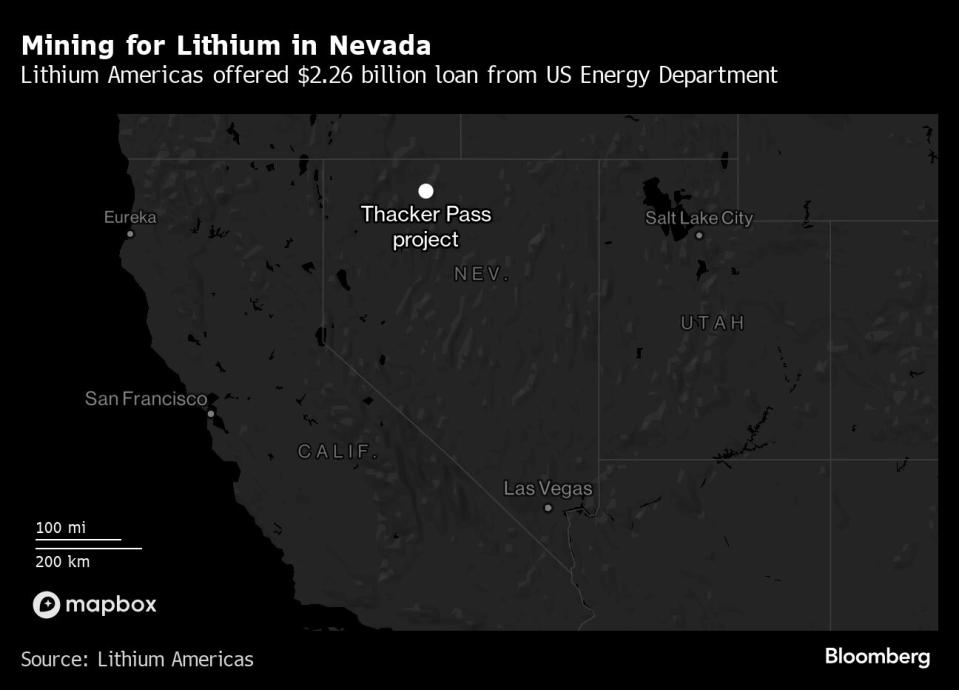

US Offers Record $2.26 Billion Loan for Nevada Lithium Plant

(Bloomberg) -- The Biden administration is offering a $2.26 billion loan to help Lithium Americas Corp. develop a Nevada lithium deposit that’s the country’s largest.

Most Read from Bloomberg

Millennium Trader Scored $40 Million Windfall in Egypt FX Plunge

A $2 Billion Airport Will Test Modi’s Mission, Adani’s Ambitions

SpaceX Starship Nears Orbit, But Is Lost Before Return to Earth

The conditional loan from the US Department of Energy will provide the vast majority of the capital needed to fund the first phase of development, the Vancouver-based company said in a statement Thursday, confirming an earlier Bloomberg News report. Shares of Lithium Americas jumped 28% in New York trading and 18% in Toronto as of 9:32 a.m.

The size of the investment in a company that’s little-known outside the industry underscores the urgency the Biden administration feels around securing supplies of the metal that’s key to the energy transition.

The funding being offered to the company’s Lithium Nevada Corp. subsidiary by the Energy Department will help finance construction of a lithium carbonate processing plant. The project will be adjacent to Lithium Americas’s $2.2 billion Thacker Pass mine, one of the country’s most promising opportunities to produce the metal that’s used in electric-vehicle batteries, solar panels and wind turbines. Once fully operational, the facility is expected to produce approximately 40,000 metric tons per year of battery-grade lithium carbonate for use in lithium-ion batteries, the Energy Department said in a statement.

The funding, the largest-ever loan to a mining company from the DOE’s Loan Programs Office, comes amid mounting efforts to help build domestic supplies of critical minerals. General Motors Co., which has invested $650 million in Lithium Americas, has an exclusive offtake agreement for 100% of the lithium production from the mine for up to 15 years after expected production commences in 2027, the company said.

Still, the Thacker Pass project has raised the ire of environmentalists and tribal groups who unsuccessfully argued in court that it posed a threat to the surrounding landscape and was inadequately vetted.

The Loan Programs Office has more than $400 billion to spend following an infusion of cash from President Joe Biden’s signature climate law. Last year, it offered a conditional commitment for up to $700 million for Ioneer Ltd.’s Rhyolite Ridge Lithium-Boron Project, a prospective supplier to Ford Motor Co. and Toyota Motor Corp.

Demand for lithium, which also is used for grid storage and weapons, is projected to exceed current production by 2030. About 65% of the critical mineral is processed in China, although US lithium production is projected to increase 13-fold thanks to tax credits and other subsidies provided in 2022’s Inflation Reduction Act, Energy Secretary Jennifer Granholm said Wednesday at a conference held by SAFE.

“We are fighting back to get every piece of the supply chain back in the United States or with our allies,” Granholm said.

--With assistance from Yvonne Yue Li and Thomas Biesheuvel.

(Updates shares in second paragraph, adds chart.)

Most Read from Bloomberg Businessweek

Gold-Medalist Coders Build an AI That Can Do Their Job for Them

An Influential Economics Forum Has a Troubling Surplus of Trolls

©2024 Bloomberg L.P.

Yahoo News

Yahoo News