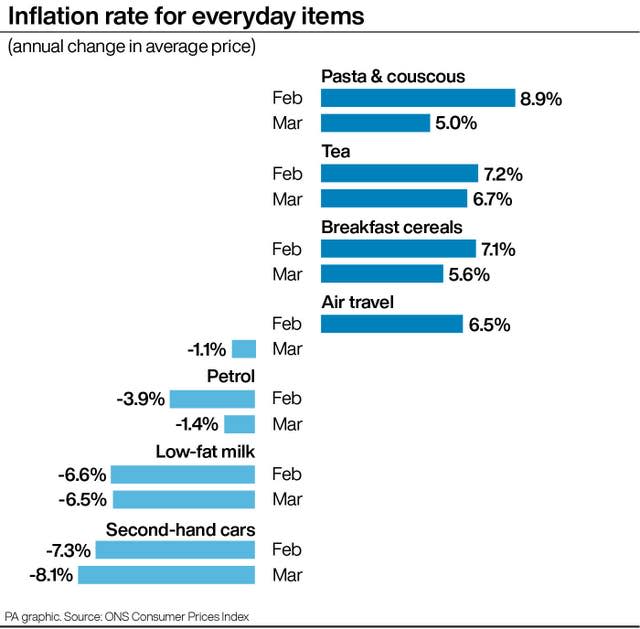

The drop was heavily linked to a slowdown in food price inflation, which was also its lowest for more than two years.

ONS chief economist Grant Fitzner said: “Inflation eased slightly in March to its lowest annual rate for two-and-a-half years.

“Once again, food prices were the main reason for the fall, with prices rising by less than we saw a year ago.

“Similarly to last month, we saw a partial offset from rising fuel prices.”

Inflation for food and non-alcoholic drinks dipped to 4% for the month, from 5% in February, to reach its lowest level since November 2021.

The increased slowdown was partly driven by a fall in meat prices and lower rises for bread and cereals, the ONS said.

Furniture and household goods prices also contributed to the fall, with prices in the sector down 0.9% in March compared with the same month last year.

Elsewhere in retail, clothing and footwear inflation also slowed to 4% for the month, from 5% in February, after women’s clothing stores increased prices by less than normal for this time of year.

The largest upwards pressure came from motor fuels, after the average price of petrol rose by 2.6p per litre between February and March 2024 to stand at 144.8 pence per litre, according to the ONS.

The overall reduction in inflation comes after rate setters at the Bank of England hiked interest rates to a 15-year-high of 5.25% in order to put pressure on demand.

Economists expect inflation for April to show a further fall in inflation, supported by another drop in energy prices, as CPI moves closer towards the central Bank’s 2% target rate.

This has also increased speculation that the central bank could cut interest rates in the coming months, although Governor Andrew Bailey and other members of the Bank’s monetary policy committee have so far suggested it is too early for a cut.

Ian Stewart, chief economist at Deloitte, said: “Inflation is in retreat but the Bank of England cannot yet be sure that it is beaten.

“Headline inflation is likely to drop below 2% in the coming months, but to be confident it will stay there wage pressures need to ease.

“With earnings growing at close to 6%, and the economy reviving, the Bank will be in no hurry to cut interest rates.”

On Tuesday, official figures showed regular wages growth, excluding bonuses, at 6% in the three months to February, which was a slight fall but also above economist predictions.

On Wednesday, Mr Sunak told broadcasters: “Today’s figures show that after a tough couple of years, our economic plan is working and inflation continues to fall.

“We have also seen energy bills falling, mortgage rates falling and, just this week, data showed people’s wages have been rising faster than inflation for 12 months in a row.

“My simple message would be: if we stick to the plan, we can ensure that everyone has a brighter future.”

Chancellor Jeremy Hunt said: “The plan is working: inflation is falling faster than expected, down from over 11% to 3.2%, the lowest level in nearly two-and-a-half years, helping people’s money go further.”

Rachel Reeves, Labour’s shadow chancellor, said: “Conservative ministers will be hitting the airwaves today to tell the British people that they have never had it so good.

“Prices are still high in the shops, monthly mortgage bills are going up and inflation is still higher than the Bank of England’s target.”

Yahoo News

Yahoo News