Wall Street Still Unimpressed by Warner Bros. Discovery: Max Reveal Needed More ‘Surprises’

While seemingly nobody likes the name “Max” (well, almost nobody) for the new HBO Max, Wall Street responded to Wednesday’s rebrand with an bigger “meh” than most.

On April 12, aka Max Day, shares in Warner Bros. Discovery (WBD) opened at $15.08. By Thursday’s close, even with the benefit of an afternoon rally, WBD closed at $14.04. That isn’t a big dip on a per-dollar basis, but it charts WBD shares down nearly 7 percent. In the same timeframe, the S&P 500 rose a hair.

More from IndieWire

As the 2009 Warner Bros. rom-com would say, Max, “[They’re] Just Not That Into You.”

Even with the decline, certain media analysts would tell you WBD shares are still overpriced. On April 13, New York City-based Rosenblatt Securities sent a note to investors, obtained by IndieWire, which reiterated WBD as a “Sell” stock with a long-term price target of just $11 per share.

These analysts were not overly impressed with the big Max reveal, a presentation with “few surprises,” they wrote. That includes the name — we all saw that one coming — and some already leaked programming decisions. The research and investment banking boutique firm summed their concerns up this way: “We continue to see a tough road for streaming growth to fully offset pay TV pressures.”

Rosenblatt seems to believe management is walking away from its stated goal of 130 million DTC subscribers by 2025, but Warner Bros. Discovery President and CEO David Zaslav reiterated that guidance on Max Day on CNBC. Rosenblatt also pegged Warner Bros. movie “Shazam 2” as heading for a $150 million loss, but an insider told IndieWire reported budget and marketing costs for the film are overstated and that the loss is closer to $90 million-$95 million.

In its own Thursday note, financial services giant UBS maintained its own prior $15 target for WBD and a “neutral,” or “Hold,” rating. As a result of the Max rebrand, UBS expects we’ll see a jump in short-term direct-to-consumer losses on Max marketing alone.

About four weeks ago, equity analysts at Wells Fargo upgraded WBD stock to a “Buy,” raising its price target from $13 per share to $20 based on the company’s cost-saving opportunities and cash. Around the same time, financial group Macquarie’s price target was $22.

In summation, WBD: Buy, Sell, or Hold. No wonder shares aren’t soaring after Wednesday’s big dog-and-pony show.

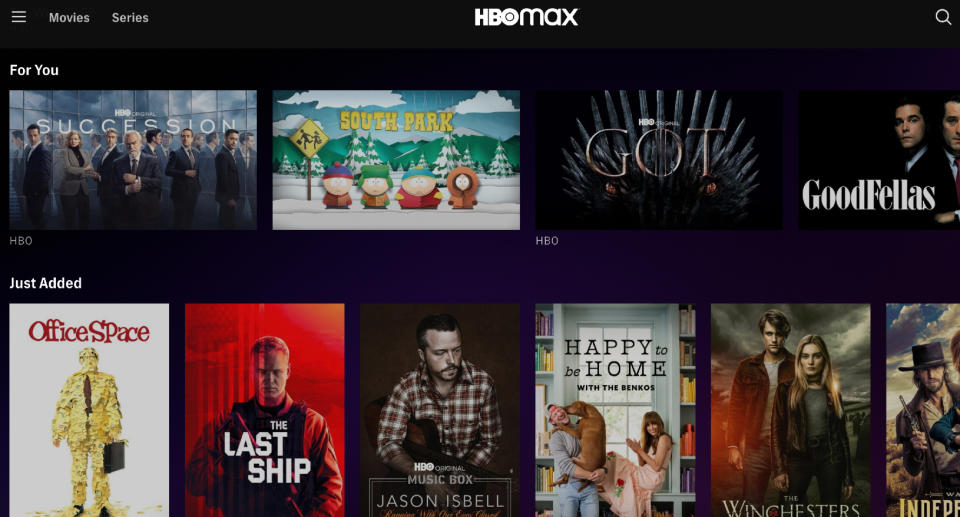

HBO Max

Also not exactly inspiring a great deal of confidence is the new platform’s name itself. “Max” may not generate the rapid-fire punchlines of “Peacock” or “Freevee,” but its online detractors are out in force. Legal strategist Bryan Sullivan of Early Sullivan likes it.

“From a branding standpoint, it’s easier to say ‘Max.’ One syllable, one word,” said the litigator, who’s practiced a lot in the entertainment and intellectual property spaces. “It might be a joke right now because you’re used to saying ‘HBO Max.'”

“Simple” and “straightforward” are good (“easy to say, not convoluted, not weird,” per Sullivan). He believes that two years from now, “Max” will sound natural for everyone. (Disclosure: Sullivan is a WBD stockholder, he’s buying and holding.)

What really matters is excitement brought by future productions. “Nobody’s really going to care (about the name),” he said. “They’re just going to focus on the content that’s being promoted and then talk about how great Max is.”

But before we get a new Harry Potter, we’ve gotten the jokes. Like:

Hopefully Peacock doesn’t get any ideas from this. https://t.co/K3ao0Q3Mj5

— Matt Goldich (@MattGoldich) April 12, 2023

Dying laughing that the rebrand is from "HBO Max" to "Max is where you can find HBO stuff." pic.twitter.com/Fp4X7t2c4N

— Jeff Zhang 张佶润 (@strangeharbors) April 12, 2023

Rebranding HBO Max as Max is like rebranding Hermes Handbag as Handbag. https://t.co/PpHoY2K5xF

— Mrs. Betty Bowers (@BettyBowers) April 13, 2023

Best of IndieWire

Sign up for Indiewire's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

Yahoo News

Yahoo News