Western incompetence is handing aerospace dominance to China

Regulators have concluded Boeing should face criminal charges over safety issues on the 737. It is being sued over a mid-air blowout. And design faults have left a pair of astronauts stranded in space.

It has been just another standard week at Boeing, the American aircraft giant that is now the world’s most disaster-prone company. Against that backdrop, and with demand for new aircraft booming, you might imagine that its main rival, Airbus, would be expanding rapidly, and cementing its leadership of the industry.

But hold on. This week, its shares plunged on supply issues. In reality, Airbus desperately needs fresh and bold leadership. This chance won’t come again – and without change the West risks surrendering aerospace to the Chinese.

The leadership of Boeing, once one of the most formidable aerospace companies in the world, is starting to make Joe Biden look fit, alert and in control.

The company stumbles from one disaster to another. In the last few days, there have been safety issues that stopped one of its spacecraft bringing two astronauts on the International Space Station back to earth; American regulators sued the company for sharing information on an investigation into safety issues that should not have been disclosed; and families of crash victims demanded that executives face jail at a congressional hearing.

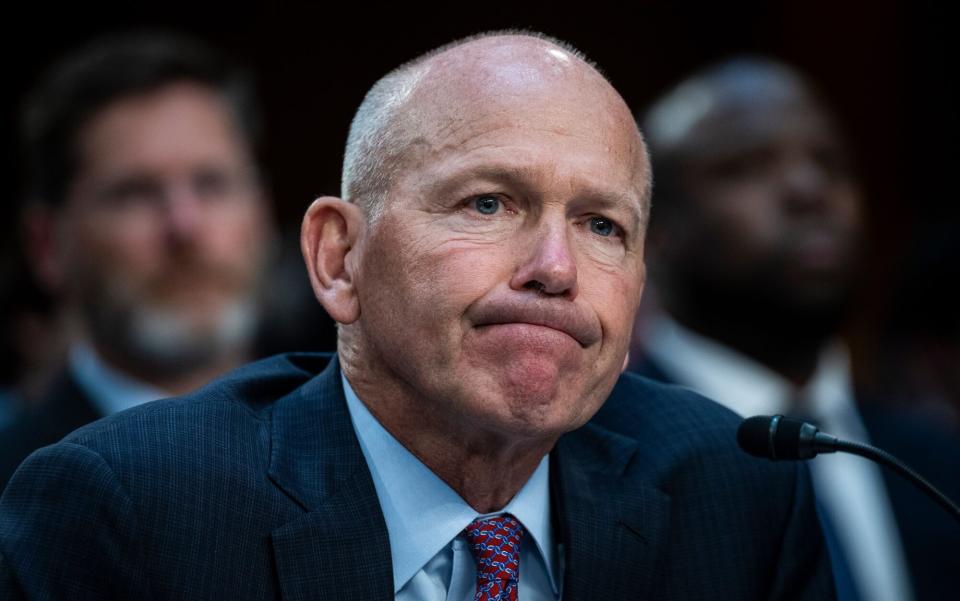

Chief executive David Calhoun is scheduled to step down at the end of this year. However, there is very little evidence that the change of leadership at the top will make any real difference. It is trapped in a cycle of decline, suffering one setback after another.

In response, Airbus should surely be seizing leadership of the industry. No one wants to see a rival fall apart and certainly not where aircraft safety is involved, but it is perfectly normal to push forward when a competitor is in trouble.

And yet there is very little sign of it.

Last week, Airbus shares dropped by 10pc as the company cut its forecasts for the year. Its chief executive Guillaume Faury admitted that it would only deliver 770 commercial aircraft this year, down from earlier forecasts of 800. The target of producing 75 of its best-selling A320 series was pushed back from 2026 to 2027.

The problem? It has been hit by a series of supply chain snarl-ups that have made it difficult to build all the planes it would like to. Meanwhile, it took a €900m (£760m) charge on its space unit, pushing its figures even lower. It is hardly surprising that investors are looking for the emergency exit, with the share price down by almost 20pc over the last month alone.

Supply issues? Seriously? It is a completely lame excuse. Sure, building an aircraft has always been a complex task. An A320 has 340,000 parts, and Airbus has more than 12,000 suppliers. No one ever said the logistics would not require some careful management.

And yet there is nothing new about the supply issues and you might have expected, with so much at stake, that it would have been sorted out by now. Likewise, in a week in which the value of SpaceX, Elon Musk’s rocket company, went above $200bn (£160bn), why is Airbus taking write-downs? Space is a booming industry and it should be making money.

In reality, Airbus’s top team is looking very tired. Faury was appointed back in 2019 and in the five years since he has done very little to improve its performance. It is taking the market for granted. No one seems to be paying very much attention right now, but China is determined to become a major player in commercial aerospace.

The Comac C-919 was launched into commercial service last year, and while it may look suspiciously similar to an A320, it is steadily proving itself in the market. Last week, Vietnam Airlines said it was looking at ordering the plane, given the supply issues with both Boeing and Airbus.

Meanwhile the head of Dubai Aerospace Enterprise, one of the top 10 leasing companies in the world, argued that the C-919 was a “perfectly fine aircraft” and one that was likely to break the current duopoly. Only last month, we learned that Comac is now working on plans for the C-939, a widebody jet that will compete with the A350 and Boeing 777. The blunt truth is that Comac is determined and well-financed. It will take a significant share of the industry.

Likewise, Boeing will recover eventually. The company may be in big trouble right now but it is in the “too big to fail” category. The US depends on it for defence, as well as for its industrial and export muscle. Its current leadership may be hopelessly inept, but sooner or later – and probably sooner – it will start to stage a recovery.

This should be the moment for Airbus to go in for the kill. It should be stepping up production to meet all the orders it can and finding new suppliers, or even taking them over itself, to make sure that it can meet all the demand.

It should be launching new models, even if they are a few years out, to make sure it has the most modern range of aircraft on the market.

And it should be pressing ahead with new fuels and lower-emission planes so that airlines can keep flying at the same time as countries are struggling to meet their net zero targets.

But that will take fresh management, and fresh energy. Faury has done a respectable job but he has failed to get to grips with either the opportunities that the demise of Boeing presents or the threat posed by the rise of Chinese competition.

It is not good enough.

Right now Airbus is floundering. Shareholders can sense it and, no matter how many feathers it might ruffle in France, someone needs to step in and demand some changes – before it is too late.

Yahoo News

Yahoo News