Our View On DiamondRock Hospitality's (NYSE:DRH) CEO Pay

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

Mark Brugger became the CEO of DiamondRock Hospitality Company (NYSE:DRH) in 2008, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for DiamondRock Hospitality

How Does Total Compensation For Mark Brugger Compare With Other Companies In The Industry?

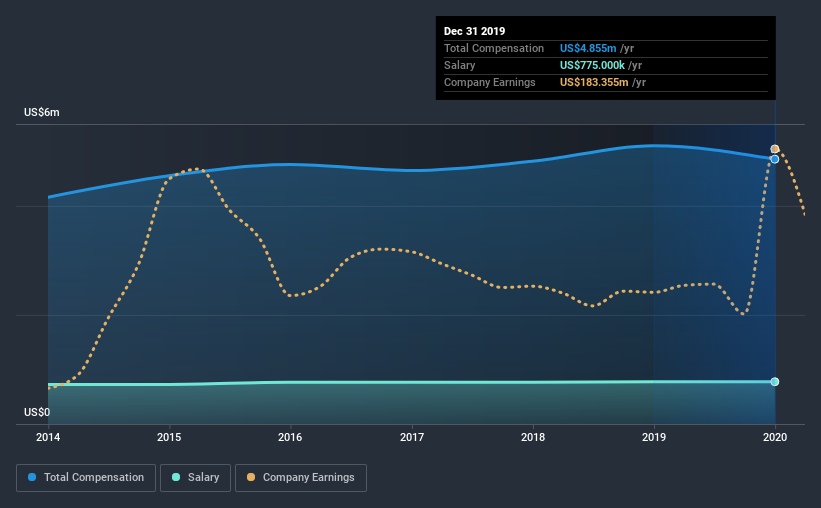

Our data indicates that DiamondRock Hospitality Company has a market capitalization of US$1.0b, and total annual CEO compensation was reported as US$4.9m for the year to December 2019. That's a slight decrease of 4.8% on the prior year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$775k.

On comparing similar companies from the same industry with market caps ranging from US$400m to US$1.6b, we found that the median CEO total compensation was US$3.9m. From this we gather that Mark Brugger is paid around the median for CEOs in the industry. Furthermore, Mark Brugger directly owns US$6.3m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2019 | 2018 | Proportion (2019) |

Salary | US$775k | US$775k | 16% |

Other | US$4.1m | US$4.3m | 84% |

Total Compensation | US$4.9m | US$5.1m | 100% |

Speaking on an industry level, nearly 15% of total compensation represents salary, while the remainder of 85% is other remuneration. DiamondRock Hospitality is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

DiamondRock Hospitality Company's Growth

DiamondRock Hospitality Company's earnings per share (EPS) grew 9.3% per year over the last three years. It achieved revenue growth of 2.4% over the last year.

We'd prefer higher revenue growth, but the modest improvement in EPS is good. Considering these factors we'd say performance has been pretty decent, though not amazing. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has DiamondRock Hospitality Company Been A Good Investment?

Given the total shareholder loss of 48% over three years, many shareholders in DiamondRock Hospitality Company are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be lessto generous with CEO compensation.

To Conclude...

As we noted earlier, DiamondRock Hospitality pays its CEO in line with similar-sized companies belonging to the same industry. Meanwhile, DiamondRock Hospitality is suffering from adverse shareholder returns and although earnings have grown over the past three years, they have not been extraordinary. We'd stop short of saying CEO compensation is inappropriate, but without an improvement in performance, it's sure to draw criticism. Shareholders will also not want to see performance improving before agreeing to any raise.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 3 warning signs for DiamondRock Hospitality (of which 1 is potentially serious!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News