UK Voters in ‘Knowledge Vacuum’ on Tax and Spend, IFS Warns

(Bloomberg) -- The Institute for Fiscal Studies warned that the UK public is “voting in a knowledge vacuum” after Labour and the Conservatives “ducked” hard choices on how to pay for their spending promises without raising taxes.

Most Read from Bloomberg

Nvidia’s 13% Stock Rout Has Traders Scouring Charts for Support

BuzzFeed Struggles to Sell Owner of Hit YouTube Show ‘Hot Ones’

Jain Global Raises $5.3 Billion, Secures Cash From Abu Dhabi

How Long Can High Rates Last? Bond Markets Say Maybe Forever

Wikileaks’ Julian Assange to Plead Guilty, Ending Yearslong US Battle

Paul Johnson, director of the economics think tank, said that the new government will face a “stark choice” when they enter office, needing to either ramp up tax even further, slash spending or break their fiscal rules to allow debt to rise.

In a scathing critique of the parties vying for power at the July 4 election, Johnson said their manifestos “ignore these big challenges” and “have left us guessing.” A “conspiracy of silence” between the main parties has been maintained.

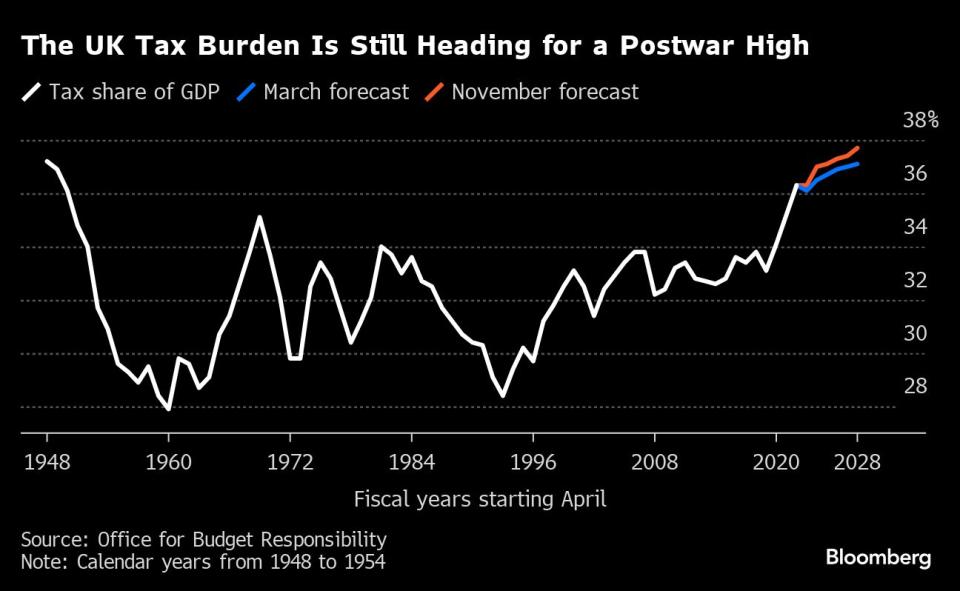

The IFS’s analysis points to a short-lived honeymoon period for the next government, projected to be Labour, before tough decisions are needed on tax and spending. Whoever wins will be under pressure to find money for struggling public services at a time when taxes and debt are at their highest level in decades.

“Despite these high tax levels, spending on many public services will likely need to be cut over the next five years if government debt is not to ratchet ever upwards or unless taxes are increased further,” Johnson said at an event in London on Monday. “The manifestos of the main parties provide thin gruel indeed. On 4 July we will be voting in a knowledge vacuum.”

The IFS said that stronger growth than in the Office for Budget Responsibility’s “relatively optimistic” forecasts – by around 0.5% per year – would solve the fiscal bind, though it warned this was unlikely. It warned that fiscal pressures could instead increase further, particularly as the OBR’s forecasts are at the more optimistic end when compared to private sector and Bank of England projections.

If the economy tracked more closely to the BOE’s more gloomy outlook, it would create a £30 billion ($38 billion) a year budget hole that would have to be filled by the next Chancellor.

“Most are more pessimistic than the OBR, most seem to have a view closer to that of the Bank of England,” said Carl Emmerson, deputy director of the IFS. “There has to be a chance it downgrades its forecast. It’s more likely surely to downgrade than it is to upgrade when it comes to produce the numbers for the next budget.”

Measures to boost growth will take time to feed through to the economy, with Labour banking on a stronger economic performance to give it more leeway on spending.

The think tank also criticized “a tax lock arms race” after Labour and the Tories ruled out raising the major taxes on workers and businesses. The parties have accused each other of having unfunded spending promises, with the Conservatives claiming that Labour will raise taxes after the election to fund spending pledges.

Johnson said “these tax locks are a mistake,” warning that they “will constrain policy if a future government decides that it does in fact want to raise more money to fund public services.”

(Adds comments on size on budget hole, starting sixth paragraph)

Most Read from Bloomberg Businessweek

How Jeff Yass Became One of the Most Influential Billionaires in the 2024 Election

Why BYD’s Wang Chuanfu Could Be China’s Version of Henry Ford

Independence Without Accountability: The Fed’s Great Inflation Fail

©2024 Bloomberg L.P.

Yahoo News

Yahoo News