US Reclaims Crypto Crown on Bitcoin ETFs, Trump Rise in Polls

(Bloomberg) -- The US is reclaiming its position as the undisputed top dog of cryptocurrency markets.

Most Read from Bloomberg

Billionaire-Friendly Modi Is Punished by Millions of Poor Voters

S&P 500 Hits 25th Record This Year as Tech Soars: Markets Wrap

BlackRock, Citadel Back Texas Stock Exchange in Challenge to NYSE

Goldman Sees ‘Wall of Money’ Fueling Stock Market’s Summer Party

From a crop of record-shattering Bitcoin ETFs to more accommodating regulators, swelling political donations and a rising presidential contender in crypto backer Donald Trump, signs of a US revival are suddenly everywhere.

Perhaps the most telling: The dollar, which ceded its role as the most-traded currency against cryptoassets to the South Korean won in the first quarter, has come roaring back and accounted for more than 50% of global volumes in early May, according to a note from research firm Kaiko.

It all amounts to a stunning turnaround from last year, when trading volumes migrated to Asia in the face of a string of enforcement actions from US regulators. The Securities and Exchange Commission, which went after players from Binance to Coinbase Global Inc. in 2023, surprised markets in late May by pivoting toward approving exchange-traded funds investing in Ether.

Trump currently holds a narrow lead over President Joe Biden in the polls, according to data tracked by Morning Consult.

On the legislative front, the odds of the Financial Innovation and Technology for the 21st Century Act passing into law in 2025 are rising, according to Bloomberg Intelligence analysts. The bill would enshrine a new regulatory framework for cryptocurrencies in the US, something the industry has long clamored for.

Mike Novogratz, the billionaire founder and chief executive of Galaxy Digital, said on Tuesday that the more positive US political landscape could push the price of Bitcoin above $100,000 by the end of the year. The largest digital asset was trading at $71,130 as of 3:10 p.m. Singapore time on Wednesday.

The political tide began to turn in favor of crypto on Jan. 11, with the introduction of spot-Bitcoin ETFs from the likes of BlackRock Inc. and Fidelity Investments that have so far amassed $61 billion of assets in one of the most successful launches for a fund category ever. Their impact is already reshaping trading patterns, which are increasingly converging on US hours.

The share of cumulative Bitcoin trading volume occurring in the hour before US markets close has increased to 7.2% this year from 4.9% during the 2021 crypto bull run, according to Kaiko. That is likely due to the Bitcoin ETFs, which calculate their net asset value against benchmarks at that time, “encouraging arbitrage and price discovery,” Kaiko said.

More recently, Hong Kong has debuted its own crop of spot-crypto ETFs tracking both Bitcoin and Ether, the second largest token. Those products have so far failed to generate anywhere near the inflows the US vehicles did.

The collapse of Sam Bankman-Fried’s FTX in late 2022 had a “dramatic chilling effect on US institutional investment, which opened a window for Asia to lead the way,” said Rich Rosenblum, co-founder of crypto market maker GSR Markets. “After the US emerged as the clear winner of Bitcoin ETF inflows, the US began to take back the lead position.”

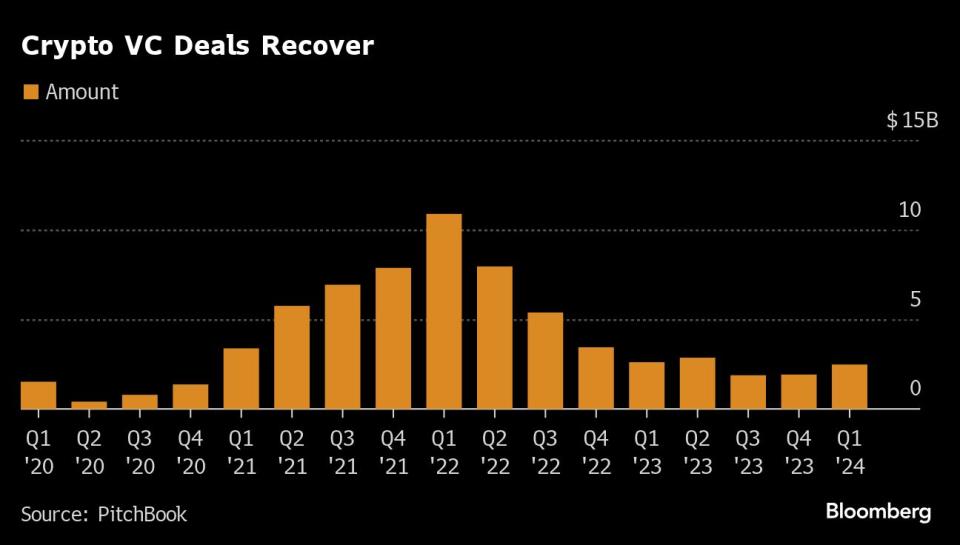

Data tracked by Galaxy Digital indicates the US is home to 324 crypto-focused venture capital firms — far exceeding the 66 based in second-ranked Singapore.

Pantera Capital and Paradigm, two prominent US-based investment firms, are in the process of raising new funds of more than $1 billion and over $750 million, respectively.

Some US investors are even managing to make hay from the FTX debacle. Pantera has been an active buyer of a $2.6 billion trove of Solana tokens sold off by the bankrupt exchange at a steep discount to market prices. Creditors of FTX are set to be repaid in full — but some remain disgruntled that they won’t recoup their original crypto.

Most Read from Bloomberg Businessweek

David Sacks Tried the 2024 Alternatives. Now He’s All-In on Trump

Startup Brings New Hope to the Pursuit of Reviving Frozen Bodies

The Budget Geeks Who Helped Solve an American Economic Puzzle

©2024 Bloomberg L.P.

Yahoo News

Yahoo News