WBD’s David Zaslav, Amazon’s Andy Jassy, Apple’s Tim Cook Among Most Overpaid CEOs In New Study As SEC Disclosure Rules Set For Shakeup

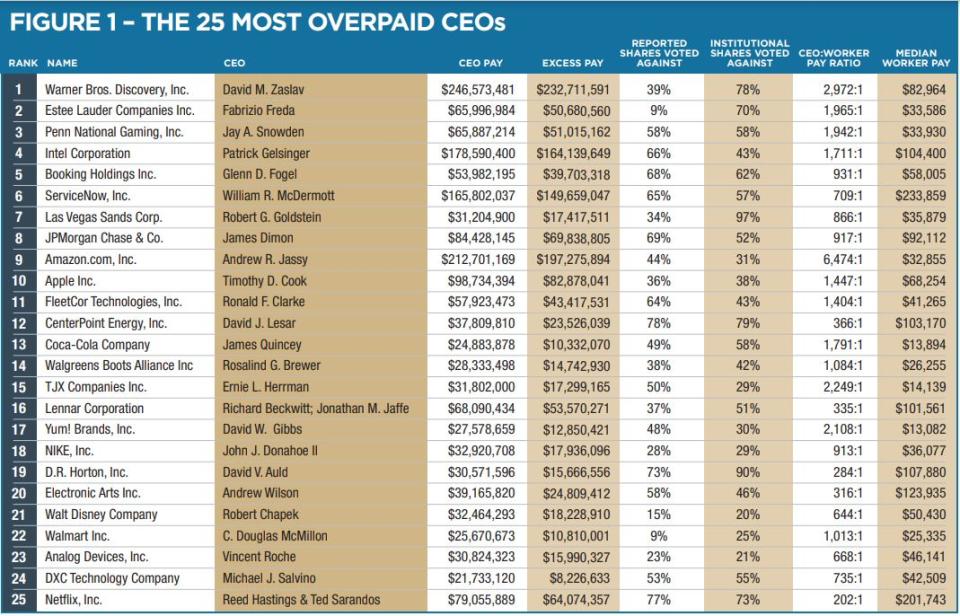

Warner Bros Discovery chief executive David Zaslav earned $232 million in excess compensation in 2021, according to As You Sow’s latest annual ranking of the most overpaid CEOs among S&P 500 companies. Amazon, Apple, Disney and Netflix are also high up in the group’s ninth report that looks beyond total pay in its own attempt to quantify overpay and draw attention to some pressing issues in the space.

The shareholder advocacy nonprofit measures compensation against three metrics: total shareholder return; the number of shares that are voted against a CEOs pay package at the annual meeting; and the ratio of CEO pay to median worker pay, a gap that has been steadily increasing. It weights the first two data points at 40% each, and the pay ratio at 20% to develop its ranking.

More from Deadline

Shareholder opposition to high pay has been rising, but As You Sow also lists the largest mutual funds “that continue to support the vast majority of overpaid CEOs.” The study comes as a new set of SEC rules on how companies disclose pay is set to take effect this proxy season.

Companies report compensation for their top five highest paid executives in proxy statements filed with the SEC each spring for the previous year. The As You Sow excess pay report, released Thursday, is based on compensation for 2021, which is the latest available data for companies reporting on a calendar year. The average pay of S&P 500 CEOs was $18.8 million in 2021, up 21%. For As You Sow’s 100 most overpaid CEOs, the average was up 31% to $38.2 million. Those 100 saw median pay, which is less influenced by mega-grants of stocks and options, grow 8% to $23 million.

Zaslav’s pay package totaled $246 million for 2021, topping the list. That compared with $37 million the year before and was inflated by a large $202 million option grant related to his contract renewal.

“The headline compensation figure reflects the extension of Mr. Zaslav’s employment agreement nearly two years ago to ensure his long-term leadership of the combined company, Warner Bros. Discovery. The vast majority of the headline number is theoretical because it is based on a one-time options grant that only starts to provide financial benefit to Mr. Zaslav if WBD’s stock price more than doubles,” WBD said in a statement.

