Worried about AI taking your job? Invest in miners to beat the robots

The AI revolution will be profound, surpassing the transformative effects of even the industrial age.

For investors, the challenge is understanding how this seismic technological disruption will impact portfolios. Is it possible to both protect and profit? Ironically, in our view, it may be the “Jurassic Park” industries, such as mining, that are best positioned to perform.

The integration of AI into business operations is not just inevitable, it’s already well underway, promising unprecedented opportunities but also considerable risks. Most companies are simply not ready. Intelligence will start to become commoditised.

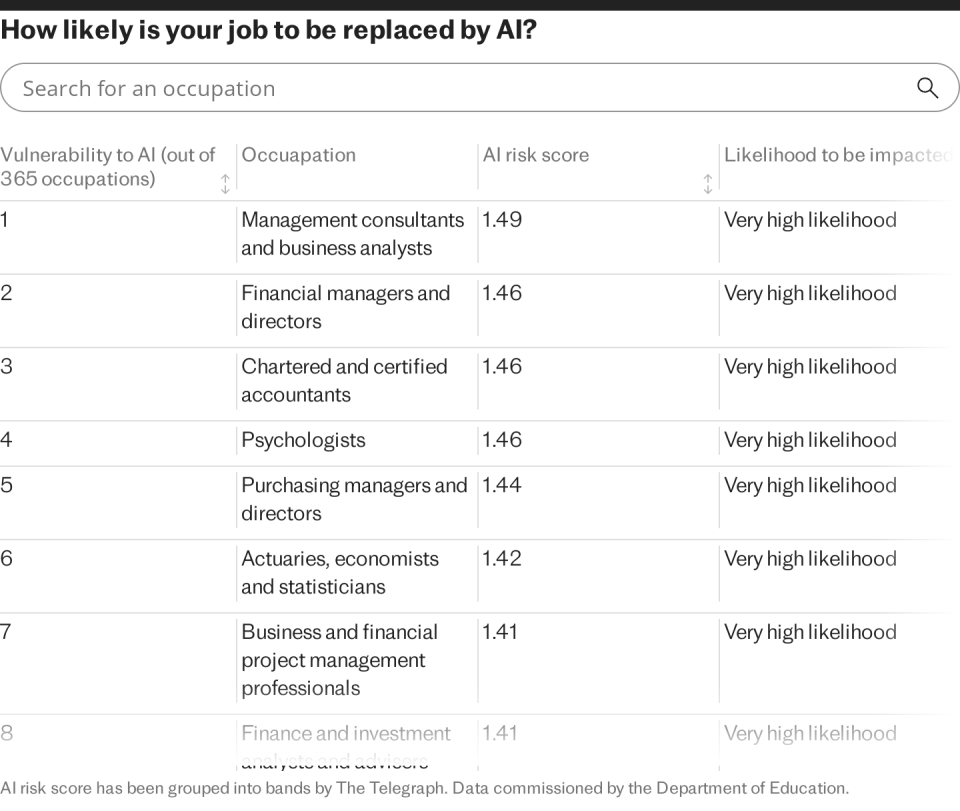

Industries with low barriers to entry, such as legal and administrative services, will face incredible competition from the technology and many could go bust as a result.

We believe predicting the precise impact of AI is nearly impossible.

So, are there any industries impervious to the rise of AI?

We think mining is a clear long-term winner. Firstly, it’s difficult to disrupt as you can’t just create another copper mine out of thin air. The copper needs to exist in the first place. And you can’t commoditise what has already been commoditised.

AI can still introduce efficiencies, particularly in logistics and supply chain management, leading to a potential win-win scenario where operational costs decrease while demand increases.

And bigger picture economics driven by AI also supports the investment case for commodities. We are expecting an explosion in global GDP driven by AI advancements, and consequently, a surge in demand for commodities.

Essential for building the infrastructure that supports an AI-driven economy, materials like copper, used extensively in electronics and data centres, will see increased demand. We are also expecting AI to lead to an explosion in robotics which will also lead to further demand for metals.

Investors can benefit from this trend by holding positions in mining and commodities, sectors that not only support the AI infrastructure but also stand to gain from the broader economic cyclical boom.

Managed by one of the most experienced teams in the market, we like the BlackRock World Mining Trust (BRWM) for commodities exposure. The closed-ended fund trust is ideally positioned to tap into a number of global tailwinds, including AI, set to benefit the sector.

The trust has significant flexibility to invest across various metals and mining companies, including unquoted businesses. The strategy also offers an alternative – and attractive – source of income to investors. The result is a conviction-led approach to investing in the mining sector, as opposed to focusing on the short-term direction of commodity prices.

We are also investing in funds that have exposure to companies that are successfully integrating AI. Microsoft, for example, has launched Copilot in its latest Windows incarnation, which demonstrates a practical use case. Funds such as IFSL Evenlode Global Income, which invests in quality cash-compounding companies, have exposure to the tech titan.

There is also the “picks and shovel” approach. During the California gold rush, some speculators recognised that selling tools and equipment for prospectors was equally important as actually panning for the yellow metal.

These early entrepreneurs became known as picks and shovels providers – and it is easy to draw parallels between the 1848 gold rush and 2023’s AI technology rush.

Nvidia stands out as the number one infrastructure provider with its H100 and A100 GPUs. Growth funds, such as the Polar Capital Technology Trust (PCT), currently give exposure to Nvidia.

But it is important to remember that we often overestimate the future adoption and the potential utility of every next-big-thing investment – and it is notoriously difficult to predict the eventual winners and losers as we saw from the dot com boom.

Ultimately, the key to withstanding the waves of AI disruption lies in strategic diversification – and incorporating assets and sectors with minimal correlation to the tech-driven upheavals.

By investing in a mix of integrated tech companies, essential providers and commodity sectors, investors can create a balanced portfolio that leverages the growth of AI while protecting against the downside. This means mixing both the new and old worlds of investing.

Yahoo News

Yahoo News