UK's cheapest cities to buy your first home in 2024 - including area near Greater Manchester

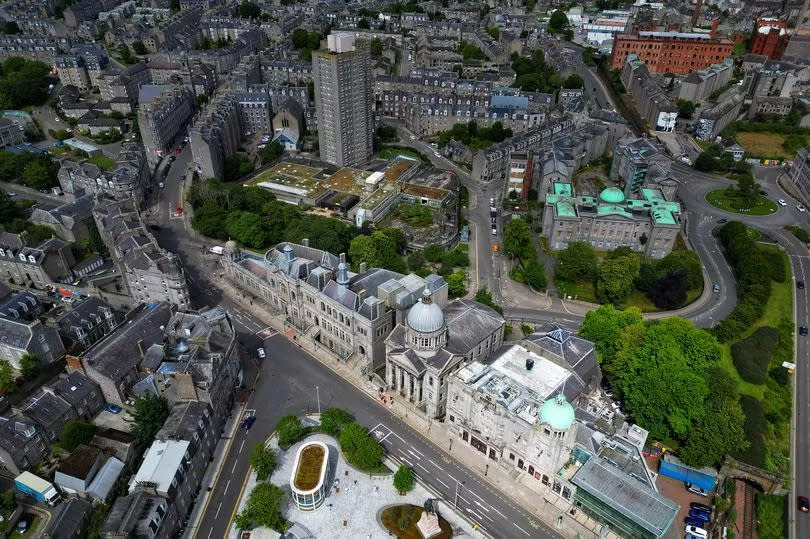

The cheapest UK cities to buy your first home have been revealed by Rightmove. New analysis from the UK’s biggest property website has revealed that Aberdeen is the most affordable city to be a first-time buyer this year.

The average house price for a typical first-time buyer type property, one that is two bedrooms or fewer, in Aberdeen is currently £102,602, with the average monthly mortgage payment now £406 per month. This assumes a first-time buyer in Aberdeen puts down a 20 percent deposit and has chosen to repay their mortgage over 35 years, at the current average five-year fixed rate of 4.84 percent.

According to Rightmove's data, Bradford is the second cheapest city to be a first-time buyer, with an average asking price of £107,929, and Sunderland is the third cheapest at £111,263.

READ MORE: The cheapest houses for sale in Lancashire that are commutable to Manchester - with prices from £20k

In contrast, London is most expensive city to buy your first home, with the average two-bedroom home or smaller costing £501,934. This is followed by St.Albans at £391,964 and Cambridge where a first-time buyer property is priced at around £361,429. Data from UK Finance shows that the average deposit size in Scotland and Wales is 20 percent, while in England it is 25 percent, and that more first-time buyers are choosing longer repayment terms to improve their affordability.

The average monthly mortgage payment for a typical first-time buyer type property in Great Britain is currently £53 more than this time last year. Despite average mortgage rates currently being slightly higher than at this time last year, there has been more stability since rates peaked in July 2023, which has helped those looking to move at the start of this year.

For those who have been able to save up the average deposit of 20 percent or 25 percent, it is cheaper to pay a monthly mortgage than rent in each of Great Britain’s largest cities, as well as the capital. The cost of renting a two-bedroom or smaller home has increased by 39 percent in the last five years, versus a 19 percent jump in the cost of buying a two-bedroom or smaller home.

Even if a first-time buyer had a smaller 15% deposit and wanted to repay their mortgage over 25 years rather than 35 years, it would still be cheaper to pay a mortgage than rent in 39 out of Britain’s 50 largest cities, outside of London. Rightmove’s property expert Tim Bannister said: “These latest figures highlight why so many people remain determined to get onto the ladder, as the soaring costs of renting has meant buying has remained attractive even with higher mortgage rates.

"Longer mortgage-terms are becoming more common as a way to improve overall affordability and reduce monthly payments, though first-time buyers should be aware of what they are paying in interest compared with their actual mortgage. Without improvements to the supply of good quality, affordable rental homes in Great Britain, owning your own home is likely to continue to be the end-goal for those that can get their deposit together, and borrow what they need to from a mortgage lender.”

Top 10 cheapest cities to buy a home:

Cities | Average asking price | Average monthly mortgage |

Aberdeen | £102,601 | £406 |

Bradford | £107,929 | £400 |

Sunderland | £111,263 | £413 |

Carlisle | £111,268 | £413 |

Preston | £112,273 | £416 |

Hull | £113,920 | £423 |

Dundee | £116,191 | £460 |

Stoke-On-Trent | £117,113 | £434 |

Durham | £125,957 | £467 |

Doncaster | £128,062 | £475 |

Top 10 most expensive cities to buy a home:

Cities | Average asking price | Average monthly mortgage |

London | £501,934 | £1,862 |

St. Albans | £391,964 | £1,454 |

Cambridge | £361,429 | £1,341 |

Winchester | £344,638 | £1,278 |

Oxford | £338,085 | £1,254 |

Brighton | £335,402 | £1,244 |

Bristol | £280,112 | £1,039 |

Chelmsford | £262,522 | £974 |

York | £244,834 | £908 |

Edinburgh | £239,028 | £946 |

Yahoo News

Yahoo News