His pay included a $3 million base salary, a stock award of $13 million, non-equity incentive plan compensation (like a cash bonus) of $22 million and a special bonus of $4.4 million for leadership through Covid, launching Discovery+ and securing the WarnerMedia deal.

The ratio of his pay to the median worker pay was 2,972 to 1. Excluding the option grant, WBD noted in the proxy, Zaslav’s salary was $43 million and the pay ratio 527 to 1.

As You Sow said 78% of institutional shares voted against executive compensation, as did 39% of reported shares voted. Reported shares includes super-voting stock, which a number of media companies use, and shares held by CEOs and insiders. As You Sow breaks out the shares voted by institutions and financial managers.

Apple Pay

Amazon’s Andrew Jassy and Apple’s Tim Cook were No. 9 and No. 10 on the list with packages of $212.7 million and $98.7 million, respectivey, for 2021. As You Sow put their overpay amounts at, respectively, $197 million and $83 million.

Jassy’s 2021 pay included a restricted stock award valued at $212 million that vests over 10 years. The compensation commitee said in the proxy it was “important to provide for clarity and stability through an award that is designed to establish a long-term owner’s perspective and encourage bold, long-term initiatives, in the same manner that Mr. Bezos’s shares as founder incentivized him to focus on long-term, expansive growth.” In a nod to the big number, it said the award “is intended to represent most of Jassy’s compensation for the coming years.” (Amazon founder Jeff Bezos stepped down as CEO in the summer of 2021.)

Apple’s fiscal year ends September 30. For FY 2022, Cook took home $99.4 million, according to the latest proxy filed in January, similar to his pay for FY 2021. Apple’s compensation committee said it plans to slash Cook’s targeted pay by more than 40% in the current fiscal year, 2023, after “feedback” from displeased investors, the proxy said.

Shareholder votes on pay are “advisory,” or non-binding, but too many votes against is not a good optic.

Disney was No. 21 with former CEO Bob Chapek’s $32.4 million for fiscal 2021 considered an $18.2 million overpay. Disney’s fiscal year also ends in September. Chapek’s pay fell to $24 million for FY 2022. He exited in November, handing Bob Iger the reins.

Netflix came in at No. 25 with co-CEOs Reed Hastings and Ted Sarandos earning combined compensation of $79 million — $64 million of that excess pay, according to As You Sow. In the streamer’s case, 77% of reported shares and 73% of institutional shares voted against. (In January, Hastings moved to executive chairman and COO Greg Peters was upped to co-CEO with Sarandos.)

The highest-paid CEOs and the most overpaid, the study noted, often have packages swelled by option grants. As WBD and other companies point out, these may only reflect grant date fair value with no assurance that value will ever be realized. Zaslav’s options, for instance, do require the stock to hit certain levels over a number of years before they’re in the money.

However, repeated grants that vest or are cashed out over time are hard to track. They are not included in a proxy’s core compensation table because they were already counted when first awarded.

Realized pay, when stocks and options are actually sold or vested “has historically been less visible and more difficult to calculate,” notes As You Sow. “Because of the extended bull market, most CEO pay stock awards have come to be worth much more than they were originally estimated to be.” Under new SEC rules, companies will also need to clarify totaly actual, or realized, pay.

That’s one of a host of additions and changes to formulas the regulator is asking for around pay disclosure. A Pay Versus Performance table requires companies to include the relationship between compensation paid to the CEO and to other named executive officers, and to the company’s total shareholder return. It must include a company’s total shareholder return versus that of its peer group.

Behind the ranking

To generate its overpaid list, As You Sow has advisory firm HIP Investor analyze the financial performance of each S&P 500 company’s five-year total returns (total stock gains and losses, plus reinvested dividends).

This year, its report breaks out Tesla as a case study of what it calls the weak links between company stock performance and CEO pay, in Tesla’s case a massive, multi-year option grant to founder and CEO Elon Musk that happens to be the subject of a lawsuit in Delaware court.

“Instead of causing Musk to share the perspective of Tesla shareholders more closely, the awards financed his purchase of Twitter and his near continuous alienation” of shareholders, As You Sow said, with the stock losing about 65% of its value last year. It’s gained back ground this year.

Best of Deadline

Sign up for Deadline's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

Yahoo News

Yahoo News